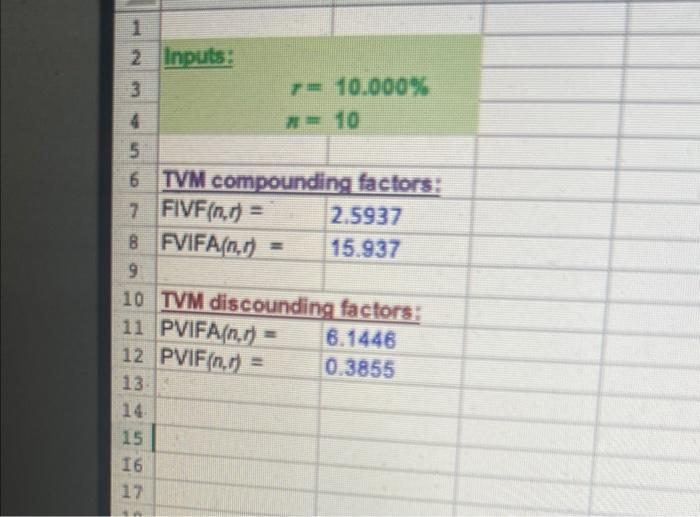

Question: begin{tabular}{l|l} 1 2 & Inputs: hline end{tabular} r=10.000%n=10 6 TVM compounding factors: 7 FIVF (n,r)=2.5937 8 FVIFA (n,1)=15.937 10 TVM discounding factors: 11

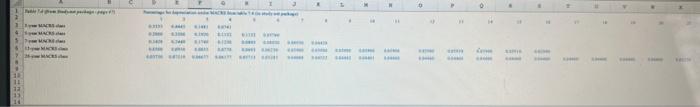

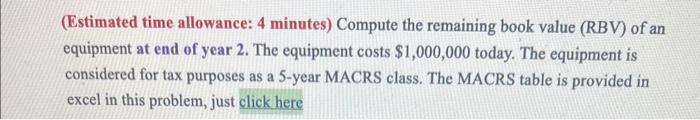

\begin{tabular}{l|l} 1 \\ 2 & Inputs: \\ \hline \end{tabular} r=10.000%n=10 6 TVM compounding factors: 7 FIVF (n,r)=2.5937 8 FVIFA (n,1)=15.937 10 TVM discounding factors: 11 PVIFA (n,r)=6.1446 12PVIF(n,t)=0.3855 (Estimated time allowance: 4 minutes) Compute the remaining book value (RBV) of an equipment at end of year 2. The equipment costs $1,000,000 today. The equipment is considered for tax purposes as a 5-year MACRS class. The MACRS table is provided in excel in this problem, just click here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts