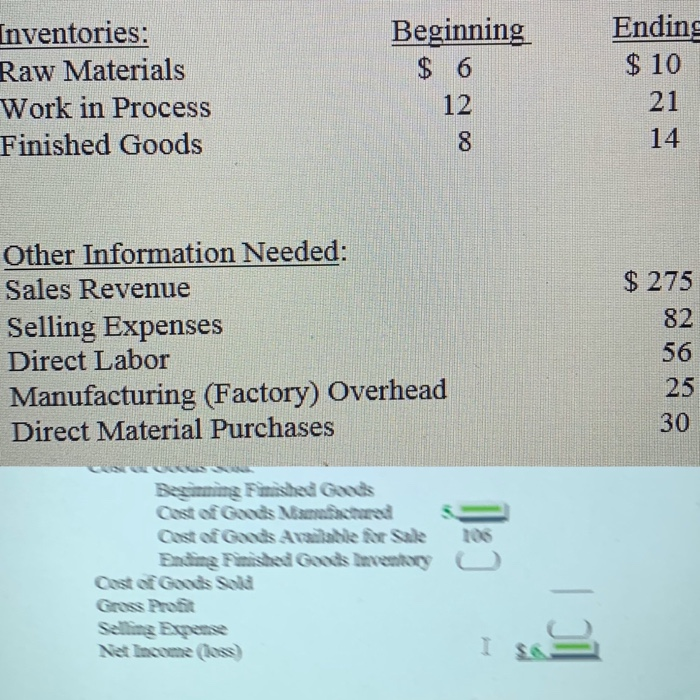

Question: Beginning $ 6 Ending $ 10 Inventories: Raw Materials Work in Process Finished Goods 21 14 $ 275 82 Other Information Needed: Sales Revenue Selling

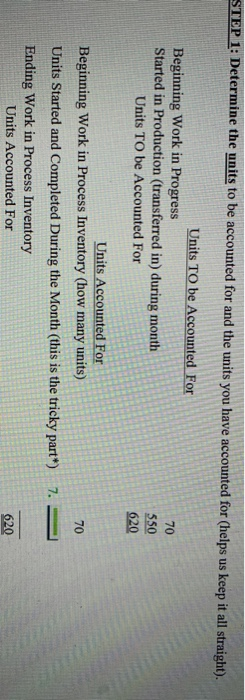

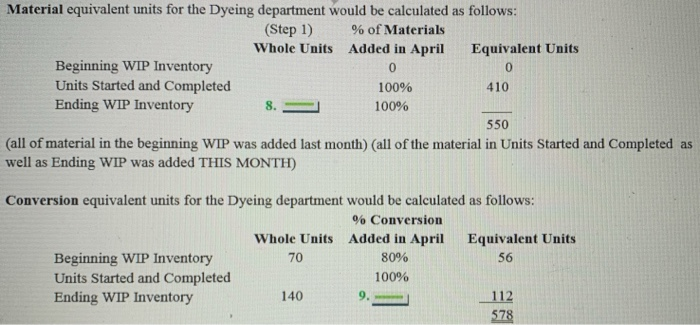

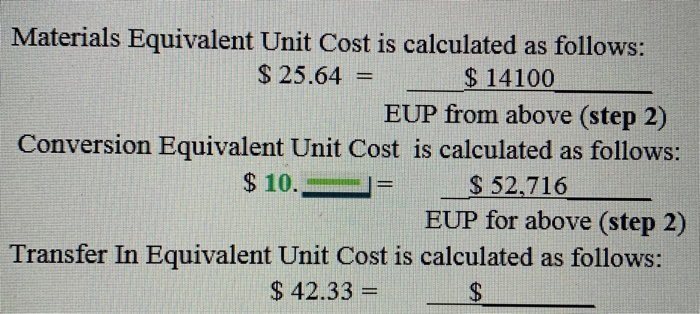

Beginning $ 6 Ending $ 10 Inventories: Raw Materials Work in Process Finished Goods 21 14 $ 275 82 Other Information Needed: Sales Revenue Selling Expenses Direct Labor Manufacturing (Factory) Overhead Direct Material Purchases 56 25 30 Cost of God uctured Cast of Gods Available for Sale Ending Fished Goods Inventory Cost of Goods Sold STEP 1: Determine the units to be accounted for and the units you have accounted for (helps us keep it all straight). Units To be Accounted For Beginning Work in Progress Started in Production (transferred in) during month Units To be Accounted For Units Accounted For Beginning Work in Process Inventory (how many units) Units Started and Completed During the Month (this is the tricky part) Ending Work in Process Inventory Units Accounted For Material equivalent units for the Dyeing department would be calculated as follows: (Step 1) % of Materials Whole Units Added in April Equivalent Units Beginning WIP Inventory Units Started and Completed 100% 410 Ending WIP Inventory 8. = 100% 550 (all of material in the beginning WIP was added last month) (all of the material in Units Started and Completed as well as Ending WIP was added THIS MONTH) Conversion equivalent units for the Dyeing department would be calculated as follows: % Conversion Whole Units Added in April Equivalent Units Beginning WIP Inventory 80% 56 Units Started and Completed 100% Ending WIP Inventory 140 112 578 70 Materials Equivalent Unit Cost is calculated as follows: $ 25.64 = $ 14100 EUP from above (step 2) Conversion Equivalent Unit Cost is calculated as follows: $ 10. == = $ 52,716 EUP for above (step 2) Transfer In Equivalent Unit Cost is calculated as follows: $ 42.33=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts