Question: Question 1 (10 points) BECE Developments is considering purchasing a small commercial building located in Prince George that will cost $800,000 and will require $125,000

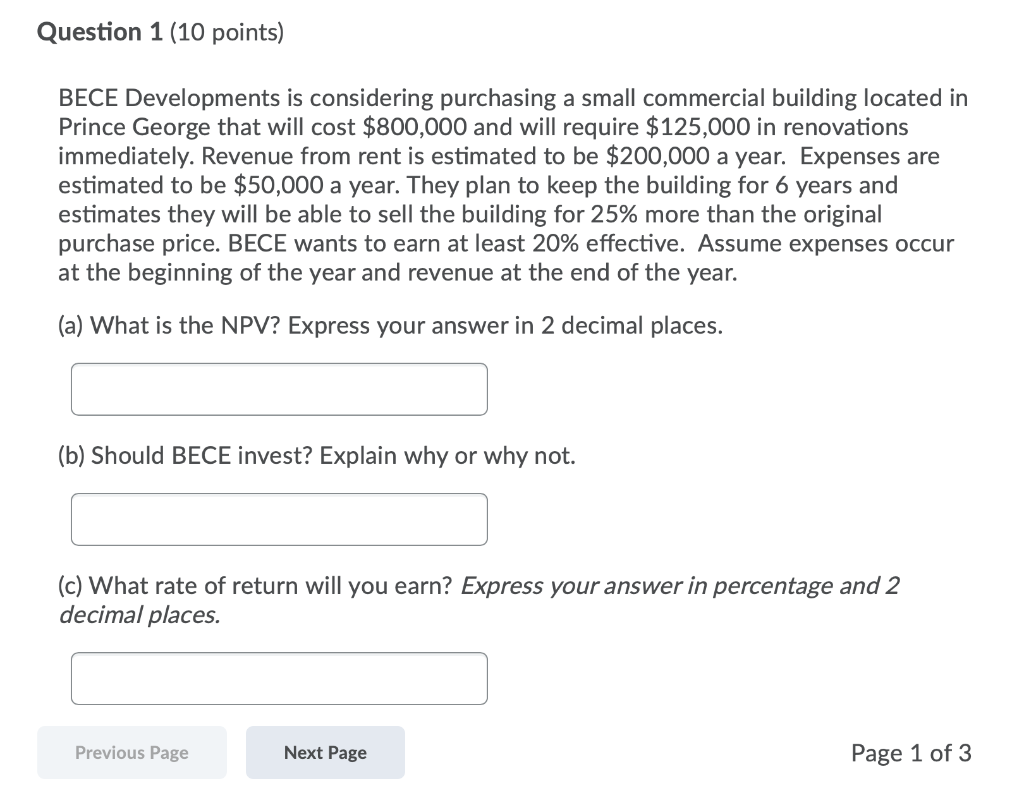

Question 1 (10 points) BECE Developments is considering purchasing a small commercial building located in Prince George that will cost $800,000 and will require $125,000 in renovations immediately. Revenue from rent is estimated to be $200,000 a year. Expenses are estimated to be $50,000 a year. They plan to keep the building for 6 years and estimates they will be able to sell the building for 25% more than the original purchase price. BECE wants to earn at least 20% effective. Assume expenses occur at the beginning of the year and revenue at the end of the year. (a) What is the NPV? Express your answer in 2 decimal places. (b) Should BECE invest? Explain why or why not. (c) What rate of return will you earn? Express your answer in percentage and 2 decimal places. Previous Page Next Page Page 1 of 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts