Question: What i have entered is incorrect, please help! Beaver Construction purchases new equipment for $45,360 cash on April 1, 2018. At the time of purchase,

What i have entered is incorrect, please help!

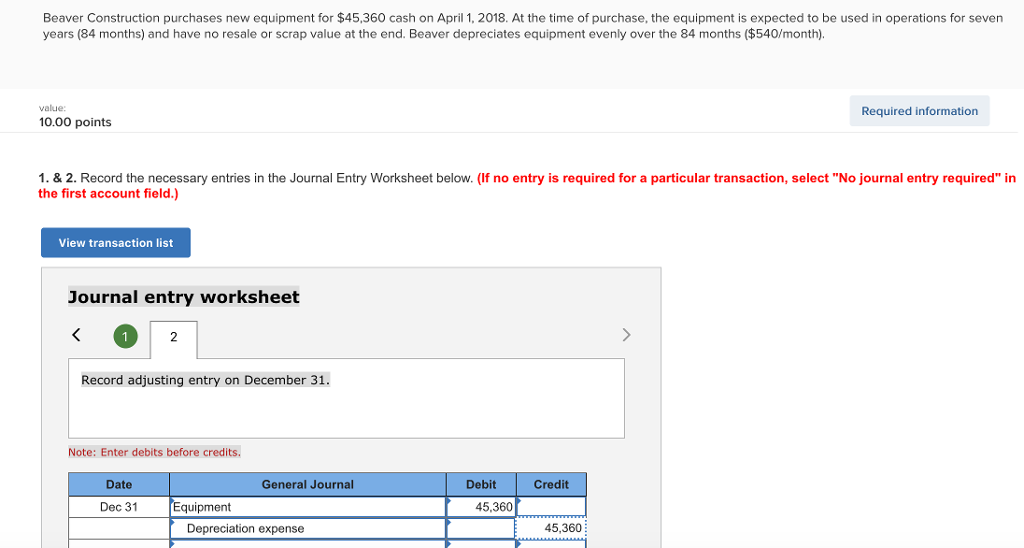

Beaver Construction purchases new equipment for $45,360 cash on April 1, 2018. At the time of purchase, the equipment is expected to be used in operations for seven years (84 months) and have no resale or scrap value at the end. Beaver depreciates equipment evenly over the 84 months ($540/month). value: Required information 10.00 points 1. & 2. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 2 Record adjusting entry on December 31. Note: Enter debits before credits Date General Journal Debit Credit Dec 31 Equipment 45,360 Depreciation expense 5,360

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts