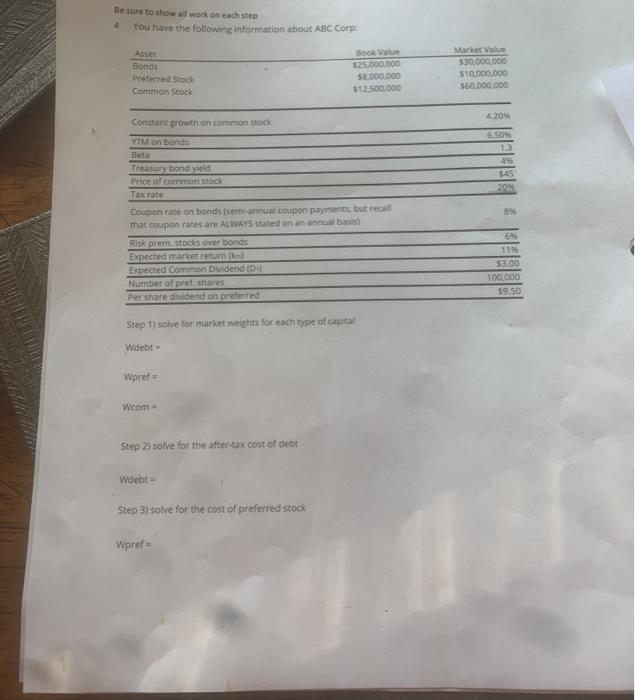

Question: Be sure to show l work on each step You have the following information about ABC Corpo Asset Book Value Bonds 525.000.000 Preferred Stock 58.000.000

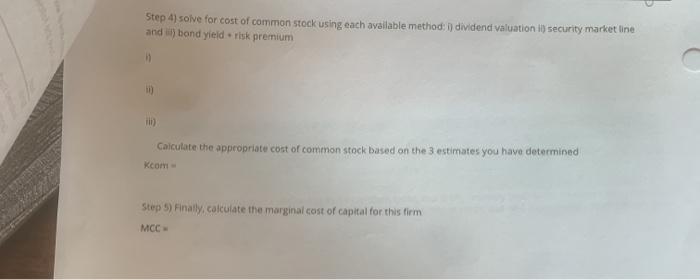

Be sure to show l work on each step You have the following information about ABC Corpo Asset Book Value Bonds 525.000.000 Preferred Stock 58.000.000 Common Stock $12.500.000 Market Value 530.000.000 $10,000,000 560.000.000 420 6.50 545 Constant growth on common YIM on bonds Beta Treasury bond yield Price of common stock Tax rate Coupon rate on bonds (semi-annual coupon payments, but recall that coupon rates are ALWAYS stated on an annual basis Risk prem, stocks over bonds Expected market returns Expected Common Dividend (D) Number of pret shares Per share dividend on preferred 8% 53.00 100,000 59.50 Step 1) solve for market weights for each type of capital Wdebt - Wpref= Wcom = Step 2) solve for the after tax cost of debt Wdebt Step 3) solve for the cost of preferred stock Wpref= Step 4) solve for cost of common stock using each available method: il dividend valuation is security market line and ) bond yield risk premium b) Calculate the appropriate cost of common stock based on the 3 estimates you have determined Kcom Step 5) Finally, calculate the marginal cost of capital for this firm MCC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts