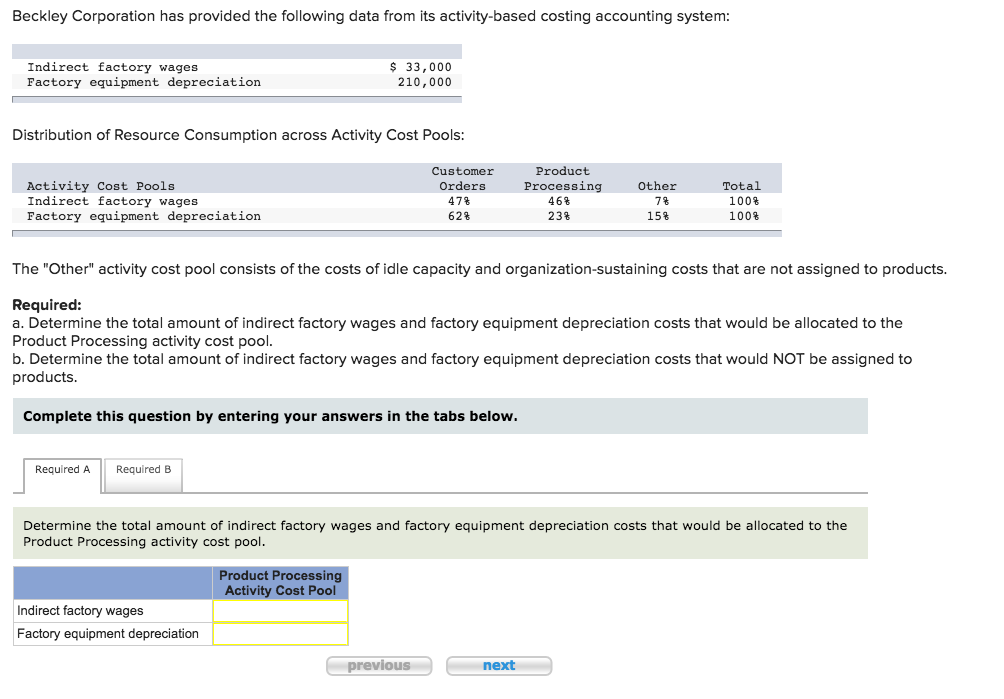

Question: Beckley Corporation has provided the following data from its activity-based costing accounting system: Indirect factory wages 33,000 Factory equipment depreciation 210,000 Distribution of Resource Consumption

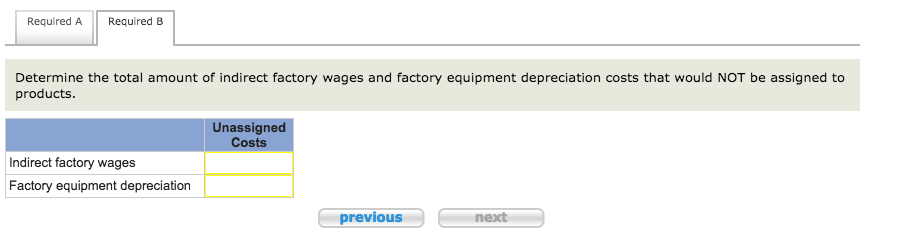

Beckley Corporation has provided the following data from its activity-based costing accounting system: Indirect factory wages 33,000 Factory equipment depreciation 210,000 Distribution of Resource Consumption across Activity Cost Pools: Product Customer Activity Cost Pools Orders Other Total Processing Indirect factory wages 7% 100% 47% 46% Factory equipment depreciation 62% 23% 15% 100% The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs that are not assigned to products. Required: a. Determine the total amount of indirect factory wages and factory equipment depreciation costs that would be allocated to the Product Processing activity cost pool b. Determine the total amount of indirect factory wages and factory equipment depreciation costs that would NOT be assigned to products Complete this question by entering your answers in the tabs below. Required A Required B Determine the total amount of indirect factory wages and factory equipment depreciation costs that would be allocated to the Product Processing activity cost pool Product Processing Activity Cost Pool indirect factory wages Factory equipment depreciation Previous next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts