Question: begin { tabular } { | l | l | l | l | l | } hline & & Outcome & &

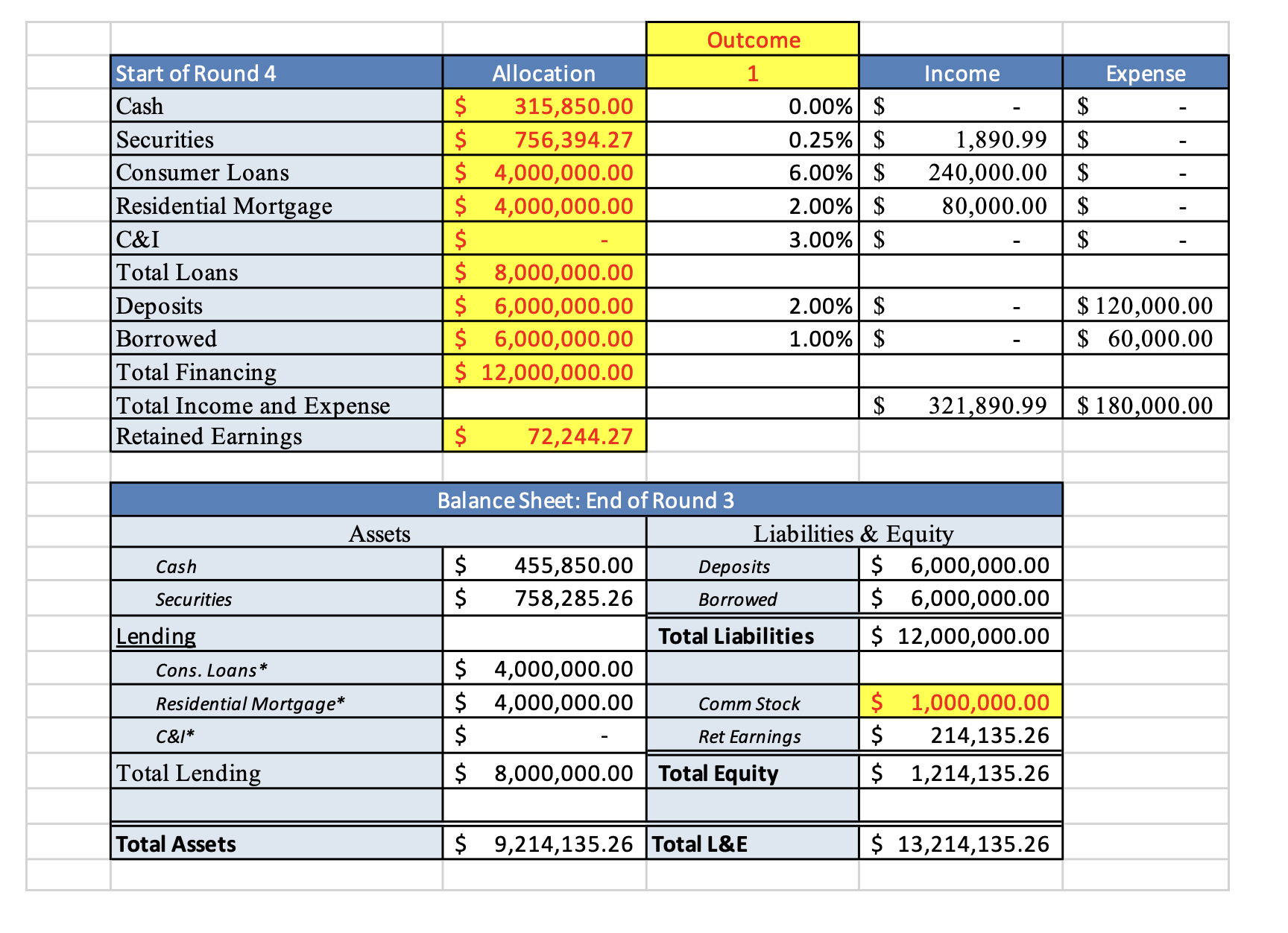

begintabularlllllhline & & Outcome & & hline Start of Round & Allocation & & Income & Expense hline Cash & $ & & $ & $ hline Securities & $ & & $ & $ hline Consumer Loans & $ & & $ & $ hline Residential Mortgage & $ & & $ & $ hline C&I & $ & & $ & $ hline Total Loans & $ & & & hline Deposits & $ & & $ & $ hline Borrowed & $ & & $ & $ hline Total Financing & $ & & & hline Total Income and Expense & & & $ & $ hline Retained Earnings & $ & & & hline & & & & hline multicolumncBalance Sheet: End of Round & hline multicolumncAssets & multicolumncLiabilities & Equity & hline Cash & $ & Deposits & $ & hline Securities & $ & Borrowed & $ & hline Lending & & Total Liabilities & $ & hline Cons.Loans & $ & & & hline Residential Mortgage & $ & Comm Stock & $ & hline C& & $ & Ret Earnings & $ & hline Total Lending & $ & Total Equity & $ & hline & & & & hline Total Assets & $ & Total L&E & $ & hline & & & & hline endtabular In Round you have expanded opportunities to lend overseas and fund your operations in the Eurodollar market and in foreign currencies. Specifically, you will now be able to make and fund C&I loans denominated in Euros andor fund your US$ operations in Eurodollars.

Revise your asset allocation and funding source decisions for Round in light of these new lending and funding alternatives and the possible outcomes through

a Notice that the outcomes in the LMS assume euro interest rates are not perfectly correlated with US dollar interest rates.

b Observe that sourcing US$ in the Eurodollar market is generally cheaper than sourcing dollars domestically, with the exception of an occurrence of a liquidity crisis.

c Also note that all balance sheet items are ultimately denominated in US$

d Open the embedded excel spreadsheet and load the items from the End of Round but also make allocations in euros and Eurodollars. Make sure your balance sheet balances correctly.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock