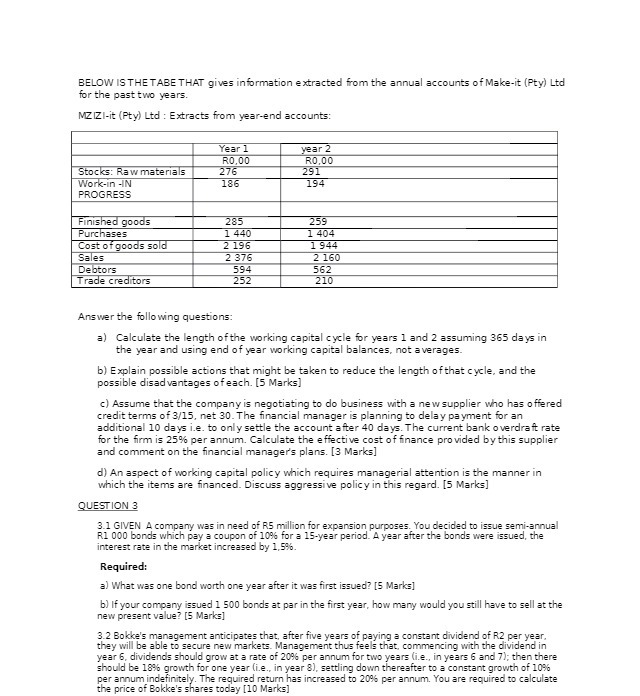

Question: BELOW IS THE TABE THAT gives information extracted from the annual accounts of Make-it (Pty) Ltd for the past two years. MZIZI-it (Pty) Led :

BELOW IS THE TABE THAT gives information extracted from the annual accounts of Make-it (Pty) Ltd for the past two years. MZIZI-it (Pty) Led : Extracts from year-end accounts: Year 1 Z JEBK RO,00 RO,00 Stocks: Raw materials 276 291 Work-in -IN 186 194 PROGRESS Finished goods 285 259 Purchases 1 440 404 Cost of goods sold 2 196 1 944 Sales 2 376 2 160 Debtors 594 562 Trade creditors 252 210 Answer the following questions: 3) Calculate the length of the working capital cycle for years 1 and 2 assuming 365 days in the year and using end of year working capital balances, not averages. b) Explain possible actions that might be taken to reduce the length of that cycle, and the possible disadvantages of each. [5 Marks] c) Assume that the company is negotiating to do business with a new supplier who has offered credit terms of 3/15, net 30. The financial manager is planning to delay payment for an additional 10 days i.e. to only settle the account after 40 days. The current bank overdraft rate for the firm is 25% per annum. Calculate the effective cost of finance provided by this supplier and comment on the financial manager's plans. [3 Marks] d) An aspect of working capital policy which requires managerial attention is the manner in which the items are financed. Discuss aggressive policy in this regard. [5 Marks] QUESTION 3 3.1 GIVEN A company was in need of R5 million for expansion purposes. You decided to issue semi-annual R1 000 bonds which pay a coupon of 10% for a 15-year period. A year after the bonds were issued, the interest rate in the market increased by 1,59%. Required: e) What was one bond worth one year after it was first issued? [5 Marks] bl If your company issued 1 500 bonds at par in the first year, how many would you still have to sell at the new present value? [5 Marks] 3.2 Bokke's management anticipates that, after five years of paying a constant dividend of R2 per year. they will be able to secure new markets. Management thus feels that, commencing with the dividend in year 6, dividends should grow at a rate of 20% per annum for two years (i.e., in years 6 and 7); then there should be 18%% growth for one year (i.e., in year 8), settling down thereafter to a constant growth of 10%% per annum indefinitely. The required return has increased to 20% per annum. You are required to calculate the price of Bokke's shares today [10 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts