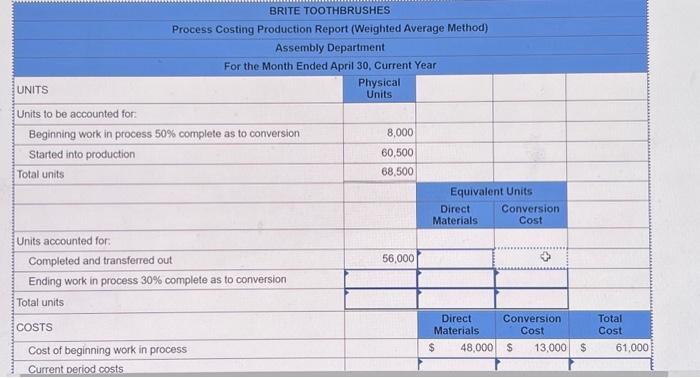

Question: begin{tabular}{|c|c|c|c|c|} hline multicolumn{5}{|c|}{ BRITE TOOTHBRUSHES } hline multicolumn{5}{|c|}{ Assembly Department } hline multicolumn{5}{|c|}{ For the Month Ended April 30, Current Year }

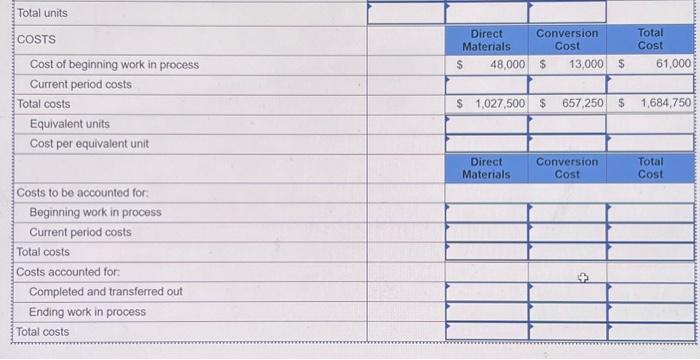

\begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ BRITE TOOTHBRUSHES } \\ \hline \multicolumn{5}{|c|}{ Assembly Department } \\ \hline \multicolumn{5}{|c|}{ For the Month Ended April 30, Current Year } \\ \hline UNITS & \begin{tabular}{l} Physical \\ Units \end{tabular} & & & \\ \hline \multicolumn{5}{|l|}{ Units to be accounted for: } \\ \hline Beginning work in process 50% complete as to conversion & 8,000 & & & \\ \hline Started into production & 60,500 & & & \\ \hline \multirow[t]{3}{*}{ Total units } & 68,500 & & & \\ \hline & \multicolumn{4}{|c|}{ Equivalent Units } \\ \hline & & \begin{tabular}{c} Direct \\ Materials \end{tabular} & \begin{tabular}{c} Conversion \\ Cost \end{tabular} & \\ \hline \multicolumn{5}{|l|}{ Units accounted for: } \\ \hline Completed and transferred out & 56,000 & & & \\ \hline \multicolumn{5}{|l|}{ Ending work in process 30% complete as to conversion } \\ \hline \multicolumn{5}{|l|}{ Total units } \\ \hline COSTS & & \begin{tabular}{l} Direct \\ Materials \end{tabular} & \begin{tabular}{c} Conversion \\ Cost \end{tabular} & \begin{tabular}{l} Total \\ Cost \end{tabular} \\ \hline Cost of beginning work in process & & 48,000 & 13,000 & 61,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Total units & & & & & & \\ \hline COSTS & & & \begin{tabular}{l} Direct \\ Materials \end{tabular} & \begin{tabular}{c} Conversion \\ Cost \end{tabular} & & \begin{tabular}{l} Total \\ Cost \end{tabular} \\ \hline Cost of beginning work in process & & & 48,000 & 13,000 & $ & 61,000 \\ \hline Current period costs & & & & & & \\ \hline Total costs & & & $1,027,500 & $657,250 & $ & 1,684,750 \\ \hline Equivalent units & - & & & & & \\ \hline Cost per equivalent unit & & & & & & \\ \hline & & & \begin{tabular}{c} Direct \\ Materials \end{tabular} & \begin{tabular}{c} Conversion \\ Cost \end{tabular} & & \begin{tabular}{l} Total \\ Cost \end{tabular} \\ \hline Costs to be accounted for: & & & & & & \\ \hline Beginning work in process & - & & & & & \\ \hline Current period costs & & & & & & \\ \hline Total costs & & & & & & \\ \hline Costs accounted for: & & & & 3 & & \\ \hline Completed and transferred out & & & & & & \\ \hline Ending work in process & & & & & & \\ \hline Total costs & & & & & & \\ \hline \end{tabular} Brite Toothbrushes has gathered the following information to complete its Production Report for the month of April. Assume all materials are added at the beginning of the process. Required: Using the provided information, complete the report. Note: Round cost per Equivalent Units to 2 decimal places. \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ BRITE TOOTHBRUSHES } \\ \hline \multicolumn{5}{|c|}{ Assembly Department } \\ \hline \multicolumn{5}{|c|}{ For the Month Ended April 30, Current Year } \\ \hline UNITS & \begin{tabular}{l} Physical \\ Units \end{tabular} & & & \\ \hline \multicolumn{5}{|l|}{ Units to be accounted for: } \\ \hline Beginning work in process 50% complete as to conversion & 8,000 & & & \\ \hline Started into production & 60,500 & & & \\ \hline \multirow[t]{3}{*}{ Total units } & 68,500 & & & \\ \hline & \multicolumn{4}{|c|}{ Equivalent Units } \\ \hline & & \begin{tabular}{c} Direct \\ Materials \end{tabular} & \begin{tabular}{c} Conversion \\ Cost \end{tabular} & \\ \hline \multicolumn{5}{|l|}{ Units accounted for: } \\ \hline Completed and transferred out & 56,000 & & & \\ \hline \multicolumn{5}{|l|}{ Ending work in process 30% complete as to conversion } \\ \hline \multicolumn{5}{|l|}{ Total units } \\ \hline COSTS & & \begin{tabular}{l} Direct \\ Materials \end{tabular} & \begin{tabular}{c} Conversion \\ Cost \end{tabular} & \begin{tabular}{l} Total \\ Cost \end{tabular} \\ \hline Cost of beginning work in process & & 48,000 & 13,000 & 61,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline Total units & & & & & & \\ \hline COSTS & & & \begin{tabular}{l} Direct \\ Materials \end{tabular} & \begin{tabular}{c} Conversion \\ Cost \end{tabular} & & \begin{tabular}{l} Total \\ Cost \end{tabular} \\ \hline Cost of beginning work in process & & & 48,000 & 13,000 & $ & 61,000 \\ \hline Current period costs & & & & & & \\ \hline Total costs & & & $1,027,500 & $657,250 & $ & 1,684,750 \\ \hline Equivalent units & - & & & & & \\ \hline Cost per equivalent unit & & & & & & \\ \hline & & & \begin{tabular}{c} Direct \\ Materials \end{tabular} & \begin{tabular}{c} Conversion \\ Cost \end{tabular} & & \begin{tabular}{l} Total \\ Cost \end{tabular} \\ \hline Costs to be accounted for: & & & & & & \\ \hline Beginning work in process & - & & & & & \\ \hline Current period costs & & & & & & \\ \hline Total costs & & & & & & \\ \hline Costs accounted for: & & & & 3 & & \\ \hline Completed and transferred out & & & & & & \\ \hline Ending work in process & & & & & & \\ \hline Total costs & & & & & & \\ \hline \end{tabular} Brite Toothbrushes has gathered the following information to complete its Production Report for the month of April. Assume all materials are added at the beginning of the process. Required: Using the provided information, complete the report. Note: Round cost per Equivalent Units to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts