Question: below is the answer for the question plz explain why NPV of year 12 is 3520 not 3920! 2. The Grove is a medium priced

below is the answer for the question

plz explain why NPV of year 12 is 3520 not 3920!

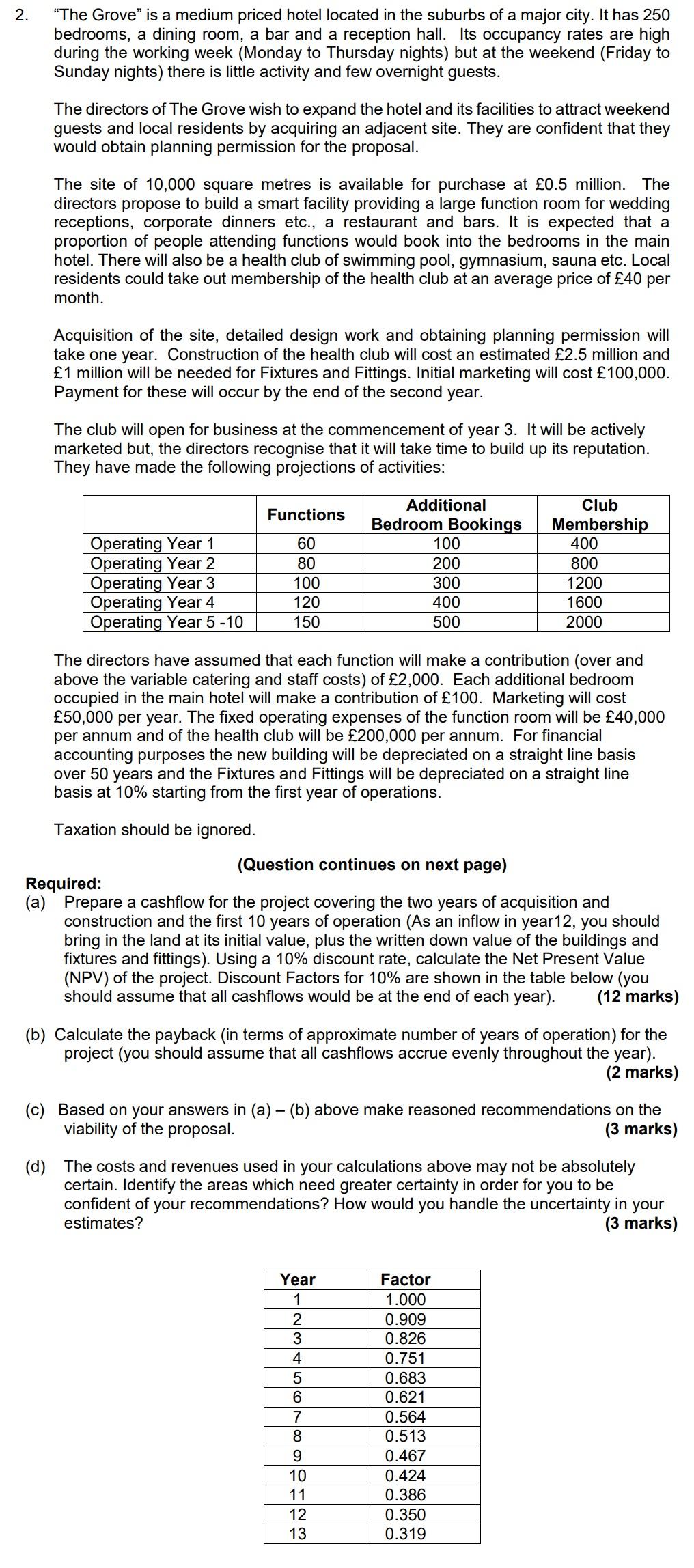

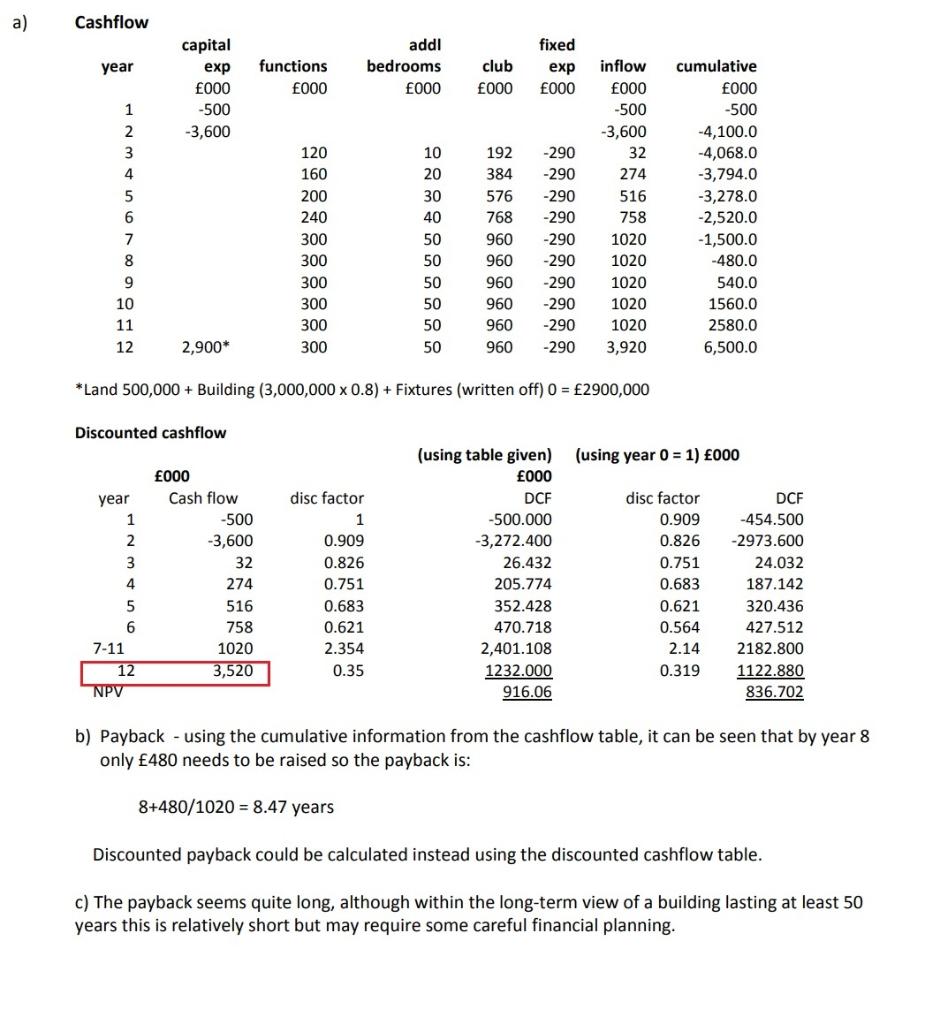

2. The Grove" is a medium priced hotel located in the suburbs of a major city. It has 250 bedrooms, a dining room, a bar and a reception hall. Its occupancy rates are high during the working week (Monday to Thursday nights) but at the weekend (Friday to Sunday nights) there is little activity and few overnight guests. The directors of The Grove wish to expand the hotel and its facilities to attract weekend guests and local residents by acquiring an adjacent site. They are confident that they would obtain planning permission for the proposal. The site of 10,000 square metres is available for purchase at 0.5 million. The directors propose to build a smart facility providing a large function room for wedding receptions, corporate dinners etc., a restaurant and bars. It is expected that a proportion of people attending functions would book into the bedrooms in the main hotel. There will also be a health club of swimming pool, gymnasium, sauna etc. Local residents could take out membership of the health club at an average price of 40 per month. Acquisition of the site, detailed design work and obtaining planning permission will take one year. Construction of the health club will cost an estimated 2.5 million and 1 million will be needed for Fixtures and Fittings. Initial marketing will cost 100,000. Payment for these will occur by the end of the second year. The club will open for business at the commencement of year 3. It will be actively marketed but, the directors recognise that it will take time to build up its reputation. They have made the following projections of activities: Functions Operating Year 1 Operating Year 2 Operating Year 3 Operating Year 4 Operating Year 5-10 60 80 100 120 150 Additional Bedroom Bookings 100 200 300 400 500 Club Membership 400 800 1200 1600 2000 The directors have assumed that each function will make a contribution (over and above the variable catering and staff costs) of 2,000. Each additional bedroom occupied in the main hotel will make a contribution of 100. Marketing will cost 50,000 per year. The fixed operating expenses of the function room will be 40,000 per annum and of the health club will be 200,000 per annum. For financial accounting purposes the new building will be depreciated on a straight line basis over 50 years and the Fixtures and Fittings will be depreciated on a straight line basis at 10% starting from the first year of operations. Taxation should be ignored. (Question continues on next page) Required: (a) Prepare a cashflow for the project covering the two years of acquisition and construction and the first 10 years of operation (As an inflow in year 12, you should bring in the land at its initial value, plus the written down value of the buildings and fixtures and fittings). Using a 10% discount rate, calculate the Net Present Value (NPV) of the project. Discount Factors for 10% are shown in the table below (you should assume that all cashflows would be at the end of each year). (12 marks) (b) Calculate the payback (in terms of approximate number of years of operation) for the project (you should assume that all cashflows accrue evenly throughout the year). (2 marks) (c) Based on your answers in (a) (b) above make reasoned recommendations on the viability of the proposal. (3 marks) (d) The costs and revenues