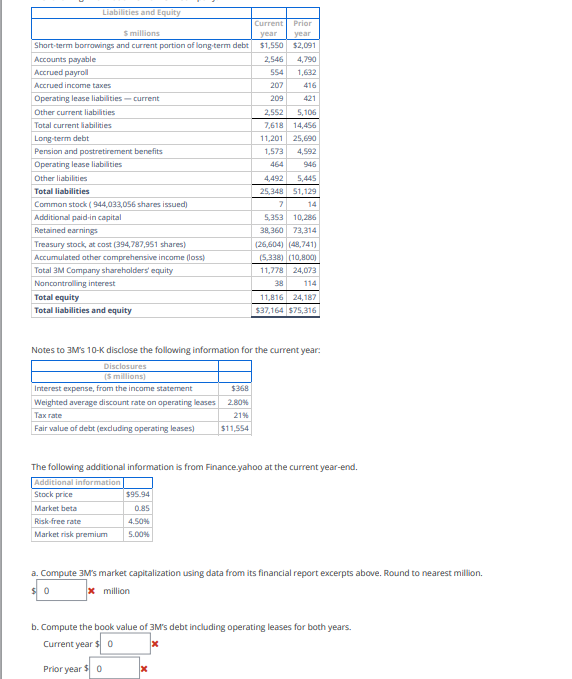

Question: begin { tabular } { | c | c | c | } hline Liabilities and Equity & & hline

begintabularccc

hline Liabilities and Equity & &

hline millions & Current year & Prior year

hline Shortterm borrowings and current portion of longterm debt & $ & $

hline Accounts payable & &

hline Accrued payrol & &

hline Accrued income taxes & &

hline Operating lease liabilities current & &

hline Other current liabilities & &

hline Total current liabilities & &

hline Longterm debt & &

hline Pension and postretirement benefits & &

hline Operating lease liabilities & &

hline Other liabilities & &

hline Total liabilities & &

hline Common stock shares issued & &

hline Additional paidin capital & &

hline Retained earnings & &

hline Treasury stock, at cost shares & &

hline Accurnulated other comprehensive income loss & &

hline Total M Company sharehalders' equity & &

hline Noncontrolling interest & &

hline Total equity & &

hline Total liabilities and equity & $ & $

hline

endtabular

Notes to M s K disclose the following information for the current year:

begintabularlr

hline multicolumnc Disclosures &

hline multicolumnc$ millions &

hline Interest expense, from the income statement & $

hline Weighted average discount rate on operating leases &

hline Tax rate &

hline Fair value of debt excluding operating leases & $

hline

endtabular

The following additional information is from Finance.yahoo at the current yearend.

begintabularlr

hline Additional information &

hline Stock price & $

hline Market beta &

hline Riskfree rate &

hline Market risk premium &

hline

endtabular

a Compute Ms market capitalization using data from its financial report excerpts above. Round to nearest million.

x million

b Compute the book value of Ms debt including operating leases for both years.

Current year

Prior year $ x

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock