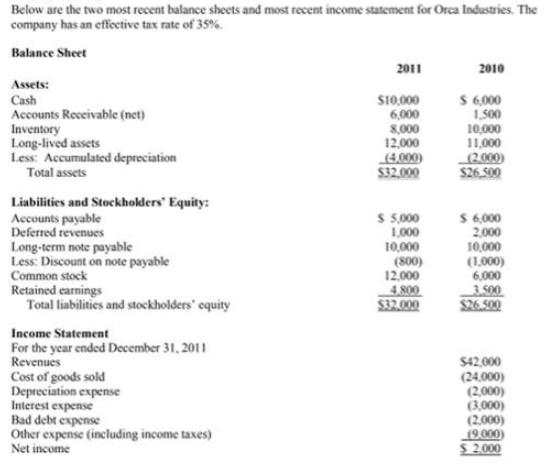

Question: Below are the two most recent balance sheets and most recent income statement for Orca Industries. The company has an effective tax rate of

Below are the two most recent balance sheets and most recent income statement for Orca Industries. The company has an effective tax rate of 35%. Balance Sheet 2011 2010 Assets: Cash Accounts Reccivable (net) Inventory Long-lived assets Less: Accumulated depreciation Total assets S 6000 1,500 10,000 11,000 (2.000) S26.500 S10,000 6,000 8,000 12,000 (4,000) $32.000 Liabilities and Stockholders Equity: Accounts payable Deferred revenues Long-term note payable Less: Discount on note payable Common stock S 5,000 1,000 $ 6,000 2,000 10,000 10,000 (800) 12.000 (100) 6,000 3.500 $26.500 Retained earnings Total liabilities and stockholders' equity 4800 $32.000 Income Statement For the year ended December 31, 2011 Revenues Cost of goods sold Depreciation expense Interest expense Bad debt expense Other expense (including income taxes) Net income $42,000 (24.000) (2,000) (3,000) (2.000) 19,000) $ 2000 1. Refer to the information for Orca Industries. The return on assets for Orca Industries is: 2. Refer to the information for Orca Industries. The return on common sharcholders' equity for Orca Industries is: 3. Refer to the information for Orca Industries. The profit margin for computing ROA for Orca Industries 4. Refer to the information for Orca Industries. Orca's asset turnover is: 5. Refer to the information for Orca Industries. Orca's accounts receivable turnover is (assume that Orca makes all sales on account): 6. Refer to the information for Orea Industries. Orca's basic earnings per share is

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

ROA Net Income Average total asset x 100 Net Income 2000 Average total asset openning ending ... View full answer

Get step-by-step solutions from verified subject matter experts