used in your calculations above may not be absolutely certain. Identify the areas which need greater certainty in order for you to be confident of your recommendations? How would you handle the uncertainty in your estimates? (3 marks) Year 1 2 3 4 5 6 7 8 9 10 11 12 13 Factor 1.000 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 WN 0000 a) Cashflow year capital exp 000 -500 -3,600 functions 000 addi bedrooms 000 club 000 fixed exp 000 -290 -290 -290 1 2 3 4 5 6 7 8 9 10 11 12 120 160 200 240 300 300 300 300 300 300 -290 10 20 30 40 50 50 50 50 50 50 inflow 000 -500 -3,600 32 274 516 758 1020 1020 1020 1020 1020 3,920 192 384 576 768 960 960 960 960 960 960 cumulative 000 -500 -4,100.0 -4,068.0 -3,794.0 -3,278.0 -2,520.0 -1,500.0 -480.0 540.0 1560.0 2580.0 6,500.0 -290 -290 -290 -290 -290 -290 2,900* *Land 500,000 + Building (3,000,000 x 0.8) + Fixtures (written off) 0 = 2900,000 Discounted cashflow year 1 2 3 000 Cash flow -500 -3,600 32 274 516 758 1020 3,520 disc factor 1 0.909 0.826 0.751 0.683 0.621 2.354 0.35 (using table given) (using year 0 = 1) 000 000 DCF disc factor DCF -500.000 0.909 -454.500 -3,272.400 0.826 -2973.600 26.432 0.751 24.032 205.774 0.683 187.142 352.428 0.621 320.436 470.718 0.564 427.512 2,401.108 2.14 2182.800 1232.000 0.319 1122.880 916.06 836.702 4 5 6 7-11 12 NPV b) Payback - using the cumulative information from the cashflow table, it can be seen that by year 8 only 480 needs to be raised so the payback 8+480/1020 = 8.47 years Discounted payback could be calculated instead using the discounted cashflow table. c) The payback seems quite long, although within the long-term view of a building lasting at least 50 years this is relatively short but may require some careful financial planning

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts