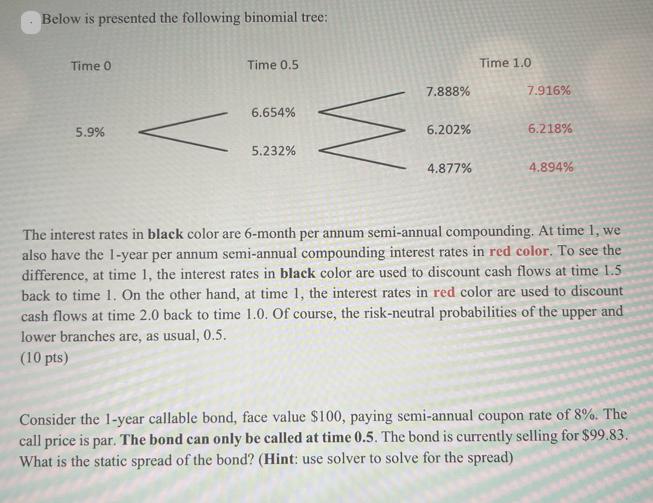

Question: Below is presented the following binomial tree: Time 0 5.9% Time 0.5 6.654% 5.232% M 7.888% 6.202% 4.877% Time 1.0 7.916% 6.218% 4.894% The

Below is presented the following binomial tree: Time 0 5.9% Time 0.5 6.654% 5.232% M 7.888% 6.202% 4.877% Time 1.0 7.916% 6.218% 4.894% The interest rates in black color are 6-month per annum semi-annual compounding. At time 1, we also have the 1-year per annum semi-annual compounding interest rates in red color. To see the difference, at time 1, the interest rates in black color are used to discount cash flows at time 1.5 back to time 1. On the other hand, at time 1, the interest rates in red color are used to discount cash flows at time 2.0 back to time 1.0. Of course, the risk-neutral probabilities of the upper and lower branches are, as usual, 0.5. (10 pts) Consider the 1-year callable bond, face value $100, paying semi-annual coupon rate of 8%. The call price is par. The bond can only be called at time 0.5. The bond is currently selling for $99.83. What is the static spread of the bond? (Hint: use solver to solve for the spread)

Step by Step Solution

3.31 Rating (163 Votes )

There are 3 Steps involved in it

To calculate the static spread of the bond we need to find the spread that makes the present value o... View full answer

Get step-by-step solutions from verified subject matter experts