Question: begin { tabular } { | c | c | c | c | c | c | c | c | c |

begintabularccccccccccccccc

hline multicolumnrYear & multicolumnrYear & multicolumnrYear & multicolumnrYear & multicolumnrYear & multicolumnrYear & multicolumnrYear

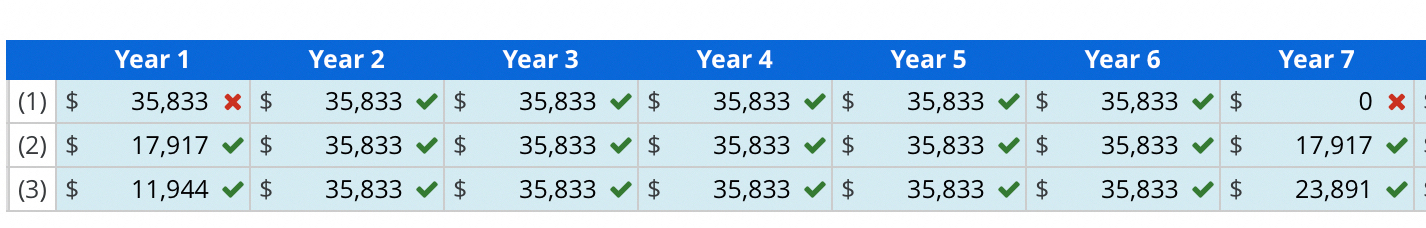

hline & $ & x & $ & & $ & & $ & & $ & & $ & & $ & times

hline & $ & & $ & & $ & & $ & & $ & & $ & & $ &

hline & $ & & $ & & $ & & $ & & $ & & $ & & $ &

hline

endtabular Partial Period Depreciation

Alpine Inc. purchased equipment on September of Year at a cost of $ The estimated residual value the end of its estimated useful life of years is $ Data relating to the equipment follow.

Part TwoPolicy Convention Applied to Partial Period

Assume the same information as in Part One, except now assume that the equipment was purchased on September of Year Compute depreciation expense each year over the life of the equipment using the straightline method and fullyear conventionbeginning of period, halfyear convention, and fullmonth convention.

Note: Round amounts to the nearest whole dollar.

Note: Enter any rounding differences in Year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock