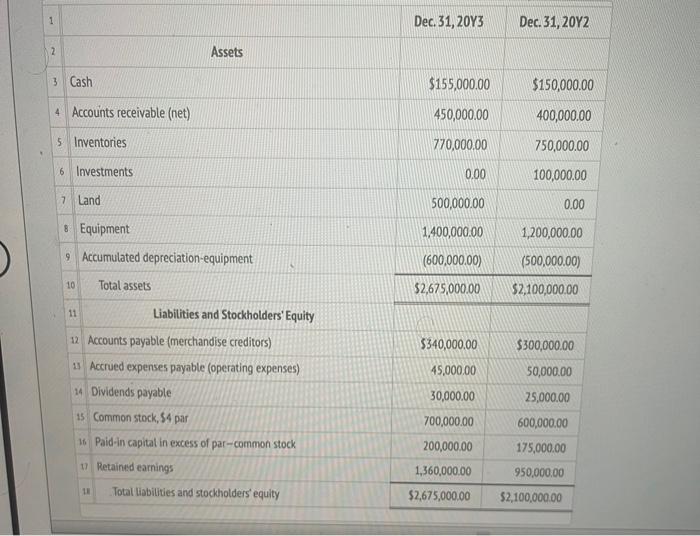

Question: begin{tabular}{|c|c|c|c|} hline 1 & & Dec. 31,20Y3 & Dec. 31, 20Y2 hline 2 & Assets & & hline 3 Cas & Cash &

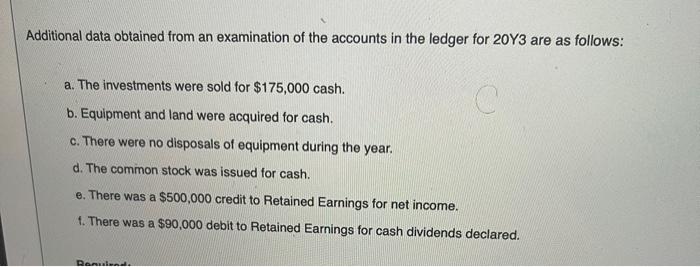

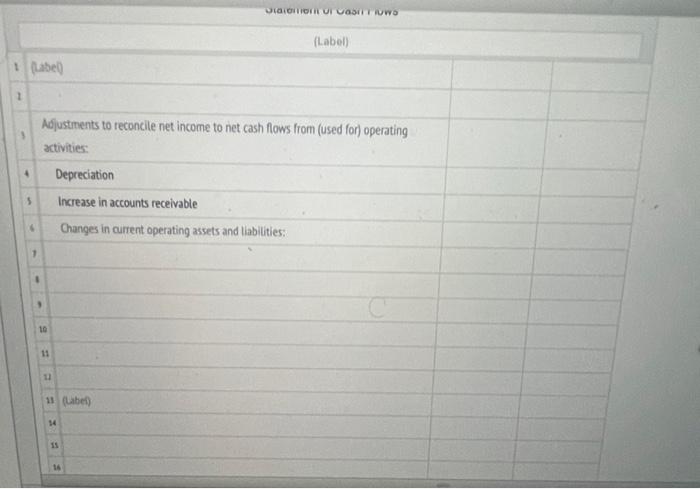

\begin{tabular}{|c|c|c|c|} \hline 1 & & Dec. 31,20Y3 & Dec. 31, 20Y2 \\ \hline 2 & Assets & & \\ \hline 3 Cas & Cash & $15$,000.00 & $150,000.00 \\ \hline 4A & Accounts receivable (net) & 450,000.00 & 400,000.00 \\ \hline 5 & Inventories & 770,000.00 & 750,000.00 \\ \hline 6 & Investments & 0.00 & 100,000,00 \\ \hline 7 & Land & 500,000.00 & 0.00 \\ \hline 8 & Equipment & 1,400,000.00 & 1,200,000.00 \\ \hline 9 & Accumulated depreciation-equipment & (600,000.00) & (500,000.00) \\ \hline & Total assets & $2,675,000.00 & $2,100,000,00 \\ \hline & Liabilities and Stockholders' Equity & & \\ \hline & 12 Accounts payable (merchandise creditors) & $340,000,00 & $300,000.00 \\ \hline & 14 Accrued expenses payable (operating expenses) & 45,000.00 & 50,000.00 \\ \hline & 14 Dividends payable & 30,000.00 & 25,000.00 \\ \hline & 15. Common stock, \$4 par & 700,000.00 & 600,000.00 \\ \hline & 16. Paid-in capital in excess of par-common stock & 200,000.00 & 175,000.00 \\ \hline & 1) Retainad earnings & 1,360,000.00 & 950,000.00 \\ \hline & Total tiabilities and stockholders equity & $2,675,000.00 & $2,100,000,00 \\ \hline \end{tabular} Additional data obtained from an examination of the accounts in the ledger for 20Y3 are as follows: a. The investments were sold for $175,000 cash. b. Equipment and land were acquired for cash. c. There were no disposals of equipment during the year. d. The common stock was issued for cash. . There was a $500,000 credit to Retained Earnings for net income. 1. There was a $90,000 debit to Retained Earnings for cash dividends declared. (Labol) pabe0 Nojusthents to reconcile net income to net cash flows from (used for) operating rctivities: Depreciation Increase in accounts receivable Changes in current operating assets and liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts