Question: below is the balance sheet for these multiple choice please CONSOLIDATED BALANCE SHEET (in millions) Year Ending Dec. 31 2020 2019 ASSETS begin{tabular}{lcc} Cash and

below is the balance sheet for these multiple choice please

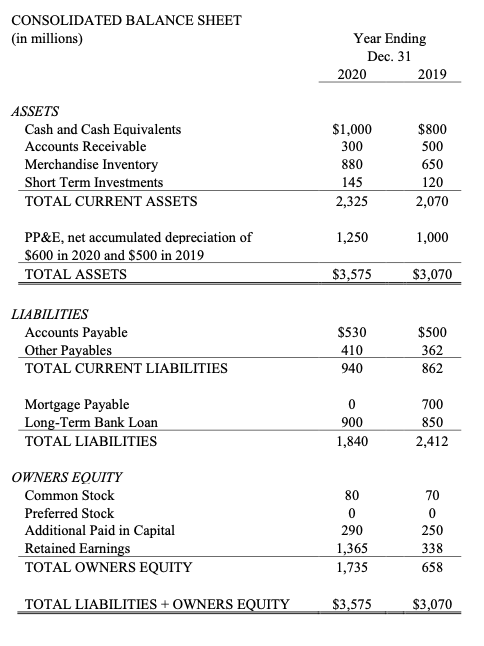

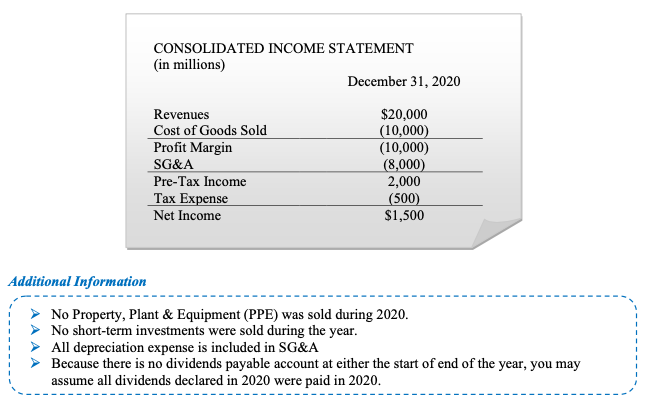

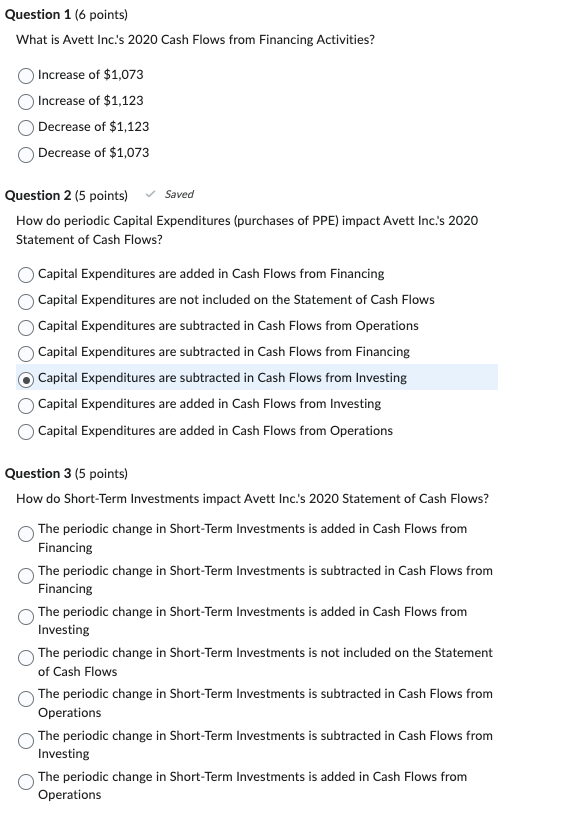

CONSOLIDATED BALANCE SHEET (in millions) Year Ending Dec. 31 2020 2019 ASSETS \begin{tabular}{lcc} Cash and Cash Equivalents & $1,000 & $800 \\ Accounts Receivable & 300 & 500 \\ Merchandise Inventory & 880 & 650 \\ Short Term Investments & 145 & 120 \\ \hline TOTAL CURRENT ASSETS & 2,325 & 2,070 \\ PP\&E, net accumulated depreciation of & 1,250 & 1,000 \\ \$600 in 2020 and \$500 in 2019 & & \\ \hline TOTAL ASSETS & $3,575 & $3,070 \\ \hline \hline \end{tabular} LIABILITIES \begin{tabular}{lcc} Accounts Payable & $530 & $500 \\ Other Payables & 410 & 362 \\ \hline TOTAL CURRENT LIABILITIES & 940 & 862 \\ & & \\ Mortgage Payable & 0 & 700 \\ Long-Term Bank Loan & 900 & 850 \\ \hline TOTAL LIABILITIES & 1,840 & 2,412 \end{tabular} OWNERS EQUITY Common Stock Preferred Stock Additional Paid in Capital Retained Earnings TOTAL OWNERS EQUITY 8070 TOTAL LIABILITIES + OWNERS EQUITY $3,575 $3,070 No Property, Plant \& Equipment (PPE) was sold during 2020. > No short-term investments were sold during the year. > All depreciation expense is included in SG\&A > Because there is no dividends payable account at either the start of end of the year, you may assume all dividends declared in 2020 were paid in 2020. What is Avett Inc.'s 2020 Cash Flows from Financing Activities? Increase of $1,073 Increase of $1,123 Decrease of $1,123 Decrease of $1,073 Question 2 (5 points) Saved How do periodic Capital Expenditures (purchases of PPE) impact Avett Inc.'s 2020 Statement of Cash Flows? Capital Expenditures are added in Cash Flows from Financing Capital Expenditures are not included on the Statement of Cash Flows Capital Expenditures are subtracted in Cash Flows from Operations Capital Expenditures are subtracted in Cash Flows from Financing Capital Expenditures are subtracted in Cash Flows from Investing Capital Expenditures are added in Cash Flows from Investing Capital Expenditures are added in Cash Flows from Operations Question 3 (5 points) How do Short-Term Investments impact Avett Inc.'s 2020 Statement of Cash Flows? The periodic change in Short-Term Investments is added in Cash Flows from Financing The periodic change in Short-Term Investments is subtracted in Cash Flows from Financing The periodic change in Short-Term Investments is added in Cash Flows from Investing The periodic change in Short-Term Investments is not included on the Statement of Cash Flows The periodic change in Short-Term Investments is subtracted in Cash Flows from Operations The periodic change in Short-Term Investments is subtracted in Cash Flows from Investing The periodic change in Short-Term Investments is added in Cash Flows from Operations CONSOLIDATED BALANCE SHEET (in millions) Year Ending Dec. 31 2020 2019 ASSETS \begin{tabular}{lcc} Cash and Cash Equivalents & $1,000 & $800 \\ Accounts Receivable & 300 & 500 \\ Merchandise Inventory & 880 & 650 \\ Short Term Investments & 145 & 120 \\ \hline TOTAL CURRENT ASSETS & 2,325 & 2,070 \\ PP\&E, net accumulated depreciation of & 1,250 & 1,000 \\ \$600 in 2020 and \$500 in 2019 & & \\ \hline TOTAL ASSETS & $3,575 & $3,070 \\ \hline \hline \end{tabular} LIABILITIES \begin{tabular}{lcc} Accounts Payable & $530 & $500 \\ Other Payables & 410 & 362 \\ \hline TOTAL CURRENT LIABILITIES & 940 & 862 \\ & & \\ Mortgage Payable & 0 & 700 \\ Long-Term Bank Loan & 900 & 850 \\ \hline TOTAL LIABILITIES & 1,840 & 2,412 \end{tabular} OWNERS EQUITY Common Stock Preferred Stock Additional Paid in Capital Retained Earnings TOTAL OWNERS EQUITY 8070 TOTAL LIABILITIES + OWNERS EQUITY $3,575 $3,070 No Property, Plant \& Equipment (PPE) was sold during 2020. > No short-term investments were sold during the year. > All depreciation expense is included in SG\&A > Because there is no dividends payable account at either the start of end of the year, you may assume all dividends declared in 2020 were paid in 2020. What is Avett Inc.'s 2020 Cash Flows from Financing Activities? Increase of $1,073 Increase of $1,123 Decrease of $1,123 Decrease of $1,073 Question 2 (5 points) Saved How do periodic Capital Expenditures (purchases of PPE) impact Avett Inc.'s 2020 Statement of Cash Flows? Capital Expenditures are added in Cash Flows from Financing Capital Expenditures are not included on the Statement of Cash Flows Capital Expenditures are subtracted in Cash Flows from Operations Capital Expenditures are subtracted in Cash Flows from Financing Capital Expenditures are subtracted in Cash Flows from Investing Capital Expenditures are added in Cash Flows from Investing Capital Expenditures are added in Cash Flows from Operations Question 3 (5 points) How do Short-Term Investments impact Avett Inc.'s 2020 Statement of Cash Flows? The periodic change in Short-Term Investments is added in Cash Flows from Financing The periodic change in Short-Term Investments is subtracted in Cash Flows from Financing The periodic change in Short-Term Investments is added in Cash Flows from Investing The periodic change in Short-Term Investments is not included on the Statement of Cash Flows The periodic change in Short-Term Investments is subtracted in Cash Flows from Operations The periodic change in Short-Term Investments is subtracted in Cash Flows from Investing The periodic change in Short-Term Investments is added in Cash Flows from Operations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts