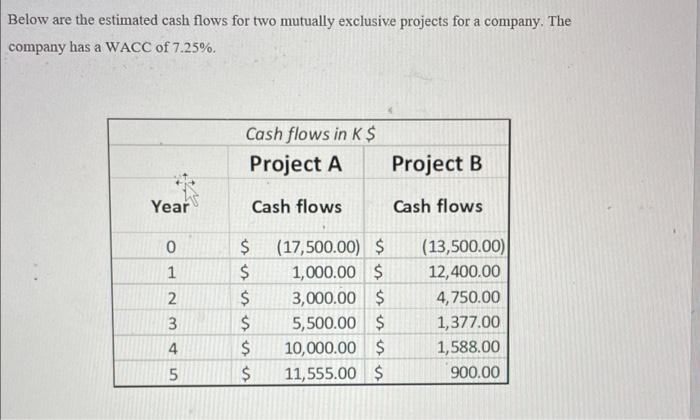

Question: Below are the estimated cash flows for two mutually exclusive projects for a company. The company has a WACC of 7.25% The discounted payback period

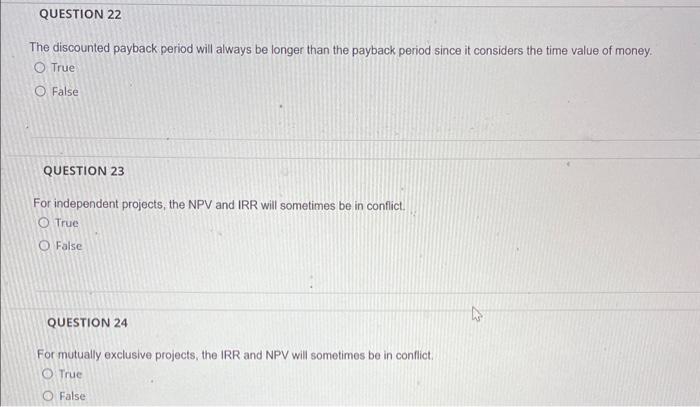

Below are the estimated cash flows for two mutually exclusive projects for a company. The company has a WACC of 7.25% The discounted payback period will always be longer than the payback period since it considers the time value of money. True False QUESTION 23 For independent projects, the NPV and IRR will sometimes be in conflict. True False QUESTION 24 For mutually exclusive projects, the IRR and NPV will sometimes be in conflict. True False Below are the estimated cash flows for two mutually exclusive projects for a company. The company has a WACC of 7.25% The discounted payback period will always be longer than the payback period since it considers the time value of money. True False QUESTION 23 For independent projects, the NPV and IRR will sometimes be in conflict. True False QUESTION 24 For mutually exclusive projects, the IRR and NPV will sometimes be in conflict. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts