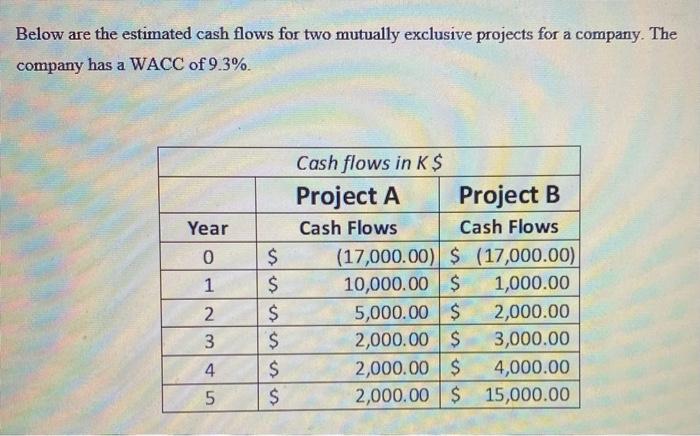

Question: Below are the estimated cash flows for two mutually exclusive projects for a company. The company has a WACC of 9.3% Year 0 1 2

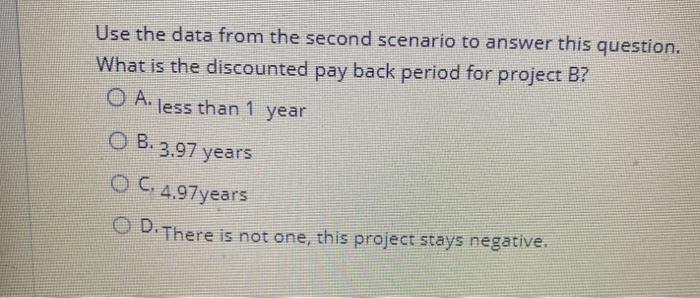

Below are the estimated cash flows for two mutually exclusive projects for a company. The company has a WACC of 9.3% Year 0 1 2 3 $ $ $ $ $ $ Cash flows in K$ Project A Project B Cash Flows Cash Flows (17,000.00) $ (17,000.00) 10,000.00 $ 1,000.00 5,000.00 $ 2,000.00 2,000.00 $ 3,000.00 2,000.00 $ 4,000.00 2,000.00 $ 15,000.00 4 5 Use the data from the second scenario to answer this question. What is the discounted pay back period for project B? O A. less than 1 year OB. 3.97 years O C. 4.97 years O D.There is not one, this project stays negative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts