Question: below in the picture, is a question and its answer under it. can anyone tell me the formula used in the table of the solution

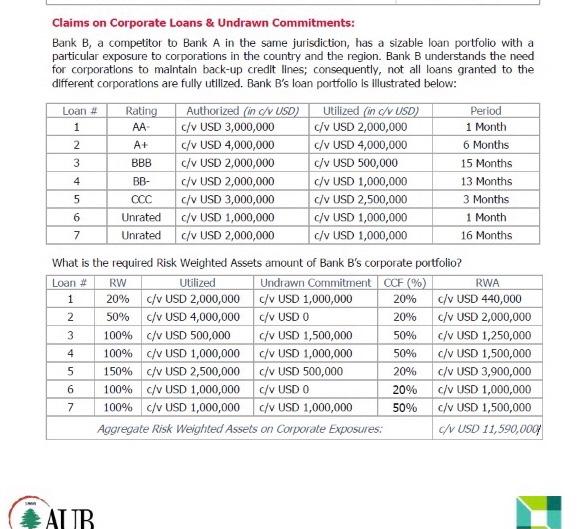

2 4 BB- 6 Claims on Corporate Loans & Undrawn Commitments: Bank B, a competitor to Bank A in the same jurisdiction, has a sizable loan portfolio with a particular exposure to corporations in the country and the region. Bank B understands the need for corporations to maintain back-up credit lines; consequently, not all loans granted to the different corporations are fully utilized. Bank B's loan portfolio is illustrated below: Loan Rating Authorized (in C/USD) Utilized (in C/V USD Period 1 AA- c/V USD 3,000,000 v USD 2,000,000 1 Month A+ c/v USD 4,000,000 c/V USD 4,000,000 6 Months 3 BBB c/v USD 2,000,000 c/v USD 500,000 15 Months C/V USD 2,000,000 Gv USD 1,000,000 13 Months 5 COC CIV USD 3,000,000 /v USD 2,500,000 3 Months Unrated C/V USD 1,000,000 /v USD 1,000,000 1 Month 7 Unrated CV USD 2,000,000 C/V USD 1,000,000 16 Months What is the required Risk Weighted Assets amount of Bank B's corporate portfolio? Utilized Undrawn Commitment CCF (%) RWA 1 20% c/v USD 2,000,000 V USD 1,000,000 20% c/v USD 440,000 50% c/v USD 4,000,000 V USD O 20% c/V USD 2,000,000 3 100% c/v USD 500,000 CIV USD 1,500,000 c/v USD 1,250,000 100% C/V USD 1,000,000 V USD 1,000,000 50% C/V USD 1,500,000 5 150% C/V USD 2,500,000 C/V USD 500,000 20% c/V USD 3,000,000 100% C/V USD 1,000,000 G/V USD O 20% c/v USD 1,000,000 100% c/v USD 1,000,000 C/USD 1,000,000 50% Cv USD 1,500,000 Aggregate Risk Weighted Assets on Corporate Exposures: Cv USD 11,590,000 Loan # RW 2 50% 4 6 7 AUB Exposures Risk Weights Sovereigns AAA to AA- Auto A- B88+ to BB to B- Below - Unrated Credit Assessment Risk Weights 50 100% 150% 100% Banks [Option 1] AAA to AA A+ to A- BBB+ to 000- B3+ to B- Below - Unrated Credit Assessment Risk Weights 20% 50 100M 100 150% 100% Banks tOption 2] A+ to A- 868 to BBB- BB+ to - AAA to AA- 20% Unrated Below - 150W 50W 50% 100% Credit Assessment Risk Weights Risk Weights for short terms claims 50 20 20% 20% sow 150% 20% BBB+ to Crede Assessment A+to A- AAA to AA- Below BB- Corporates B0- Unrated Risk Weights 20 50 100% 150% 100 2 4 BB- 6 Claims on Corporate Loans & Undrawn Commitments: Bank B, a competitor to Bank A in the same jurisdiction, has a sizable loan portfolio with a particular exposure to corporations in the country and the region. Bank B understands the need for corporations to maintain back-up credit lines; consequently, not all loans granted to the different corporations are fully utilized. Bank B's loan portfolio is illustrated below: Loan Rating Authorized (in C/USD) Utilized (in C/V USD Period 1 AA- c/V USD 3,000,000 v USD 2,000,000 1 Month A+ c/v USD 4,000,000 c/V USD 4,000,000 6 Months 3 BBB c/v USD 2,000,000 c/v USD 500,000 15 Months C/V USD 2,000,000 Gv USD 1,000,000 13 Months 5 COC CIV USD 3,000,000 /v USD 2,500,000 3 Months Unrated C/V USD 1,000,000 /v USD 1,000,000 1 Month 7 Unrated CV USD 2,000,000 C/V USD 1,000,000 16 Months What is the required Risk Weighted Assets amount of Bank B's corporate portfolio? Utilized Undrawn Commitment CCF (%) RWA 1 20% c/v USD 2,000,000 V USD 1,000,000 20% c/v USD 440,000 50% c/v USD 4,000,000 V USD O 20% c/V USD 2,000,000 3 100% c/v USD 500,000 CIV USD 1,500,000 c/v USD 1,250,000 100% C/V USD 1,000,000 V USD 1,000,000 50% C/V USD 1,500,000 5 150% C/V USD 2,500,000 C/V USD 500,000 20% c/V USD 3,000,000 100% C/V USD 1,000,000 G/V USD O 20% c/v USD 1,000,000 100% c/v USD 1,000,000 C/USD 1,000,000 50% Cv USD 1,500,000 Aggregate Risk Weighted Assets on Corporate Exposures: Cv USD 11,590,000 Loan # RW 2 50% 4 6 7 AUB Exposures Risk Weights Sovereigns AAA to AA- Auto A- B88+ to BB to B- Below - Unrated Credit Assessment Risk Weights 50 100% 150% 100% Banks [Option 1] AAA to AA A+ to A- BBB+ to 000- B3+ to B- Below - Unrated Credit Assessment Risk Weights 20% 50 100M 100 150% 100% Banks tOption 2] A+ to A- 868 to BBB- BB+ to - AAA to AA- 20% Unrated Below - 150W 50W 50% 100% Credit Assessment Risk Weights Risk Weights for short terms claims 50 20 20% 20% sow 150% 20% BBB+ to Crede Assessment A+to A- AAA to AA- Below BB- Corporates B0- Unrated Risk Weights 20 50 100% 150% 100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts