Question: n Equity Valuation (Workbook 11), we will introduce the concept of valuing a stock as the Net Present Value (NPV) of future cash flows (Discunted

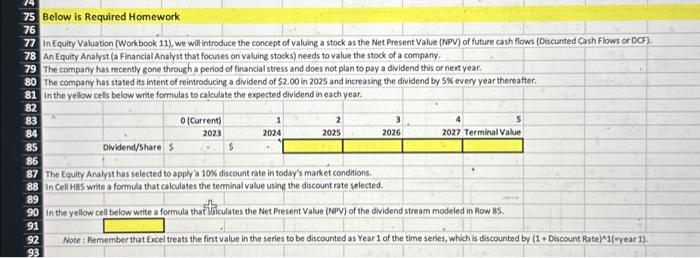

n Equity Valuation (Workbook 11), we will introduce the concept of valuing a stock as the Net Present Value (NPV) of future cash flows (Discunted Cash Flows or DCF). An Equity Analyst (a Financial Analyst that focuses on valuing stocks) needs to value the stock of a company. The company has recently gone through a period of financial stress and does not plan to pay a dividend this or next year. The company has stated its intent of reintroducing a dividend of $2.00 in 2025 and increasing the dividend by 5% every year thereafter

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts