Question: Below are descriptions and company ratio data based on four real, publicly traded and private subsidiary companies operating in the UK. The company ratio

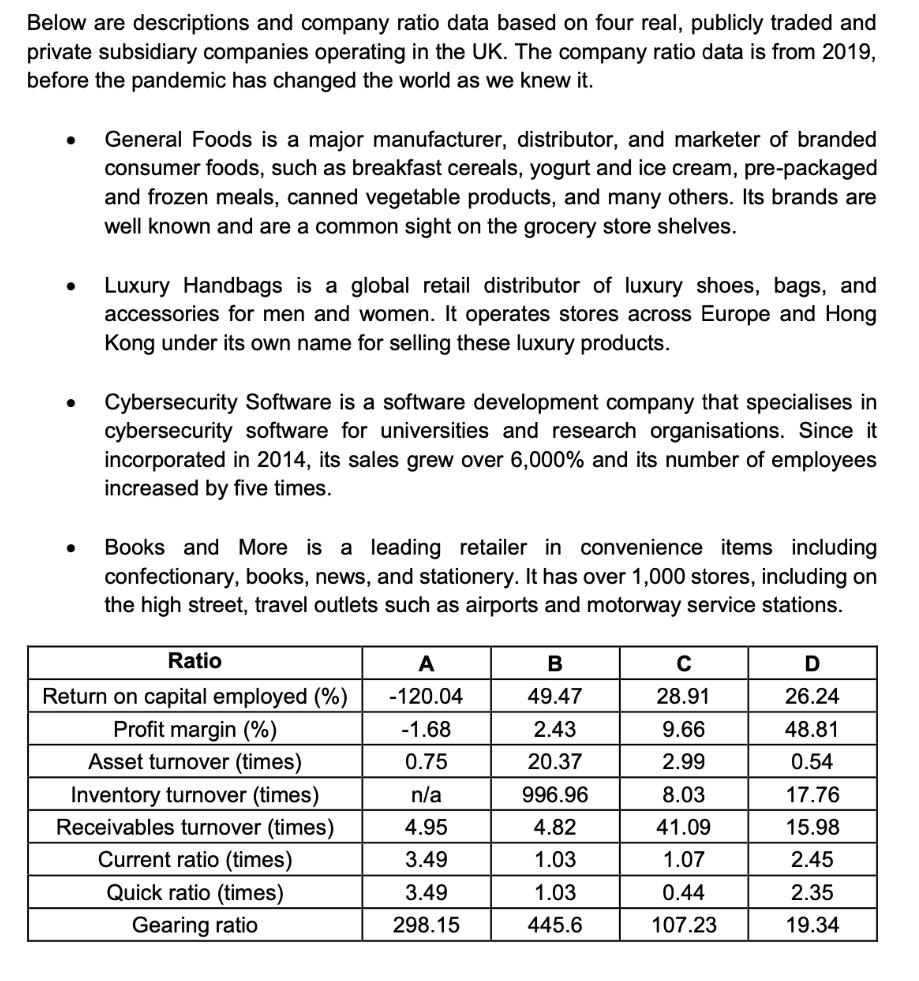

Below are descriptions and company ratio data based on four real, publicly traded and private subsidiary companies operating in the UK. The company ratio data is from 2019, before the pandemic has changed the world as we knew it. General Foods is a major manufacturer, distributor, and marketer of branded consumer foods, such as breakfast cereals, yogurt and ice cream, pre-packaged and frozen meals, canned vegetable products, and many others. Its brands are well known and are a common sight on the grocery store shelves. Luxury Handbags is a global retail distributor of luxury shoes, bags, and accessories for men and women. It operates stores across Europe and Hong Kong under its own name for selling these luxury products. Cybersecurity Software is a software development company that specialises in cybersecurity software for universities and research organisations. Since it incorporated in 2014, its sales grew over 6,000% and its number of employees increased by five times. Books and More is a leading retailer in convenience items including confectionary, books, news, and stationery. It has over 1,000 stores, including on the high street, travel outlets such as airports and motorway service stations. Ratio Return on capital employed (%) Profit margin (%) Asset turnover (times) Inventory turnover (times) Receivables turnover (times) Current ratio (times) Quick ratio (times) Gearing ratio A -120.04 -1.68 0.75 n/a 4.95 3.49 3.49 298.15 B 49.47 2.43 20.37 996.96 4.82 1.03 1.03 445.6 C 28.91 9.66 2.99 8.03 41.09 1.07 0.44 107.23 D 26.24 48.81 0.54 17.76 15.98 2.45 2.35 19.34 REQUIRED: (a) Match each company to the correct set of ratios (A, B, C, D). For each company, justify your answer by explaining two relevant ratios. [8 marks] (b) Compare the ratios for companies B and D. What strategy do you think is adopted by each company as per Porter's Five Forces and why? Refer to specific ratios and/or specific Porter's Five Forces to explain your answer. [3 marks] (c) Company D share price as of its 2019 balance sheet date was 20.22, with 108 million shares outstanding (i.e., issued to date). The profit for the year for 2019 was 106 million. Calculate the P/E ratio for company D for 2019 and interpret your answer. Explain what the P/E ratio indicates about investor expectations of future performance of company D. [3 marks] (d) Assume your friend is planning to invest into company D. Your friend tells you their reason for the decision: "Did you see its EPS for 2019? It's really high!" Using what you learned in this module, give your friend three specific pieces of advice regarding making an investment decision based on a single number. [3 marks]

Step by Step Solution

There are 3 Steps involved in it

Match each company to the correct set of ratios A B C D For each company justify your answer by explaining two relevant ratios Company A is General Foods The relevant ratios are return on capital empl... View full answer

Get step-by-step solutions from verified subject matter experts