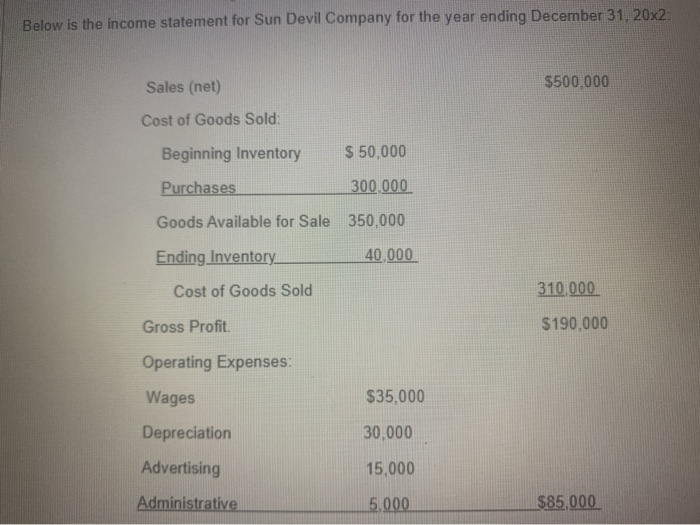

Question: Below is the income statement for Sun Devil Company for the year ending December 31, 20x2: Sales (net) $500,000 Cost of Goods Sold: Beginning Inventory

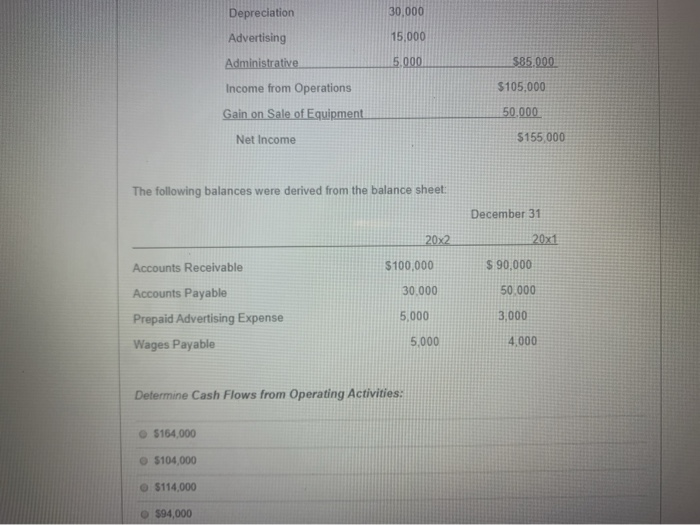

Below is the income statement for Sun Devil Company for the year ending December 31, 20x2: Sales (net) $500,000 Cost of Goods Sold: Beginning Inventory $ 50,000 Purchases 300,000 Goods Available for Sale 350,000 Ending Inventory 40.000 Cost of Goods Sold 310,000 Gross Profit $190,000 Operating Expenses: $35,000 Wages Depreciation Advertising 30,000 15,000 Administrative 5.000 $85,000 30,000 Depreciation Advertising 15,000 Administrative 5.000 $85.000 $105,000 Income from Operations Gain on Sale of Equipment 50.000 Net Income $155 000 The following balances were derived from the balance sheet: December 31 20x2. 20x1 $100,000 $ 90,000 30.000 50.000 Accounts Receivable Accounts Payable Prepaid Advertising Expense Wages Payable 5,000 3,000 5,000 4,000 Determine Cash Flows from Operating Activities: $164,000 $104,000 $114,000 $94,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts