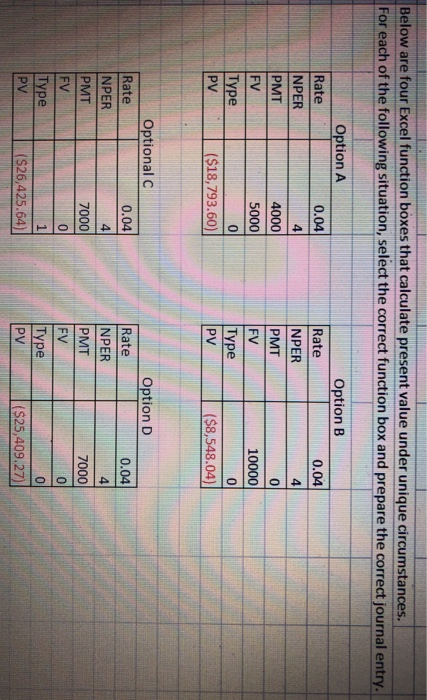

Question: Below are four Excel function boxes that calculate present value under unique circumstances. For each of the following situation, select the correct function box and

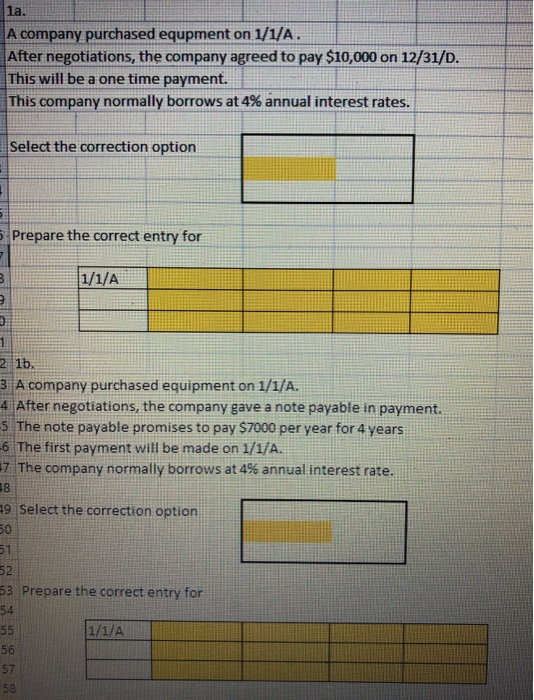

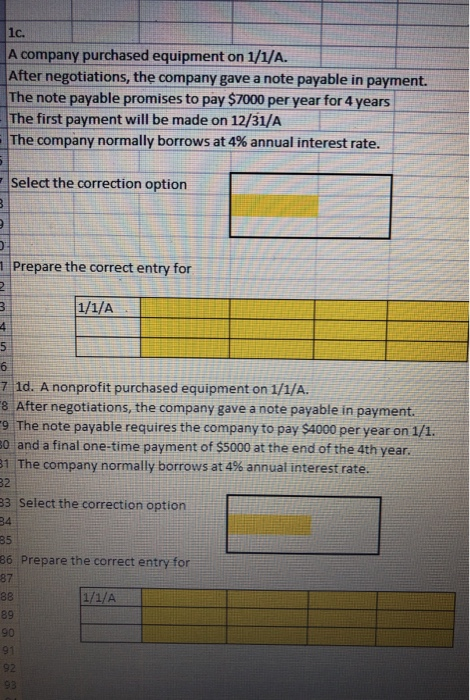

Below are four Excel function boxes that calculate present value under unique circumstances. For each of the following situation, select the correct function box and prepare the correct journal entry. Option A Option B 0.04 0.04 Rate NPER PMT 4000 5000 Rate NPER PMT FV Type FV 10000 Type PV ($18,793.60) ($8,548.04) Optional c Option D 0.04 0.04 7000 Rate NPER PMT FV Type PV Rate NPER PMT FV Type PV 7000 0 (S26,425.64) ($25,409.27) A company purchased equpment on 1/1/A. After negotiations, the company agreed to pay $10,000 on 12/31/D. This will be a one time payment. This company normally borrows at 4% annual interest rates. Select the correction option 5 Prepare the correct entry for 1/1/A 2 16 31 A company purchased equipment on 1/1/A. After negotiations, the company gave a note payable in payment. 5 The note payable promises to pay $7000 per year for 4 years 6 The first payment will be made on 1/1/A. 7 The company normally borrows at 4% annual interest rate. 19 Select the correction option 2 13 Prepare the correct entry for 1/1/A 1c. A company purchased equipment on 1/1/A. After negotiations, the company gave a note payable in payment. The note payable promises to pay $7000 per year for 4 years The first payment will be made on 12/31/A The company normally borrows at 4% annual interest rate. Select the correction option Prepare the correct entry for UU. 1/1/A U 7 1d. A nonprofit purchased equipment on 1/1/A. 8 After negotiations, the company gave a note payable in payment. 9 The note payable requires the company to pay $4000 per year on 1/1 D and a final one-time payment of $5000 at the end of the 4th year. The company normally borrows at 4% annual interest rate. Select the correction option 36 Prepare the correct entry for Below are four Excel function boxes that calculate present value under unique circumstances. For each of the following situation, select the correct function box and prepare the correct journal entry. Option A Option B 0.04 0.04 Rate NPER PMT 4000 5000 Rate NPER PMT FV Type FV 10000 Type PV ($18,793.60) ($8,548.04) Optional c Option D 0.04 0.04 7000 Rate NPER PMT FV Type PV Rate NPER PMT FV Type PV 7000 0 (S26,425.64) ($25,409.27) A company purchased equpment on 1/1/A. After negotiations, the company agreed to pay $10,000 on 12/31/D. This will be a one time payment. This company normally borrows at 4% annual interest rates. Select the correction option 5 Prepare the correct entry for 1/1/A 2 16 31 A company purchased equipment on 1/1/A. After negotiations, the company gave a note payable in payment. 5 The note payable promises to pay $7000 per year for 4 years 6 The first payment will be made on 1/1/A. 7 The company normally borrows at 4% annual interest rate. 19 Select the correction option 2 13 Prepare the correct entry for 1/1/A 1c. A company purchased equipment on 1/1/A. After negotiations, the company gave a note payable in payment. The note payable promises to pay $7000 per year for 4 years The first payment will be made on 12/31/A The company normally borrows at 4% annual interest rate. Select the correction option Prepare the correct entry for UU. 1/1/A U 7 1d. A nonprofit purchased equipment on 1/1/A. 8 After negotiations, the company gave a note payable in payment. 9 The note payable requires the company to pay $4000 per year on 1/1 D and a final one-time payment of $5000 at the end of the 4th year. The company normally borrows at 4% annual interest rate. Select the correction option 36 Prepare the correct entry for

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts