Question: Below is Required Homework In Workbook 11, we will introduce the concept of valuing a stock as the Net Present Value (NPV) of future dividends

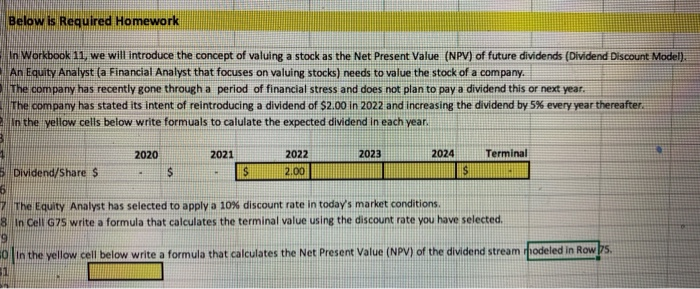

Below is Required Homework In Workbook 11, we will introduce the concept of valuing a stock as the Net Present Value (NPV) of future dividends (Dividend Discount Model). An Equity Analyst (a Financial Analyst that focuses on valuing stocks) needs to value the stock of a company. The company has recently gone through a period of financial stress and does not plan to pay a dividend this or next year. The company has stated its intent of reintroducing a dividend of $2.00 in 2022 and increasing the dividend by 5% every year thereafter. In the yellow cells below write formuals to calulate the expected dividend in each year, 2020 2022 2023 2024 Terminal 5 Dividend/Share $ 7 The Equity Analyst has selected to apply a 10% discount rate in today's market conditions 8 in cell G7s write a formula that calculates the terminal value using the discount rate you have selected. 0 in the yellow cell below write a formula that calculates the Net Present Value (NPV) of the dividend stream modeled in Rows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts