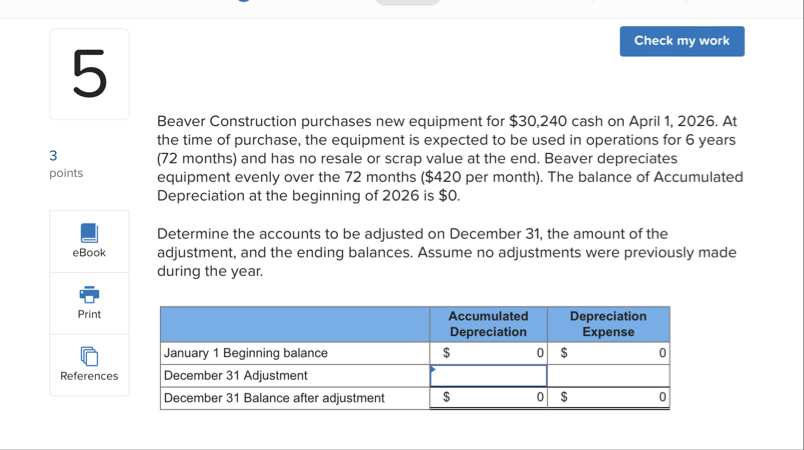

Question: Beaver Construction purchases new equipment for $ 3 0 , 2 4 0 cash on April 1 , 2 0 2 6 . At the

Beaver Construction purchases new equipment for $ cash on April At the time of purchase, the equipment is expected to be used in operations for years

points eBook Print

References months and has no resale or scrap value at the end. Beaver depreciates equipment evenly over the months $ per month The balance of Accumulated Depreciation at the beginning of is $

Determine the accounts to be adjusted on December the amount of the adjustment, and the ending balances. Assume no adjustments were previously made during the year.

tableAccumulated Depreciation,Depreciation ExpenseJanuary Beginning balance,$$December Adjustment,,,,December Balance after adjustment,$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock