Question: Write a neat and professional report ( = 2 pages including graphs with proper legends inserted into a document, if necessary ) answering ALL the

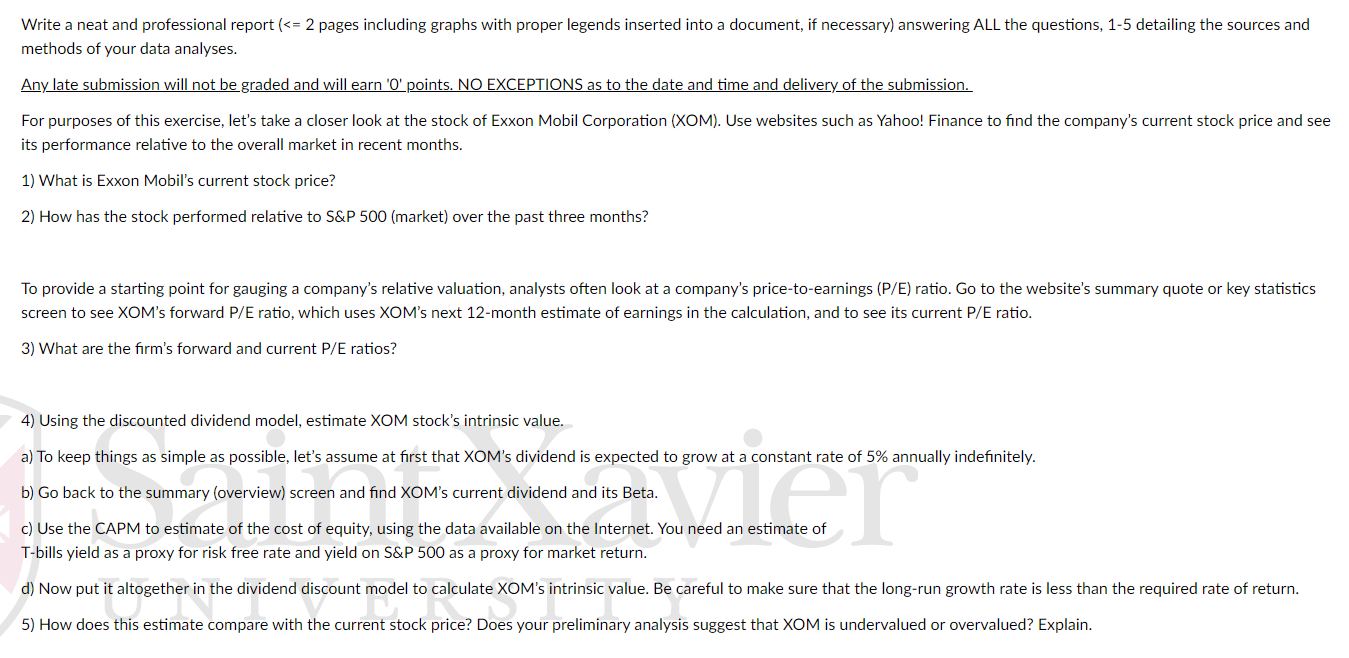

Write a neat and professional report pages including graphs with proper legends inserted into a document, if necessary answering ALL the questions, detailing the sources and methods of your data analyses.

For purposes of this exercise, lets take a closer look at the stock of Exxon Mobil Corporation XOM Use websites such as Yahoo! Finance to find the companys current stock price and see its performance relative to the overall market in recent months.

What is Exxon Mobils current stock price?

How has the stock performed relative to S&P market over the past three months?

To provide a starting point for gauging a companys relative valuation, analysts often look at a companys pricetoearnings PE ratio. Go to the websites summary quote or key statistics screen to see XOMs forward PE ratio, which uses XOMs next month estimate of earnings in the calculation, and to see its current PE ratio.

What are the firms forward and current PE ratios?

Using the discounted dividend model, estimate XOM stocks intrinsic value.

a To keep things as simple as possible, lets assume at first that XOMs dividend is expected to grow at a constant rate of annually indefinitely.

b Go back to the summary overview screen and find XOMs current dividend and its Beta.

c Use the CAPM to estimate of the cost of equity, using the data available on the Internet. You need an estimate of Tbills yield as a proxy for risk free rate and yield on S&P as a proxy for market return.

d Now put it altogether in the dividend discount model to calculate XOMs intrinsic value. Be careful to make sure that the longrun growth rate is less than the required rate of return.

How does this estimate compare with the current stock price? Does your preliminary analysis suggest that XOM is undervalued or overvalued? Explain.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock