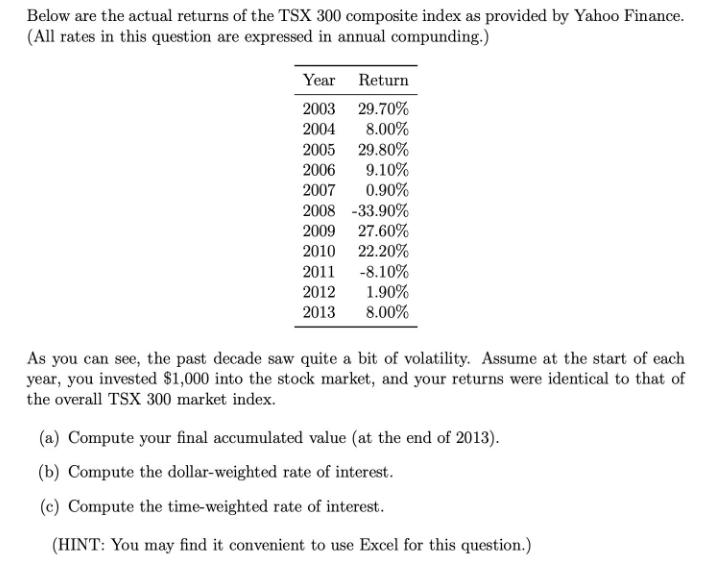

Below are the actual returns of the TSX 300 composite index as provided by Yahoo Finance....

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

Below are the actual returns of the TSX 300 composite index as provided by Yahoo Finance. (All rates in this question are expressed in annual compunding.) Year 2003 2004 Return 29.70% 8.00% 2005 29.80% 2006 9.10% 2007 0.90% 2008 -33.90% 2009 27.60% 2010 22.20% 2011 -8.10% 2012 1.90% 2013 8.00% As you can see, the past decade saw quite a bit of volatility. Assume at the start of each year, you invested $1,000 into the stock market, and your returns were identical to that of the overall TSX 300 market index. (a) Compute your final accumulated value (at the end of 2013). (b) Compute the dollar-weighted rate of interest. (c) Compute the time-weighted rate of interest. (HINT: You may find it convenient to use Excel for this question.) Below are the actual returns of the TSX 300 composite index as provided by Yahoo Finance. (All rates in this question are expressed in annual compunding.) Year 2003 2004 Return 29.70% 8.00% 2005 29.80% 2006 9.10% 2007 0.90% 2008 -33.90% 2009 27.60% 2010 22.20% 2011 -8.10% 2012 1.90% 2013 8.00% As you can see, the past decade saw quite a bit of volatility. Assume at the start of each year, you invested $1,000 into the stock market, and your returns were identical to that of the overall TSX 300 market index. (a) Compute your final accumulated value (at the end of 2013). (b) Compute the dollar-weighted rate of interest. (c) Compute the time-weighted rate of interest. (HINT: You may find it convenient to use Excel for this question.)

Expert Answer:

Related Book For

Posted Date:

Students also viewed these finance questions

-

A leaky bucket picks up 20 litres of water from a well but drips out 1 litre every second from the bottom. If the bucket was lifted 5 metres from the surface of the water at a constant speed of 2...

-

Merck Corporation manufactures blood glucose meters. Each meter sells for $50 and has a variable cost of $30. There are $120,000 in fixed costs involved in the production process. (PLEASE SHOW YOUR...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Class Median Midpoint, x Income, I 19.5 $12,965 An individual's income varies with age. The table shows the median income I of individuals of different age groups within the United States for a...

-

To what extent is each partner liable for the obligations of the partnership? Compare this with the obligations of shareholders in a corporation.

-

The line ax 2y = 30 passes through the points A(10, 10) and B(b, 10b), where a and b are constants. a. Find the values of a and b. b. Find the coordinates of the midpoint of AB. c. Find the equation...

-

True or False Quiz Assuming that no questions are left unanswered, in how many ways can a six-question true-false quiz be answered? Classical Probabilities In Exercises 2934, a probability experiment...

-

Discuss why variable pay-for-performance plans have become popular and what elements are needed to make them successful.

-

To be convicted in a criminal case, the defendant must be found: Select one: a. Guilty beyond a reasonable doubt by a unanimous jury b. Guilty beyond a reasonable doubt by a majority of the Jury c....

-

See Table E11-1 for data on the ratings of quarterbacks for the 2008 National Football League season (The Sports Network). It is suspected that the rating (y) is related to the average number of...

-

You have a portfolio that consists of 1000 stocks of XYZ and a single corporate bond. XYZ has just paid a dividend of $1.30. It is believed that this will grow by 10% a year for 5 years and then grow...

-

21. How a degradation process is modeled? 22.Give the homogenity property in Linear Operator 23. Give the relation for degradation model for continuous function 24.which is called the superposition...

-

28. Define Gray-level interpolation 29. What is meant by Noise probability density function? 30. Why the restoration is called as unconstrained restoration? 31. Which is the most frequent method to...

-

34. Give the relation for guassian noise 35. Give the relation for rayleigh noise 36. Give the relation for Gamma noise 37. Give the relation for Exponential noise 38. Give the relation for Uniform...

-

41. What is pseudo inverse filter? 42. What is meant by least mean square filter? 43. Give the difference between Enhancement and Restoration PART-B 1. Discuss different mean filters

-

1.Discuss different mean filters 2. Draw the degradation model and explain. 3.Write short notes on Median Filters

-

A firms debt financing decisions are generally affected by firm-specific factors as well as market, regulatory, and macro-economic conditions. You are asked to discuss the individual impact of six...

-

For the following exercises, rewrite the sum as a product of two functions or the product as a sum of two functions. Give your answer in terms of sines and cosines. Then evaluate the final answer...

-

YTM can also be calculated directly in the spreadsheet using the function=YIELD (Al, A2, An) where n is the last cell with inputs for the problem. The user inputs settlement date, maturity date,...

-

If all investors believe that the market is efficient, could that eventually lead to less efficiency in the market?

-

Fill in the missing data in the spreadsheet below to calculate the net asset value of this mutual fund for each of the years shown. Years Ended December 31, Selected Per-Share Data Net asset value,...

-

33. On January 1,2008, a rich citizen of the Town of Ristoni donates a painting valued at $300,000 to be displayed to the public in a government building. Although this painting meets the three...

-

31. The City of Lawrence opens a solid waste landfill in 2008 that is at 54 percent of capacity on December 31, 2008. The city had initially anticipated closure costs of $2 million but later that...

-

29. On January 1, 2008, the City ofVerga leased a large truck for five years and made the initial annual payment of $22,000 immediately. The present value of these payments based on an 8 percent...

Study smarter with the SolutionInn App