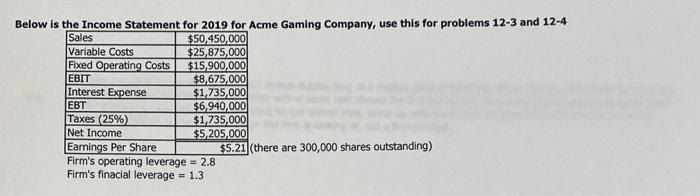

Question: Below is the Income Statement Sales Variable Costs Fixed Operating Costs EBIT Interest Expense EBT Taxes (25%) Net Income Earnings Per Share Firm's operating leverage

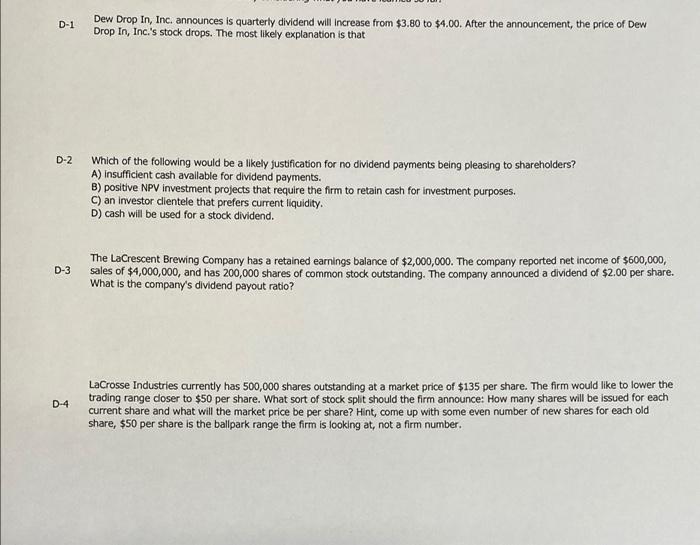

Below is the Income Statement Sales Variable Costs Fixed Operating Costs EBIT Interest Expense EBT Taxes (25%) Net Income Earnings Per Share Firm's operating leverage = 2.8 Firm's finacial leverage = 1.3 for 2019 for Acme Gaming Company, use this for problems 12-3 and 12-4 $50,450,000 $25,875,000 $15,900,000 $8,675,000 $1,735,000 $6,940,000 $1,735,000 $5,205,000 $5.21 (there are 300,000 shares outstanding) D-1 Dew Drop In, Inc. announces is quarterly dividend will increase from $3.80 to $4.00. After the announcement, the price of Dew Drop In, Inc.'s stock drops. The most likely explanation is that D- D-2 Which of the following would be a likely Justification for no dividend payments being pleasing to shareholders? A) insufficient cash available for dividend payments. B) positive NPV investment projects that require the firm to retain cash for investment purposes. C) an investor dientele that prefers current liquidity. D) cash will be used for a stock dividend. D-3 The LaCrescent Brewing Company has a retained earnings balance of $2,000,000. The company reported net income of $600,000, sales of $4,000,000, and has 200,000 shares of common stock outstanding. The company announced a dividend of $2.00 per share. What is the company's dividend payout ratio? D-4 LaCrosse Industries currently has 500,000 shares outstanding at a market price of $135 per share. The firm would like to lower the trading range doser to $50 per share. What sort of stock split should the firm announce: How many shares will be issued for each current share and what will the market price be per share? Hint, come up with some even number of new shares for each old share, $50 per share is the ballpark range the firm is looking at, not a firm number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts