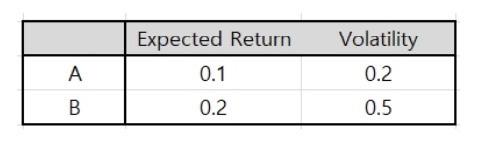

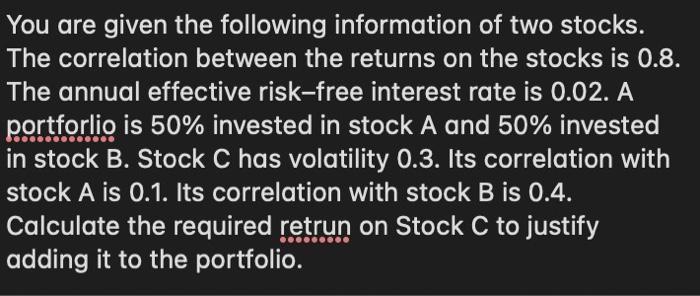

Question: begin{tabular}{|c|cc|} hline & Expected Return & Volatility hline A & 0.1 & 0.2 B & 0.2 & 0.5 hline end{tabular} You are

\begin{tabular}{|c|cc|} \hline & Expected Return & Volatility \\ \hline A & 0.1 & 0.2 \\ B & 0.2 & 0.5 \\ \hline \end{tabular} You are given the following information of two stocks. The correlation between the returns on the stocks is 0.8. The annual effective risk-free interest rate is 0.02. A portforlio is 50% invested in stock A and 50% invested in stock B. Stock C has volatility 0.3. Its correlation with stock A is 0.1. Its correlation with stock B is 0.4. Calculate the required retrun on Stock C to justify adding it to the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts