Question: BELOW IS SOLUTION TO SIMILAR PROBLEM BUT DIFFERENT NUMBERS. PLEASE USE THOSE FORMULAS/PROCESSES Zoso is a rental car company that is trying to determine whether

BELOW IS SOLUTION TO SIMILAR PROBLEM BUT DIFFERENT NUMBERS. PLEASE USE THOSE FORMULAS/PROCESSES

Zoso is a rental car company that is trying to determine whether to add 25 cars to its fleet. The company fully depreciates all its rental cars over four years using the straight-line method. The new cars are expected to generate $190,000 per year in earnings before taxes and depreciation for four years. The company is entirely financed by equity and has a 35 percent tax rate. The required return on the companys unlevered equity is 14 percent, and the new fleet will not change the risk of the company. The risk-free rate is 8 percent.

a. What is the maximum price that the company should be willing to pay for the new fleet of cars if it remains an all-equity company? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Maximum price $

b. Suppose the company can purchase the fleet of cars for $460,000. Additionally, assume the company can issue $390,000 of four-year debt at the risk-free rate of 8 percent to finance the project. All principal will be repaid in one balloon payment at the end of the fourth year. What is the adjusted present value (APV) of the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) APV $

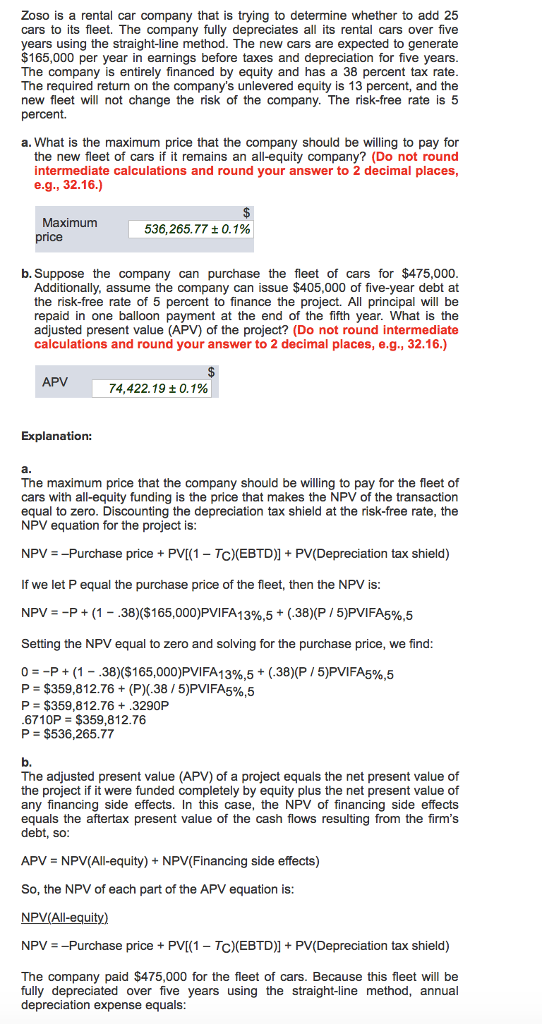

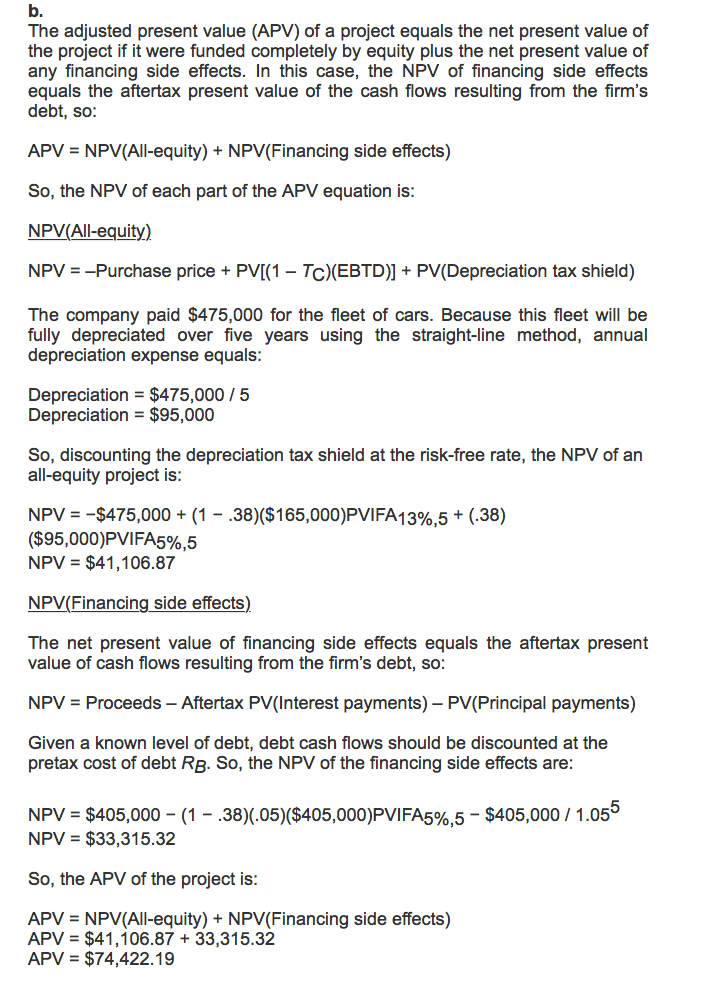

Zoso is a rental car company that is trying to determine whether to add 25 cars to its fleet. The company fully depreciates all its rental cars over five years using the straight-line method. The new cars are expected to generate $165,000 per year in earnings before taxes and depreciation for five years The company is entirely financed by equity and has a 38 percent tax rate The required return on the company's unlevered equity is 13 percent, and the new fleet will not change the risk of the company. The risk-free rate is 5 percent. a. What is the maximum price that the company should be willing to pay for the new fleet of cars if it remains an all-equity company? (Do not round intermediate calculations and round your answer to 2 decimal places e.g., 32.16.) Maximum price 536,265.77 0.1% b.Suppose the company can purchase the fleet of cars for $475,000 Additionally, assume the company can issue $405,000 of five-year debt at the risk-free rate of 5 percent to finance the project. All principal will be repaid in one balloon payment at the end of the fifth year. What is the adjusted present value (APV) of the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) APV 74,422.19 0.1% Explanation: The maximum price that the company should be willing to pay for the fleet of cars with all-equity funding is the price that makes the NPV of the transaction equal to zero. Discounting the depreciation tax shield at the risk-free rate, the NPV equation for the project is NPV-Purchase price + PVI(1-Tc)(EBTD)] + PV(Depreciation tax shield) If we let P equal the purchase price of the fleet, then the NPV is NPV-P + (1-.38)($165,000)PVIFAI 3%,5 + (.38)(P / 5)PVIFA5%,5 Setting the NPV equal to zero and solving for the purchase price, we find 0--P + (1-.38)($165,000)PVIFAI 3%,5 + (.38)(P / 5)PVIFA5%,5 Pa $359,812.76 + (P)(.38 / 5)PVIFA5%,5 P = $359,812.76 + ,3290P 6710P $359,812.76 P = $536,265.77 b. The adjusted present value (APV) of a project equals the net present value of the project if it were funded completely by equity plus the net present value of any financing side effects. In this case, the NPV of financing side effects equals the aftertax present value of the cash flows resulting from the firm's debt, so APV = NPV(All-equity) + NPV(Financing side effects) So, the NPV of each part of the APV equation is: NPV-Purchase price+PV(1 Tc(EBTD)+PV(Depreciation tax shield) The company paid $475,000 for the fleet of cars. Because this fleet will be fully depreciated over fve years using the straight-line method, annual depreciation expense equals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts