Question: Becton Dickinson: Ethics and Business Practices (A) Pleas write An analysis according to ( SWOT). The answer must Include: 1- Explain ( Strengths, Weaknesses, Opportunities,

Becton Dickinson: Ethics and Business Practices (A)

Pleas write An analysis according to ( SWOT).

The answer must Include:

1- Explain ( Strengths, Weaknesses, Opportunities, and Threats,

2- Conclusions: )

3- Recommendations.

4- How should Becton Dickinson proceed forward?

a Brief History Becton Dickinson and Company had been founded in 1897 as an importer of medical devices by two friends, Maxwell W. Becton and Fairleigh S. Dickinson. Dissatisfied with the quality of the devices they imported, Becton and Dickinson began to acquire manufacturing companies of medical products. In addition, they aggressively pushed to expand the geographical reach of their business. Their company grew rapidly into a major manufacturer of a wide range of medical supplies and diagnostic equipment. Priding itself as a medical products pioneer, BD was the first manufacturer of the modern stethoscope, the insulin syringe, and the vacuum tube for blood-drawing products.BD went public in 1962.

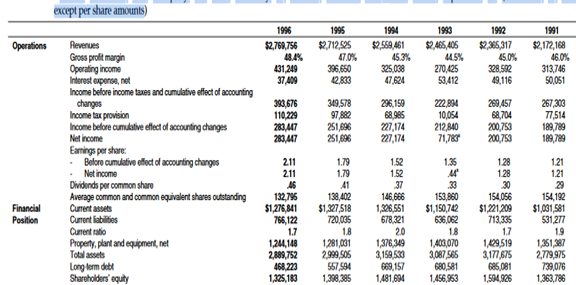

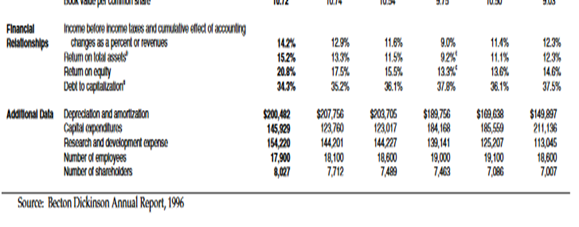

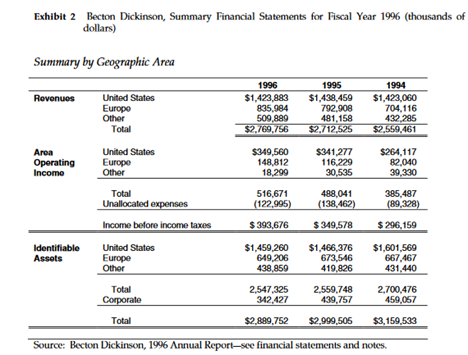

By 1996, it was the world's largest producer of medical syringes, needles, and tissue collection devices. It held 80% of the world-wide market for diabetes-care devices, 70% for pharmaceutical systems, and 50% for hypodermic syringes. BD was also a major supplier of hospital laboratory instrumentation and a variety of other disposable medical supplies used by health care professionals, medical research institutions, and the general public. With products sold in over 70 countries, international sales accounted for almost half the companys total revenues. In countries other than the United States, 50%-90% of BDs sales were to public entities such as national health systems. In the United States, 5%-15% were to public entities. With headquarters in Franklin Lakes, New Jersey, BD employed over 19,000 people worldwide and had manufacturing facilities in twelve countries, including China. In fiscal 1996, BD was approaching a crossroads. Despite record earnings of $238 million on revenues of $2.7 billion, and an unprecedented return on shareholders equity of 20.8%, the company faced a number of fundamental challenges. According to certain analysts, despite consistent earnings and extensive cost-cutting efforts in the late 1980s and early 1990s, BD had failed to create new "meaningful growth" industries; it was viewed as a less than optimal performance. 2 Yet demographic trendsthe aging of populations throughout the industrial worldand huge emerging markets in China and India created great opportunities for suppliers of medical equipment; the global market for medical technology products, about $100 billion, was growing at a rate of approximately 7% per year. 3 In this dynamic and fast-changing market, a "good, but not great, performance" could, many analysts worried, bode ill for BD's long-term future. (See Exhibits 1 and 2 for summary financial data.). Alongside a growing and changing market, BD was also facing intensified competition by highly rated competitors as well as an increasingly complex legal and regulatory environment around the world. At the same time cost containment was a key priority among private health care providers and insurance companies, as well as politicians in Washington, D.C., and elsewhere. Consolidation among health care providers meant fewer and larger buyers in many markets. To succeed at the highest levels in this increasingly demanding environment, BD would have to rethink its approach to the business.

1995 Restructuring

New strategy In the face of these opportunities and challenges, CEO Castellini introduced a new strategy in 1995. The companys goal would be to increase ROE to 20% by 1997 and annual sales growth to 10% by the end of the year 2000. To accomplish this, BD reorganized into worldwide businesses according to the lines of business with the greatest potential profit. In 1995 five were identified: 1) diabetic health care; 2) injection systems; 3) infusion therapy; 4) infectious disease diagnostics; and 5) fluid and solid tissue collection systems. Two othersflow cytometry and labwarewere added later. Each of these product lines, according to Castellini's plan, would have to hold a leading position in global markets, with a scope and scale capable of supporting strategic investments in new product development, marketing, and management. Moreover, each should also satisfy basic customer needs while somehow lowering health care costs.

Executive compensation

To reinforce the new push for financial performance, Castellini embraced a new metric for compensating executives. Rather than compensating executives for performance as measured by operating income against budget, they would be paid for creating value in excess of the cost of capital according to a metric called EVA (Economic Value Added). Another aim was to increase the number of employees owning BD shares and participating in the stock savings plan, including employees outside the U.S. Eventually, it was hoped, all employees worldwide would become shareholders.

Coordination and integration

While sharpening BDs business focus, Castellini also sought to improve coordination and integration across the businesses. He set in motion a number of one-company initiatives aimed at promoting efficiencies, leveraging the knowledge spread across the company, and forging a single corporate identity among the previously disjointed collection of quasi independent businesses. More coordination across the businesses in areas such as procurement, supply chain management, and technology sharing, would help BD reap the full benefit of its size and diverse capabilities.

Cultural change

A deeper challenge in Castellini's plan was to reshape the companys culture. Not only would the five business-focus areas require BD to make difficult choices in its corporate portfoliodivesting unrelated business lines such as surgical gloves and other groupsbut its entire culture and behavioral environment would have to evolve. Castellini wanted his managers to abandon the old command and control mentalityto become more flexible, more open with knowledge and information, and more entrepreneurial. To achieve higher levels of performance, he believed it would be necessary for everyoneespecially associates on the front linesto have more freedom and more responsibility for innovating, seizing opportunities, and making decisions. It was no good having a strategy without the capability to carry it out. Continuous improvement would have to be the norm in a rapidly changing environment. Castellini saw the cultural transformation as his master projectfrom which everything else followed. With a compelling sense of purpose and the right values in place, Castellini felt the organization could achieve its lofty ambitions. In late 1995, he and the executive committee set in motion several initiatives toward that end.

Mission and values

One was an effort to engage as many employees as possible in defining BDs mission and values. Working with a task force of corporate employees, Castellini and other members of the executive committee began by drafting a tentative statement of the companys mission and values. Based on this inputsome thought the values too vague, lacking in excitement, or aspirational rather than actualmanagement launched another round of reflection and discussion. This time, by a small group of seven employees chosen as exemplars of BDs values. The result was a company purpose defined as "helping all people live healthy lives" and four core values: "We act in harmony,

We do what is right, We always seek to improve, and We accept personal responsibility."

In late 1995, six design teams were formed to identify obstacles to performance and opportunities for growth. Each team was assigned to review one of the following:

- the companys operating philosophy and the roles and responsibilities of senior executives;

- the relationship between the corporate center and the businesses, and their respective

contribution to value creation;

the roles and responsibilities of the worldwide businesses vis-a-vis the country/regional

organizations;

the companys information planning and performance measurement systems;

the philosophy and standards used in hiring, assessing, and developing employees;

ways to enhance creativity, innovation, and adaptability.

Ethics and Business Practices Program

Another facet of the transformation launched by Castellini was the Ethics and Business Practices program, established in late 1995. Although BD had long enjoyed an excellent reputation for responsible conduct, it had not previously had a formal ethics or business practices initiative. The new effort, explained Castellini, was designed to communicate basic expectations for business conduct worldwide, the "points we don't want to compromise. Jack Galiardo, BDs vice chairman and general counsel, put the program in perspective: "The people of Becton Dickinson have always been concerned about doing the right thing. But it is a complex world and we operate in many different countries each with its own culture. So it is not always easy to know what the right thing is.".

By early 1997, the Ethics and Business Practices program was well under way, with several accomplishments to its credit:

! the publication of a Business Conduct and Compliance Guide in ten languages;

- extensive communication of the program, including meetings with division managers and associates in numerous locations in the Americas, Europe, and Asia, as well as discussion at summer management development programs;

- the establishment of a multilingual and confidential Help Line for associates worldwide;

- the appointment of a number of Business Practice Coordinators, a "volunteer fire department" to handle compliance and conduct issues in addition to their normal responsibilities;

The Global AntiCorruption Movement

These questions from BD associates came at a time of heightened attention worldwide to the problems of bribery and corruption in business and government. Although officially outlawed by virtually every country in the world, commercial bribery had nevertheless long been considered business as usual or part of the culture in many environments where laws against bribery were enforced rarely, if at all. Consequently, U.S. businesses had complained vigorously when in 1977 the federal Congress passed legislation prohibiting U.S. citizens and companies from offering bribes to overseas government officials to get business.

Views from the Field

Despite the seeming convergence of world opinion on corruption, BD managers around the world found things on the ground to be rather more complex. While reporting a decrease in pressure for out and out unethical payments, they encountered seemingly endless requests for questionable gray area favors and payments. Many people feel that this is not the correct way to do business, said one manager, but its very unlikely that things will change very rapidly. Indeed, requests for gratuities and favors could arise at any stage of the business process: in securing licenses and permits, selecting a distributor, closing a sale, or even collecting payment after delivery.

While BD managers in the region wanted the company to avoid an inflexible approach to the gifts, gratuities, and entertainment issues, most expressed support for positioning the company as highly ethical. We shouldnt relax our standard; .

Managers with experience in the EMA region were divided in their recommendations regarding BDs policy on gifts, favors, and gratuities. One view favored the existing policywhich was perceived as very strictbut saw a need to supplement it with better training and steps to get competitors to live by the same rules. The other view considered BDs policy to be correct, but too strong.

Business conduct and compliance guide,

This Guide was designed to clearly define the Companys expectations for legal and ethical behavior on the part of every employeean obligation that is in fact a condition of employment. It provides information and guidance about situations that may challenge us in our business dealings.

Becton Dickinson and Company Conflicts of Interest Policy Statement

Becton Dickinson and Company hereby restates the Companys policy relating to conflicts of interest, first adopted and published in 1962. This current statement reaffirms the continuing obligation of the Companya to ensure that the actions of its directors, officers, and other employees are above reproach and suspicion, and provides some guidance as to situations which might bring about a conflict of interest. It is the policy of Becton, Dickinson and Company that no director, officer or employee shall take any action, engage in any activity or place herself or himself in a position which reasonably could be construed to be in conflict with the best interests of the Company. The Executive Committee of the Company is responsible for administering this policy in such a manner as to obtain disclosure of any conflicts of interest involving officers and other employees and to determine whether they are adverse to the best interests of the Company. The Committee on Directors of the Companys Board of Directors is responsible for so administering this policy with respect to the members of the Companys Board of Directors.

While all the situations in which a conflict of interest may arise cannot be anticipated, in order to alert directors, officers and employees to the general areas of possible conflict, there are listed below some particular situations in which a conflict of interest could arise and should be avoided: SUCH AS :

exopt per share amounts) Soure: Becton Didinson Annual Report, 19% Exhibit 2 Becton Dickinson, Summary Financial Statements for Fiscal Year 1996 (thousands of dollars) Summary by Geographic Area

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts