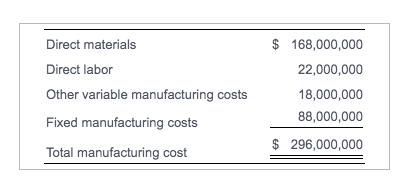

Question: begin{tabular}{|lr|} hline Direct materials & $168,000,000 Direct labor & 22,000,000 Other variable manufacturing costs & 18,000,000 Fixed manufacturing costs & 88,000,000

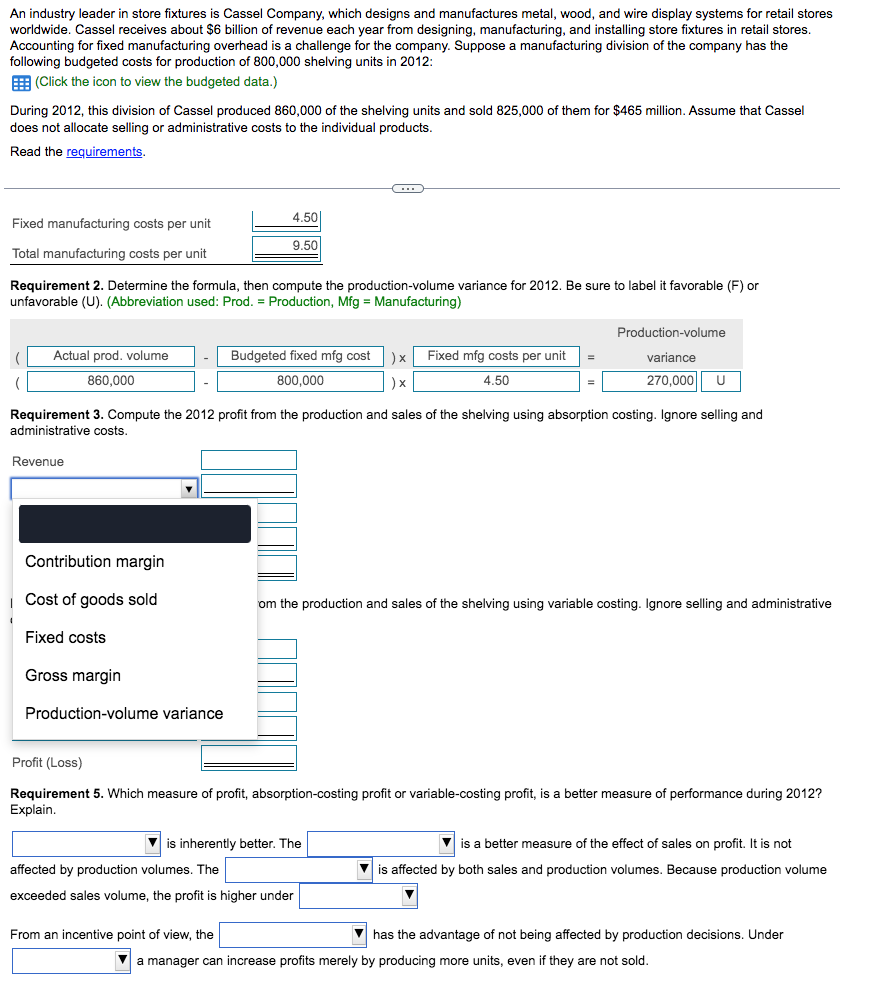

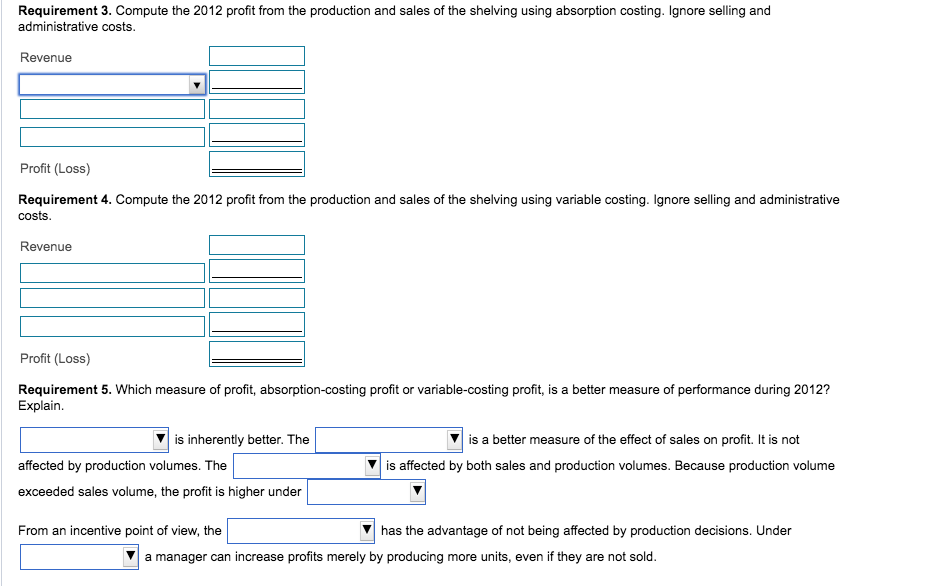

\begin{tabular}{|lr|} \hline Direct materials & $168,000,000 \\ Direct labor & 22,000,000 \\ Other variable manufacturing costs & 18,000,000 \\ Fixed manufacturing costs & 88,000,000 \\ \cline { 2 - 2 } & $296,000,000 \\ \hline Total manufacturing cost & \\ \hline \end{tabular} An industry leader in store fixtures is Cassel Company, which designs and manufactures metal, wood, and wire display systems for retail stores worldwide. Cassel receives about $6 billion of revenue each year from designing, manufacturing, and installing store fixtures in retail stores. Accounting for fixed manufacturing overhead is a challenge for the company. Suppose a manufacturing division of the company has the following budgeted costs for production of 800,000 shelving units in 2012: (Click the icon to view the budgeted data.) During 2012, this division of Cassel produced 860,000 of the shelving units and sold 825,000 of them for $465 million. Assume that Cassel does not allocate selling or administrative costs to the individual products. Read the requirements. Requirement 2. Determine the formula, then compute the production-volume variance for 2012. Be sure to label it favorable (F) or unfavorable (U). (Abbreviation used: Prod. = Production, Mfg = Manufacturing) Requirement 3. Compute the 2012 profit from the production and sales of the shelving using absorption costing. Ignore selling and administrative costs. Revenue roduction and sales of the shelving using variable costing. Ignore selling and administrative Requirement 5. Which measure of profit, absorption-costing profit or variable-costing profit, is a better measure of performance during 2012? Explain. is inherently better. The affected by production volumes. The exceeded sales volume, the profit is higher under From an incentive point of view, the is a better measure of the effect of sales on profit. It is not is affected by both sales and production volumes. Because production volume has the advantage of not being affected by production decisions. Under a manager can increase profits merely by producing more units, even if they are not sold. Requirement 3. Compute the 2012 profit from the production and sales of the shelving using absorption costing. Ignore selling and administrative costs. Requirement 4. Compute the 2012 profit from the production and sales of the shelving using variable costing. Ignore selling and administrative costs. Requirement 5. Which measure of profit, absorption-costing profit or variable-costing profit, is a better measure of performance during 2012? Explain. is inherently better. The affected by production volumes. The exceeded sales volume, the profit is higher under From an incentive point of view, the is a better measure of the effect of sales on profit. It is not is affected by both sales and production volumes. Because production volume has the advantage of not being affected by production decisions. Under a manager can increase profits merely by producing more units, even if they are not sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts