Question: Be sure to show work to support your answer. Work means the appropriate equations with all known information completed. Q) WorldFamous Hotel's current capital structure

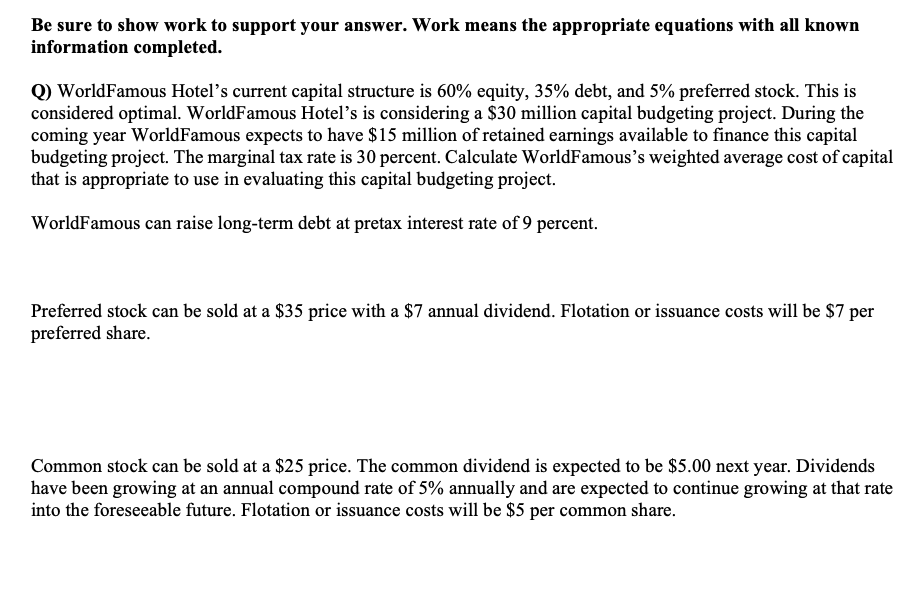

Be sure to show work to support your answer. Work means the appropriate equations with all known information completed. Q) WorldFamous Hotel's current capital structure is 60% equity, 35% debt, and 5% preferred stock. This is considered optimal. WorldFamous Hotel's is considering a $30 million capital budgeting project. During the coming year WorldFamous expects to have $15 million of retained earnings available to finance this capital budgeting project. The marginal tax rate is 30 percent. Calculate WorldFamous's weighted average cost of capital that is appropriate to use in evaluating this capital budgeting project. WorldFamous can raise long-term debt at pretax interest rate of 9 percent. Preferred stock can be sold at a $35 price with a $7 annual dividend. Flotation or issuance costs will be $7 per preferred share. Common stock can be sold at a $25 price. The common dividend is expected to be $5.00 next year. Dividends have been growing at an annual compound rate of 5% annually and are expected to continue growing at that rate into the foreseeable future. Flotation or issuance costs will be $5 per common share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts