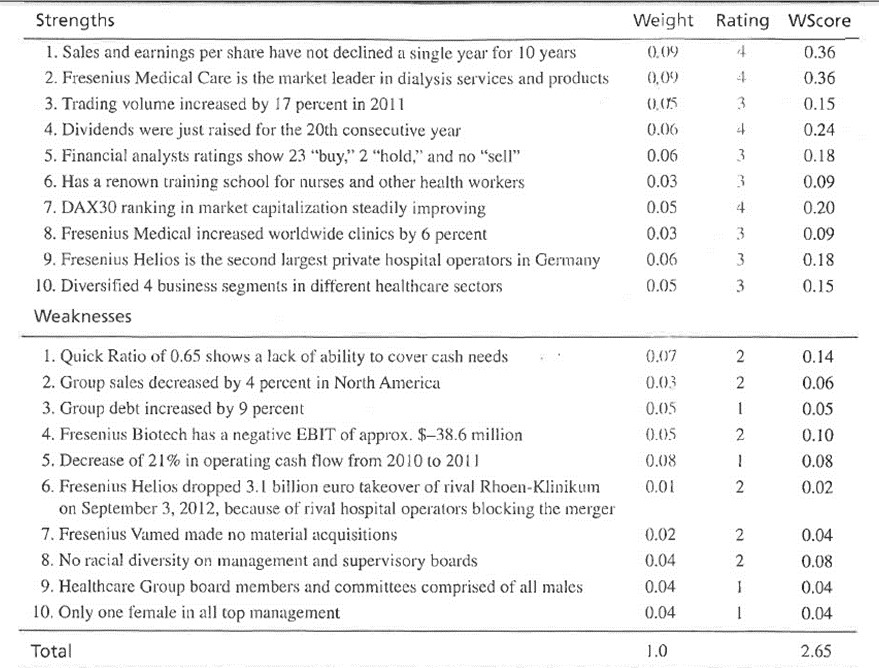

Question: Below is the Internal Factor Evaluation (IFE) Matrix for Fresenius Inc., a leading medical services provider. Analyze and interpret the information for meaningful managerial insights.

Below is the Internal Factor Evaluation (IFE) Matrix for Fresenius Inc., a leading medical services provider. Analyze and interpret the information for meaningful managerial insights. Briefly explain FOUR (4) conclusions from the analysis.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts