Question: Below are several word type problems that are written in the manner / style one will expect to see on both our exams and the

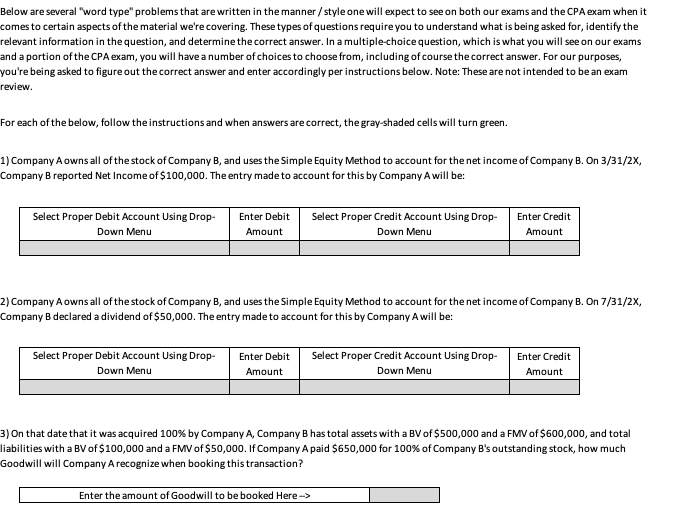

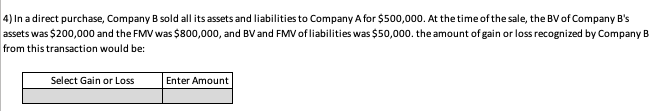

Below are several "word type" problems that are written in the manner / style one will expect to see on both our exams and the CPA exam when it comes to certain aspects of the material we're covering. These types of questions require you to understand what is being asked for, identify the celevant information in the question, and determine the correct answer. In a multiple-choice question, which is what you will see on our exams and a portion of the CPA exam, you will have a number of choices to choose from, including of course the correct answer. For our purposes, rou're being asked to figure out the correct answer and enter accordingly per instructions below. Note: These are not intended to be an exam review. For each of the below, follow the instructions and when answers are correct, the gray-shaded cells will turn green. 1) Company A owns all of the stock of Company B, and uses the Simple Equity Method to account for the net income of Company B. On 3/31/2X, Company B reported Net Income of $100,000. The entry made to account for this by Company A will be: 2) Company A owns all of the stock of Company B, and uses the Simple Equity Method to account for the net income of Company B. On 7/31/2X, Company B declared a dividend of $50,000. The entry made to account for this by Company A will be: 3) On that date that it was acquired 100% by Company A, Company B has total assets with a BV of $500,000 and a FMV of $600,000, and total iabilities with a BV of $100,000 and a FMV of $50,000. If Company A paid $650,000 for 100% of Company B's outstanding stock, how much Goodwill will Company A recognize when booking this transaction? 4) In a direct purchase, Company B sold all its assets and liabilities to Company A for $500,000. At the time of the sale, the BV of Company B's assets was $200,000 and the FMV was $800,000, and BV and FMV of liabilities was $50,000. the amount of gain or loss recognized by Company B from this transaction would be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts