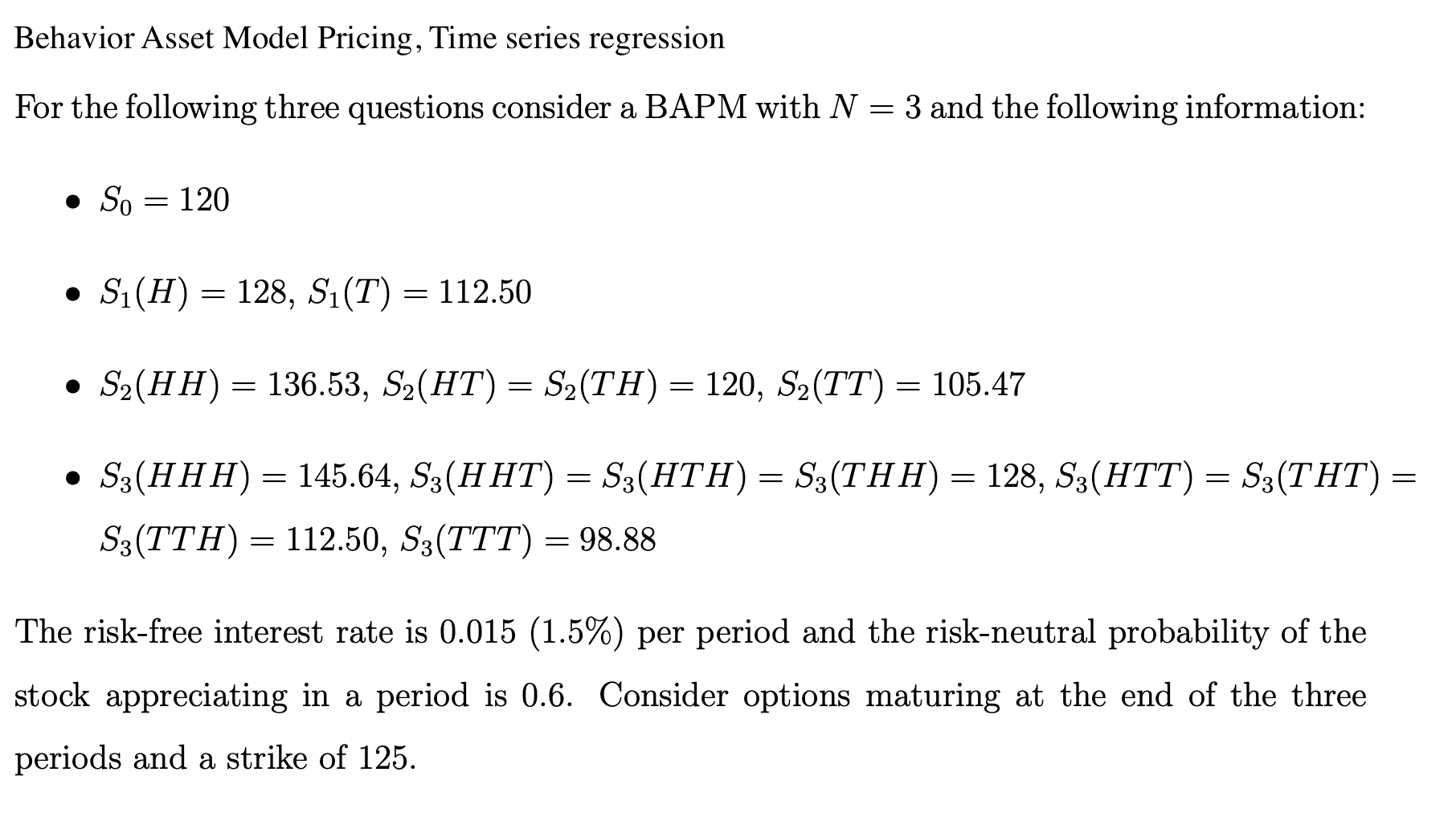

Question: Behavior Asset Model Pricing, Time series regression For the following three questions consider a BAPM with N = 3 and the following information: So =

Behavior Asset Model Pricing, Time series regression For the following three questions consider a BAPM with N = 3 and the following information: So = 120 S(H) = 128, S1(T) = 112.50 S2(HH) = 136.53, S2(HT) = S2(TH) = 120, S2(TT) = 105.47 = Sz(HHH) = 145.64, S3(HHT) = S(HTH) = S(THH) = 128, S3(HTT) = S(THT) S3(TTH) = 112.50, S3(TTT) = 98.88 The risk-free interest rate is 0.015 (1.5%) per period and the risk-neutral probability of the stock appreciating in a period is 0.6. Consider options maturing at the end of the three periods and a strike of 125. Behavior Asset Model Pricing, Time series regression For the following three questions consider a BAPM with N = 3 and the following information: So = 120 S(H) = 128, S1(T) = 112.50 S2(HH) = 136.53, S2(HT) = S2(TH) = 120, S2(TT) = 105.47 = Sz(HHH) = 145.64, S3(HHT) = S(HTH) = S(THH) = 128, S3(HTT) = S(THT) S3(TTH) = 112.50, S3(TTT) = 98.88 The risk-free interest rate is 0.015 (1.5%) per period and the risk-neutral probability of the stock appreciating in a period is 0.6. Consider options maturing at the end of the three periods and a strike of 125

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts