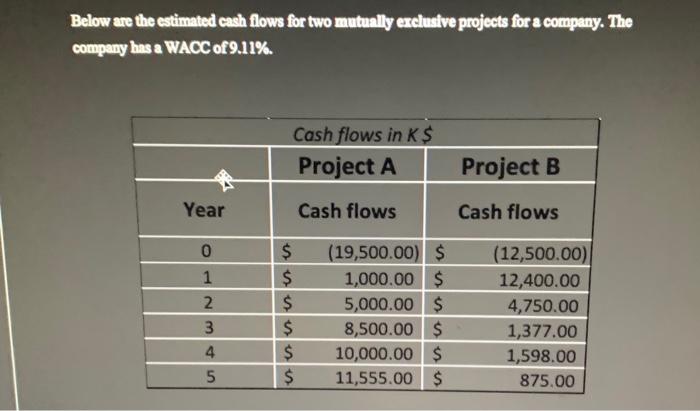

Question: Below are the estimated cach flows for two mutually ereludve projects for a company. The company has a WACC of 9.11%. Use the data from

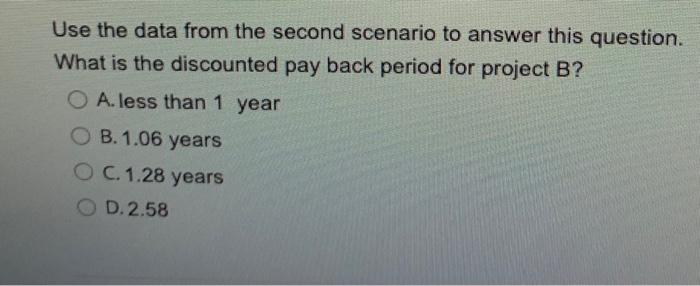

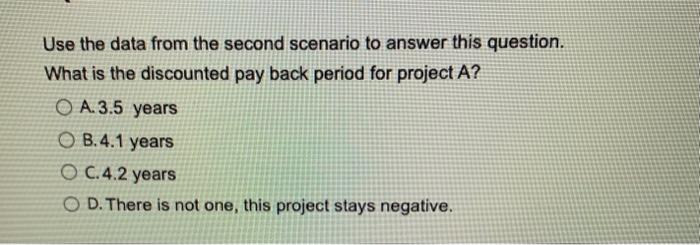

Below are the estimated cach flows for two mutually ereludve projects for a company. The company has a WACC of 9.11\%. Use the data from the second scenario to answer this question. What is the discounted pay back period for project B? A. less than 1 year B. 1.06 years C. 1.28 years D. 2.58 Use the data from the second scenario to answer this question. What is the discounted pay back period for project A? A. 3.5 years B. 4.1 years C. 4.2 years D. There is not one, this project stays negative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts