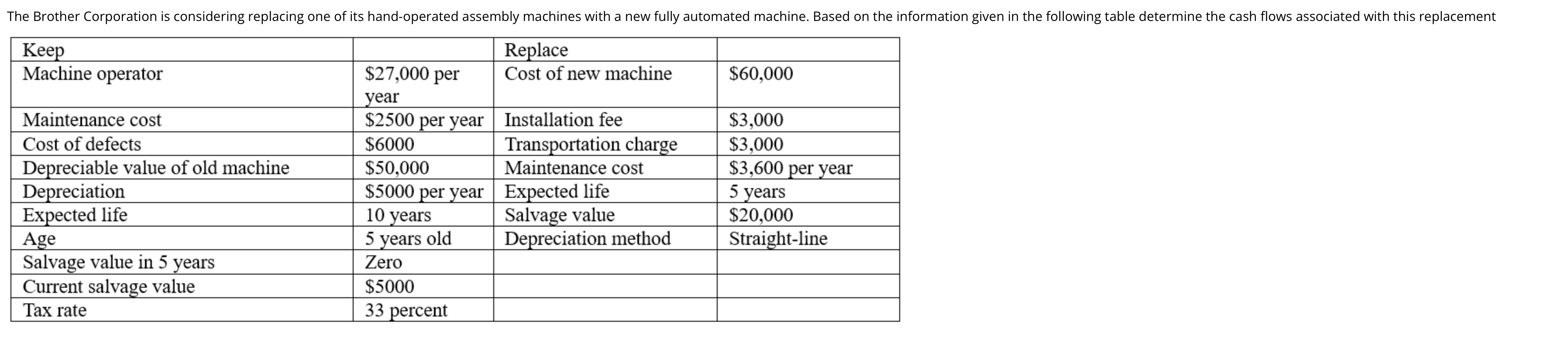

Question: begin{tabular}{|l|l|l|l|} hline Keep & & Replace & hline Machine operator & $27,000peryear & Cost of new machine & $60,000 hline Maintenance cost &

\begin{tabular}{|l|l|l|l|} \hline Keep & & Replace & \\ \hline Machine operator & $27,000peryear & Cost of new machine & $60,000 \\ \hline Maintenance cost & $2500 per year & Installation fee & $3,000 \\ \hline Cost of defects & $6000 & Transportation charge & $3,000 \\ \hline Depreciable value of old machine & $50,000 & Maintenance cost & $3,600 per year \\ \hline Depreciation & $5000 per year & Expected life & 5 years \\ \hline Expected life & 10 years & Salvage value & $20,000 \\ \hline Age & 5 years old & Depreciation method & Straight-line \\ \hline Salvage value in 5 years & Zero & & \\ \hline Current salvage value & $5000 & & \\ \hline Tax rate & 33 percent & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts