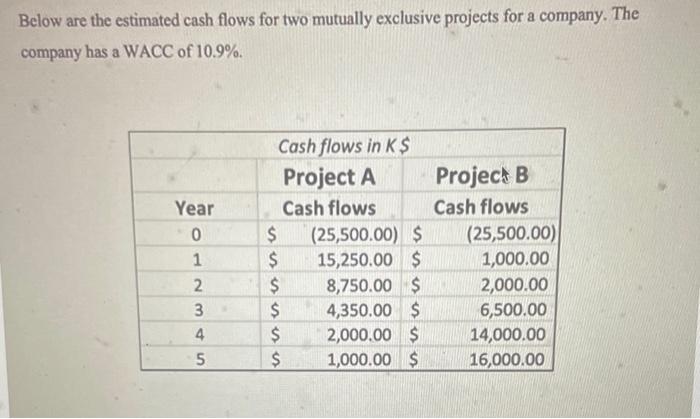

Question: Below are the estimated cash flows for two mutually exclusive projects for a company. The company has a WACC of 10.9% Year 0 1 Cash

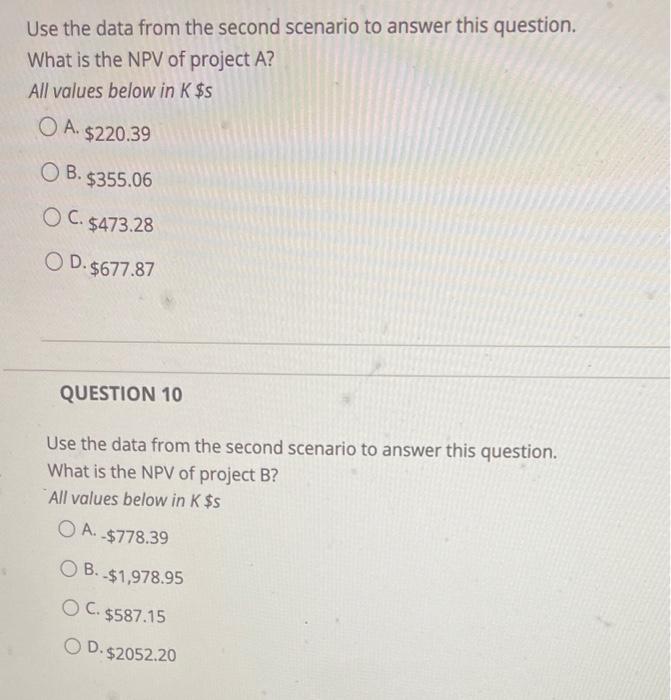

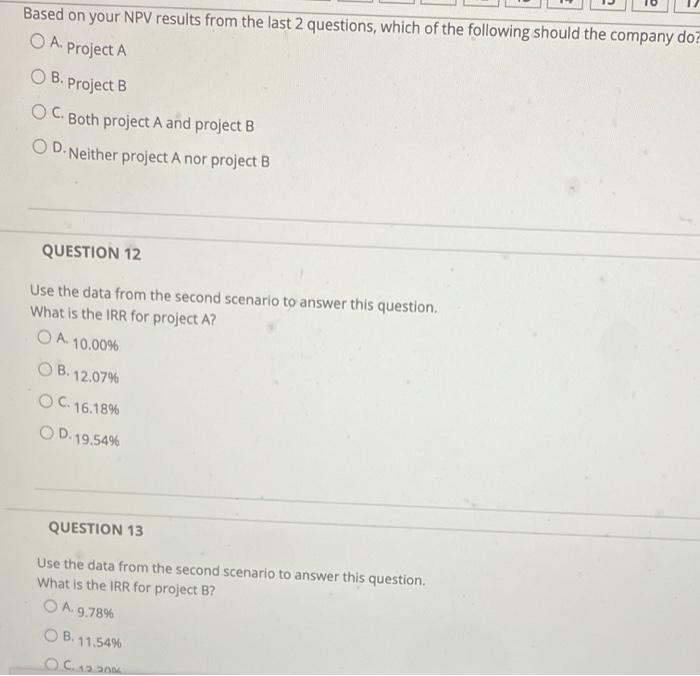

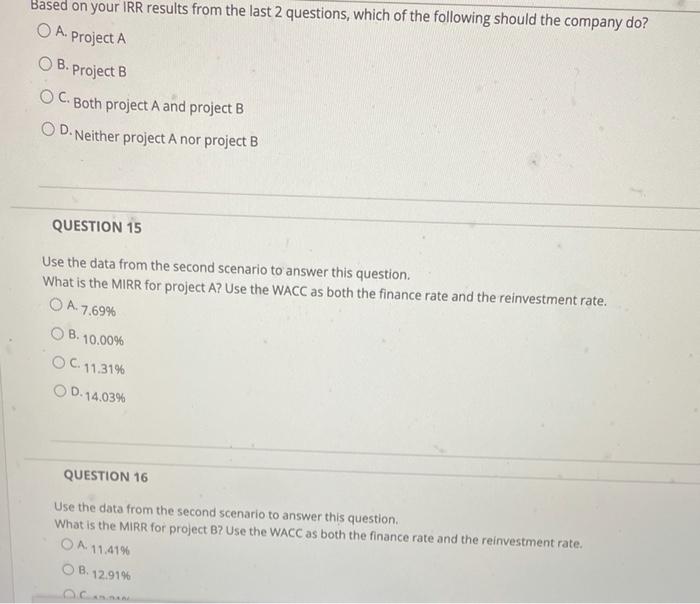

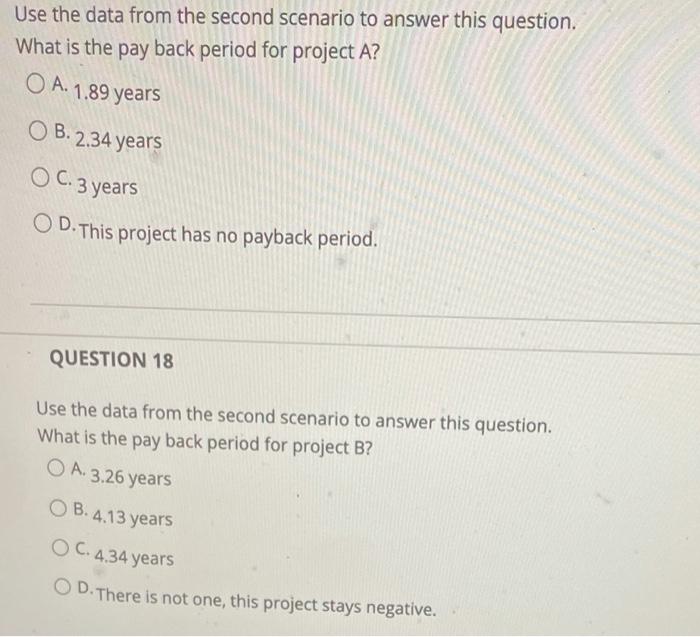

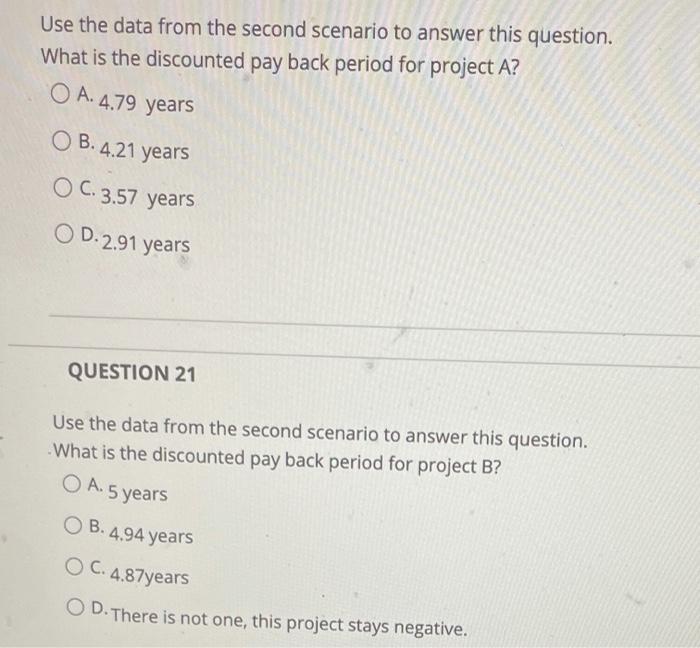

Below are the estimated cash flows for two mutually exclusive projects for a company. The company has a WACC of 10.9% Year 0 1 Cash flows in K$ Project A Cash flows $ (25,500.00) $ $ 15,250.00 $ $ 8,750.00 $ $ 4,350.00 $ $ 2,000.00 $ $ 1,000.00 $ Project B Cash flows (25,500.00) 1,000.00 2,000.00 6,500.00 14,000.00 16,000.00 2 3 4 5 Use the data from the second scenario to answer this question. What is the NPV of project A? All values below in K $s O A. $220.39 O B. $355.06 O C. $473.28 OD. $677.87 QUESTION 10 Use the data from the second scenario to answer this question. What is the NPV of project B? All values below in K $s O A. $778.39 OB. $1,978.95 O C. $587.15 OD. $2052.20 Based on your NPV results from the last 2 questions, which of the following should the company do? O A. Project A O B. Project B OC. Both project A and project B OD. Neither project A nor project B QUESTION 12 Use the data from the second scenario to answer this question What is the IRR for project A? O A 10.00% OB. 12.07% OC.16.18% OD. 19.54% QUESTION 13 Use the data from the second scenario to answer this question. What is the IRR for project B? O A. 9.78% OB. 11.54% OC. 2.200 Based on your IRR results from the last 2 questions, which of the following should the company do? O A. Project A OB. Project B O C. Both project A and project B OD. Neither project A nor project B QUESTION 15 Use the data from the second scenario to answer this question, What is the MIRR for project A? Use the WACC as both the finance rate and the reinvestment rate. O A. 7.69% OB. 10.00% O C. 11.31% OD. 14.03% QUESTION 16 Use the data from the second scenario to answer this question What is the MIRR for project B? Use the WACC as both the finance rate and the reinvestment rate. O A 11.41% OB 12.91% Use the data from the second scenario to answer this question. What is the pay back period for project A? O A. 1.89 years OB.2.34 years OC. 3 years O D. This project has no payback period. QUESTION 18 Use the data from the second scenario to answer this question. What is the pay back period for project B? O A. 3.26 years OB.4.13 years OC. 4.34 years O D.There is not one, this project stays negative. Use the data from the second scenario to answer this question. What is the discounted pay back period for project A? O A. 4.79 years OB. 4.21 years O C.3.57 years OD.2.91 years QUESTION 21 Use the data from the second scenario to answer this question. What is the discounted pay back period for project B? O A. 5 years OB.4.94 years OC. 4.87years O D.There is not one, this project stays negative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts