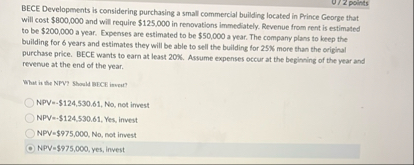

Question: BECE Developments is considering purchasing a small commerclal building located in Prince George that will cost $ 8 0 0 , 0 0 0 and

BECE Developments is considering purchasing a small commerclal building located in Prince George that will cost $ and will require $ in renovations immediately. Revenue from rent is estimated to be $ a year. Expenses are estimated to be $ a year. The company plans to keep the building for years and estimates they will be able to sell the building for more than the original purchase price. BECE wants to earn at least Assume expenses occur at the beginning of the year and revenue at the end of the year.

What is the NPV Should BECE inven?

NPVY$ No not irvest

NPV $ Yes, invest

NPV $ No not imvest

NPY $ yes, invest

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock