Question: been practicing and stucked on this question, Please help. Picture Perfect Ltd is in the digital printing industry and makes use of digital litho printers

been practicing and stucked on this question, Please help.

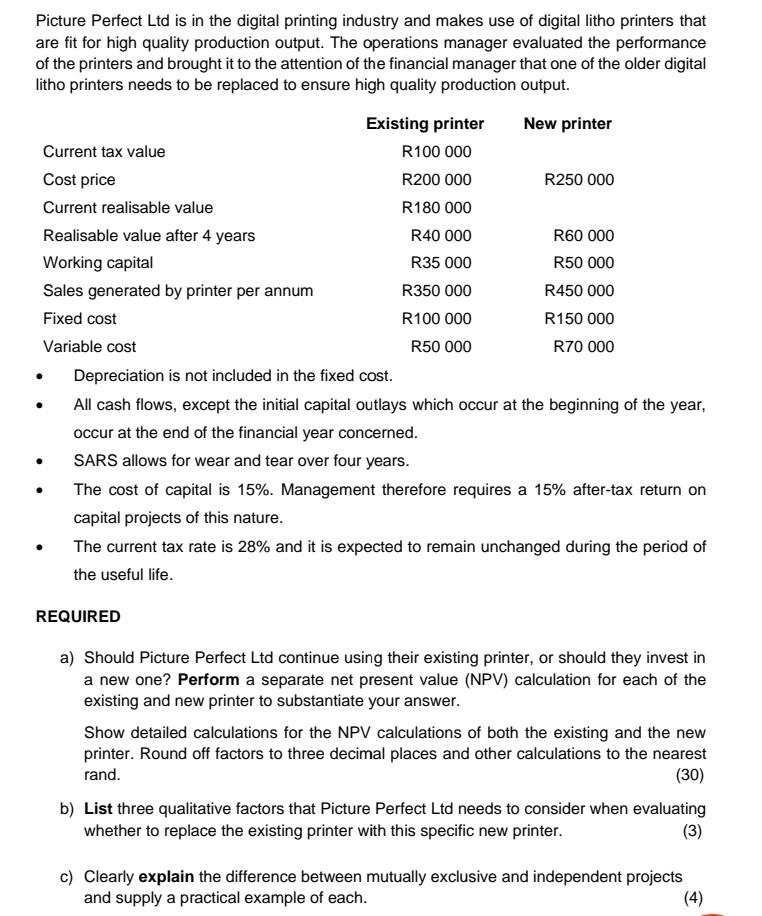

Picture Perfect Ltd is in the digital printing industry and makes use of digital litho printers that are fit for high quality production output. The operations manager evaluated the performance of the printers and brought it to the attention of the financial manager that one of the older digital litho printers needs to be replaced to ensure high quality production output. - Depreciation is not included in the fixed cost. - All cash flows, except the initial capital outlays which occur at the beginning of the year, occur at the end of the financial year concerned. - SARS allows for wear and tear over four years. - The cost of capital is 15%. Management therefore requires a 15% after-tax return on capital projects of this nature. - The current tax rate is 28% and it is expected to remain unchanged during the period of the useful life. REQUIRED a) Should Picture Perfect Ltd continue using their existing printer, or should they invest in a new one? Perform a separate net present value (NPV) calculation for each of the existing and new printer to substantiate your answer. Show detailed calculations for the NPV calculations of both the existing and the new printer. Round off factors to three decimal places and other calculations to the nearest rand. (30) b) List three qualitative factors that Picture Perfect Ltd needs to consider when evaluating whether to replace the existing printer with this specific new printer. (3) c) Clearly explain the difference between mutually exclusive and independent projects and supply a practical example of each

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts