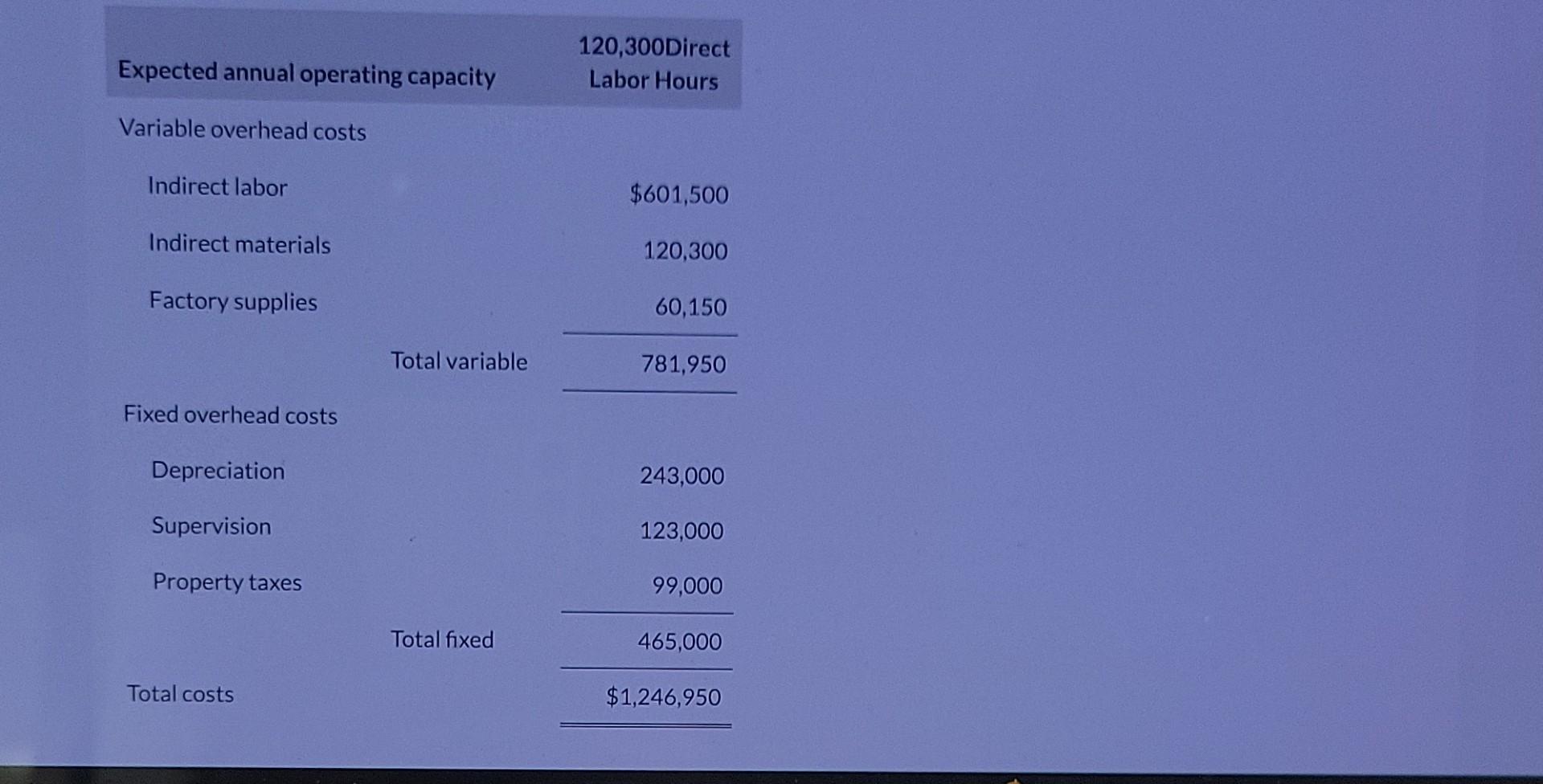

Question: begin{tabular}{lr} Expected annual operating capacity & 120,300DirectLaborHours Variable overhead costs & $601,500 Indirect labor & 120,300 Indirect materials & 60,150 Factory

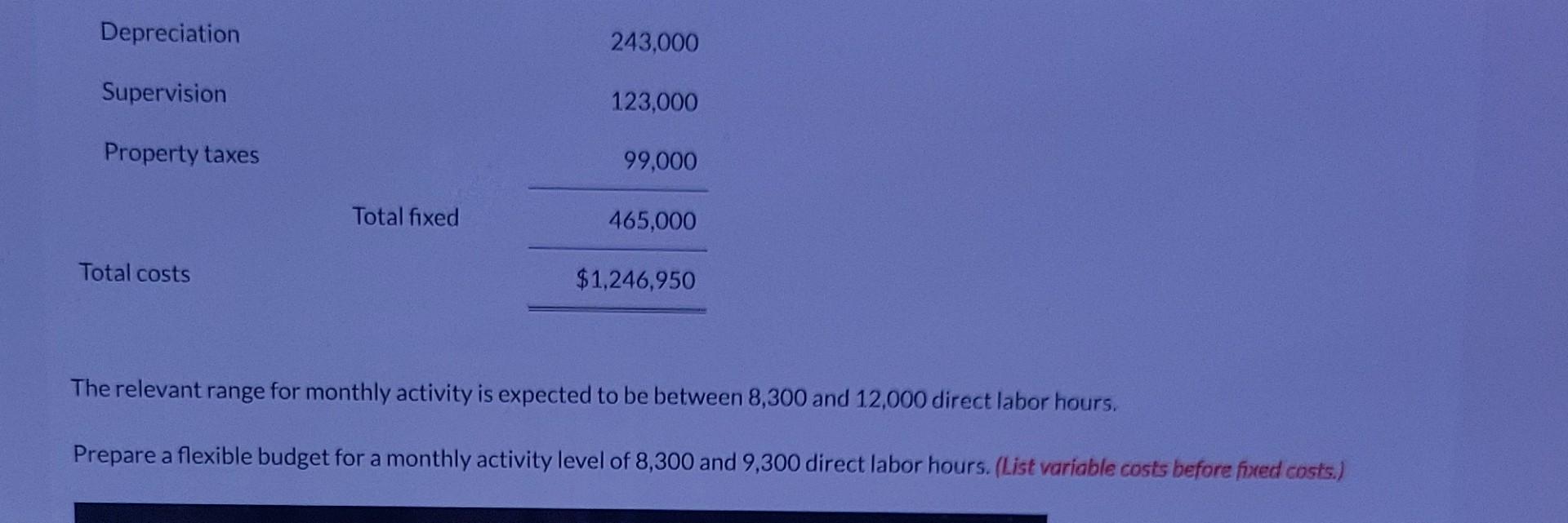

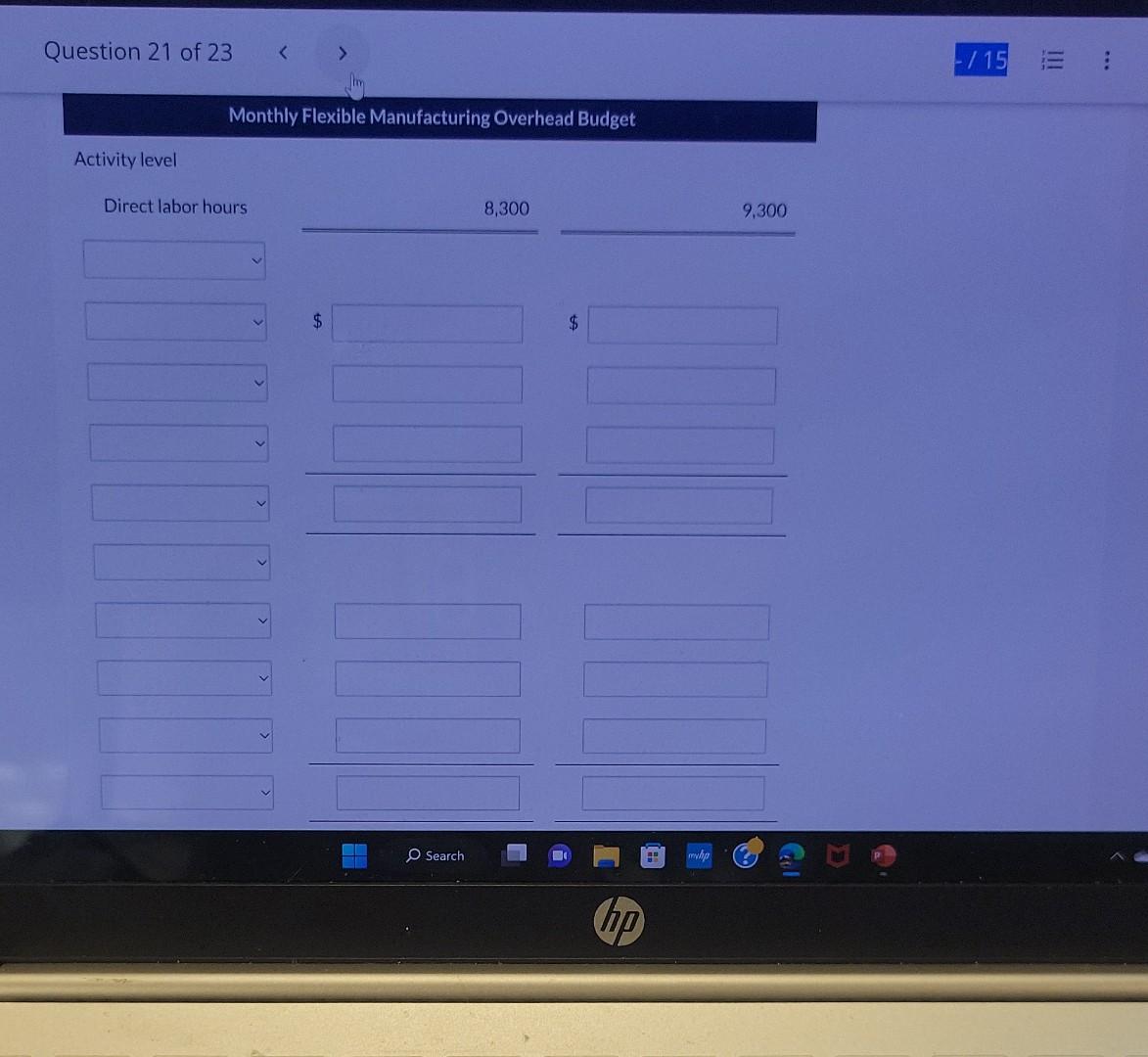

\begin{tabular}{lr} Expected annual operating capacity & 120,300DirectLaborHours \\ Variable overhead costs & $601,500 \\ Indirect labor & 120,300 \\ Indirect materials & 60,150 \\ Factory supplies & 781,950 \\ \hline Fixed overhead costs & \\ Depreciation & 243,000 \\ Supervision & 123,000 \\ Property taxes & 99,000 \\ \hline Total costs & 465,000 \\ \hline \end{tabular} The relevant range for monthly activity is expected to be between 8,300 and 12,000 direct labor hours. Prepare a flexible budget for a monthly activity level of 8,300 and 9,300 direct labor hours. (List variable costs before fixed costs.) Question 21 of 23 Monthly Flexible Manufacturing Overhead Budget Activity level Direct labor hours \begin{tabular}{l} 8,300 \\ \hline \end{tabular} $ $ Attempts: 0 of 1 used

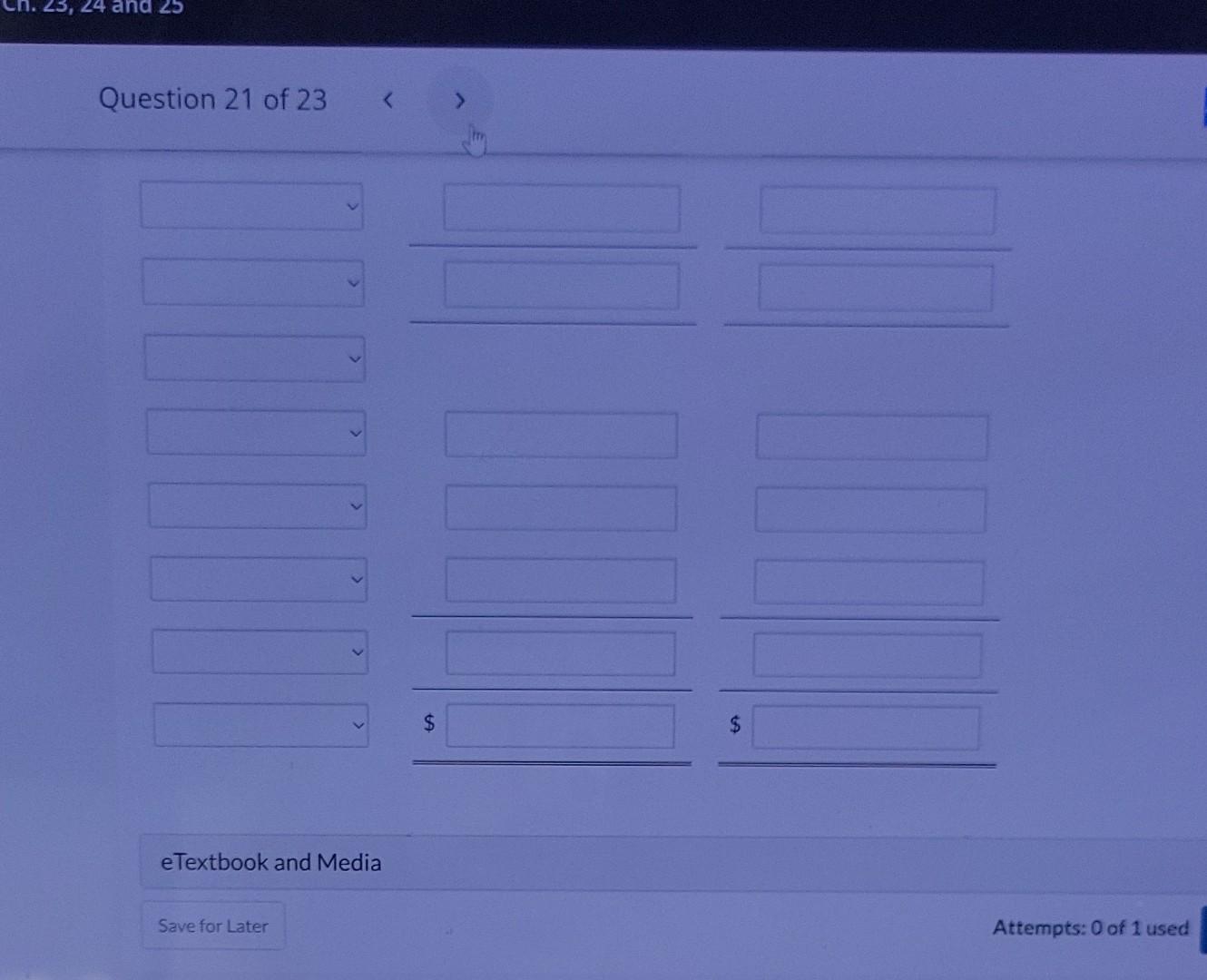

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts