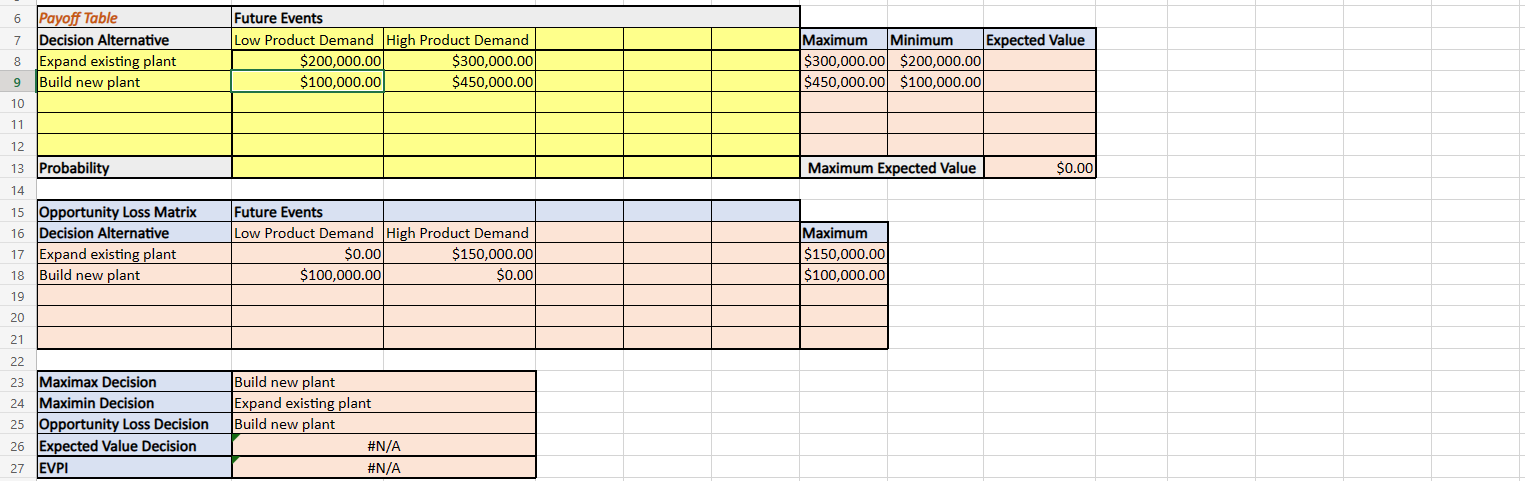

Question: begin{tabular}{l|l|l|} hline 22 & & cline { 2 - 3 } & Maximax Decision & Build new plant 24 & Maximin Decision &

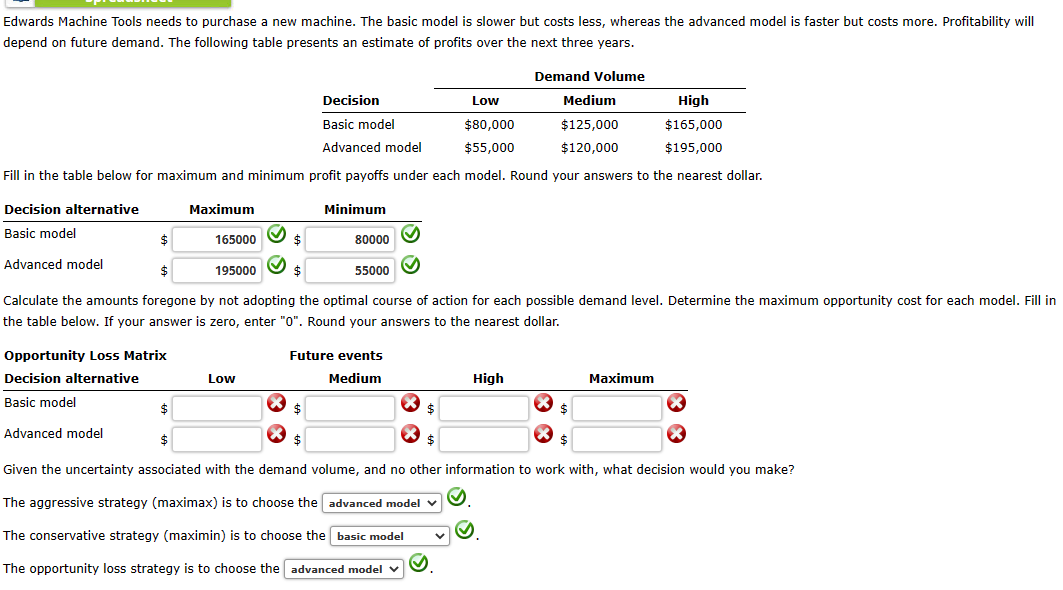

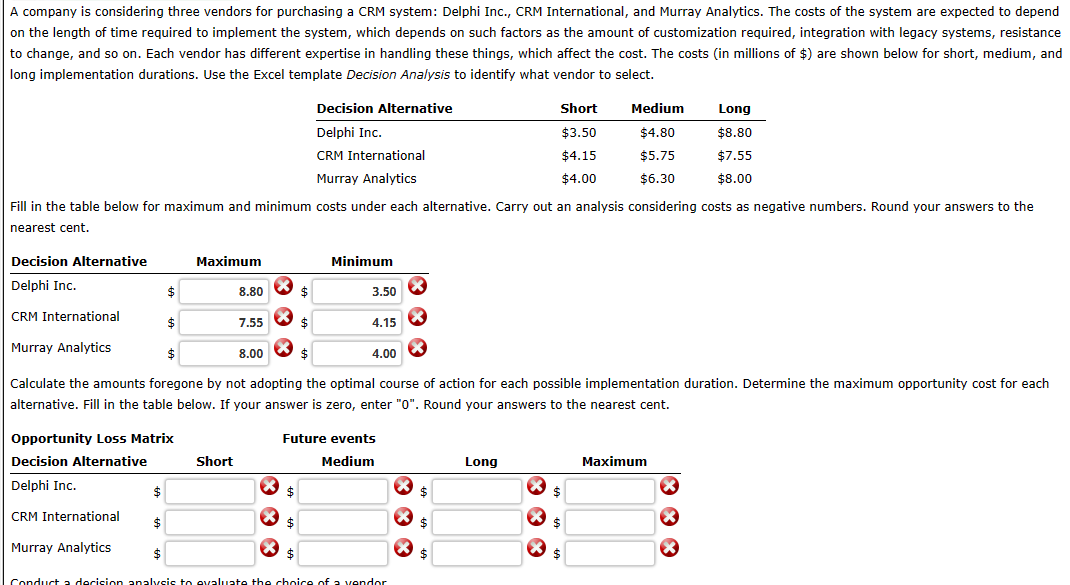

\begin{tabular}{l|l|l|} \hline 22 & & \\ \cline { 2 - 3 } & Maximax Decision & Build new plant \\ 24 & Maximin Decision & Expand existing plant \\ \hline 25 & Opportunity Loss Decision & Build new plant \\ \hline 26 & \multicolumn{1}{|c|}{#N/A} \\ \hline Expected Value Decision & \\ \cline { 2 - 3 } & EVPI & \\ \hline \end{tabular} Edwards Machine Tools needs to purchase a new machine. The basic model is slower but costs less, whereas the advanced model is faster but costs more. Profitability will depend on future demand. The following table presents an estimate of profits over the next three years. Fill in the table below for maximum and minimum profit payoffs under each model. Round your answers to the nearest dollar. Calculate the amounts foregone by not adopting the optimal course of action for each possible demand level. Determine the maximum opportunity cost for each model. Fill in the table below. If your answer is zero, enter "0". Round your answers to the nearest dollar. Given the uncertainty associated with the demand volume, and no other information to work with, what decision would you make? The aggressive strategy (maximax) is to choose the The conservative strategy (maximin) is to choose the The opportunity loss strategy is to choose the A company is considering three vendors for purchasing a CRM system: Delphi Inc., CRM International, and Murray Analytics. The costs of the system are expected to depend on the length of time required to implement the system, which depends on such factors as the amount of customization required, integration with legacy systems, resistance to change, and so on. Each vendor has different expertise in handling these things, which affect the cost. The costs (in millions of $ ) are shown below for short, medium, and long implementation durations. Use the Excel template Decision Analysis to identify what vendor to select. Fill in the table below for maximum and minimum costs under each alternative. Carry out an analysis considering costs as negative numbers. Round your answers to the nearest cent. Calculate the amounts foregone by not adopting the optimal course of action for each possible implementation duration. Determine the maximum opportunity cost for each alternative. Fill in the table below. If your answer is zero, enter "0". Round your answers to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts