Question: Below is an accounting problem, with two answers (#1, #2), both of which relate to the information above. On June 30, 2017. Bergeron Enterprises purchased

Below is an accounting problem, with two answers (#1, #2), both of which relate to the information above.

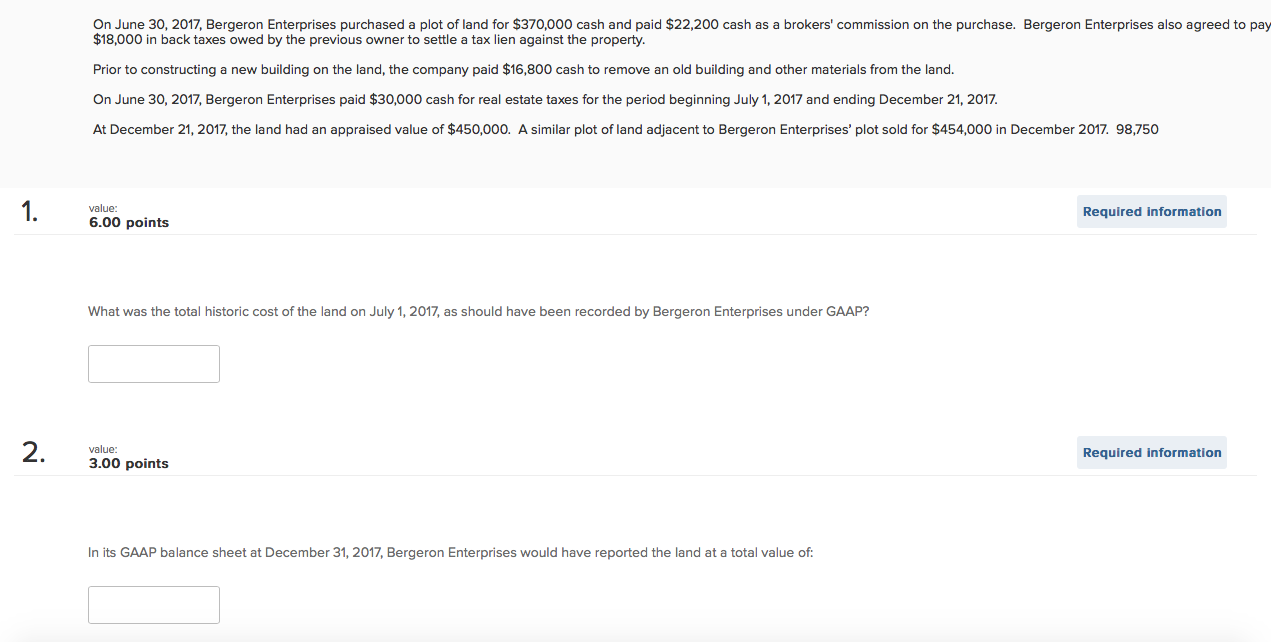

On June 30, 2017. Bergeron Enterprises purchased a plot ofland for $370,000 cash and paid $22200 cash as a brokers' commiion on the purchase. Bergeron Enterprises also agreed to pay $13,000 in back taxes owed by the previous owner to settle a tax lien against the property. Prior to constructing a new building on the land, the company paid $16,300 cash to remove an old building and other materials from the land. On June 30, 201?, Bergeron Enterprises paid $30,000 cash for real estate taxes for the period beginning July1, 201? and ending December 21, 201?. At December 21, 2017, the land had an appraised value of $450,000. Asimilar plot ot'land adjacent to Bergernn Enterprises' plot sold for Sit-545000 in December 201?. 98,750 value: _ Requlred Informallon 5.00 polnts What was the total historic cost cfthe land on July1, 2017. as should have been recorded by Bergeron Enterprises under GAAP? value: Requlred Informallnn 3.00 points In its 6MP balance sheet at. December31, 2017, Bergeron Enterprises would have reported the land at a total value of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts