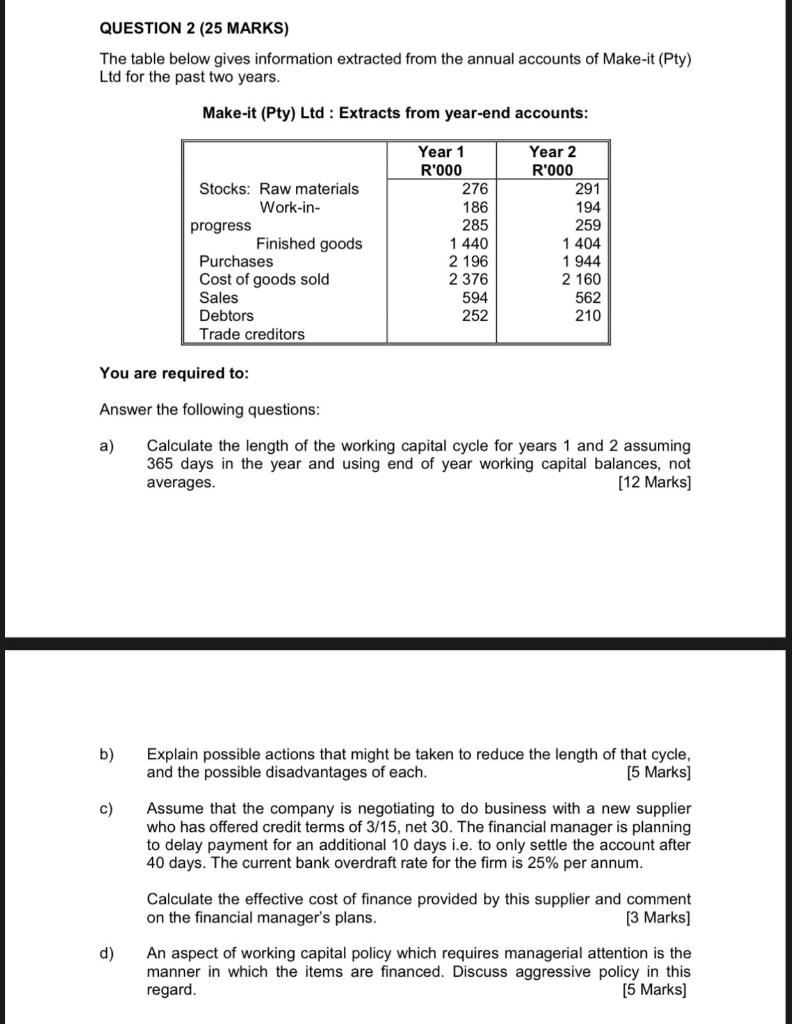

Question: QUESTION 2 (25 MARKS) The table below gives information extracted from the annual accounts of Make-it (Pty) Ltd for the past two years. Make-it (Pty)

QUESTION 2 (25 MARKS) The table below gives information extracted from the annual accounts of Make-it (Pty) Ltd for the past two years. Make-it (Pty) Ltd : Extracts from year-end accounts: Stocks: Raw materials Work-in- progress Finished goods Purchases Cost of goods sold Sales Debtors Trade creditors Year 1 R'000 276 186 285 1 440 2 196 2 376 594 252 Year 2 R'000 291 194 259 1 404 1 944 2 160 562 210 You are required to: Answer the following questions: a) Calculate the length of the working capital cycle for years 1 and 2 assuming 365 days in the year and using end of year working capital balances, not averages. [12 Marks) b) Explain possible actions that might be taken to reduce the length of that cycle, and the possible disadvantages of each. (5 Marks) c) Assume that the company is negotiating to do business with a new supplier who has offered credit terms of 3/15, net 30. The financial manager is planning to delay payment for an additional 10 days i.e. to only settle the account after 40 days. The current bank overdraft rate for the firm is 25% per annum. Calculate the effective cost of finance provided by this supplier and comment on the financial manager's plans. [3 Marks] d) An aspect of working capital policy which requires managerial attention is the manner in which the items are financed. Discuss aggressive policy in this regard. [5 Marks] QUESTION 2 (25 MARKS) The table below gives information extracted from the annual accounts of Make-it (Pty) Ltd for the past two years. Make-it (Pty) Ltd : Extracts from year-end accounts: Stocks: Raw materials Work-in- progress Finished goods Purchases Cost of goods sold Sales Debtors Trade creditors Year 1 R'000 276 186 285 1 440 2 196 2 376 594 252 Year 2 R'000 291 194 259 1 404 1 944 2 160 562 210 You are required to: Answer the following questions: a) Calculate the length of the working capital cycle for years 1 and 2 assuming 365 days in the year and using end of year working capital balances, not averages. [12 Marks) b) Explain possible actions that might be taken to reduce the length of that cycle, and the possible disadvantages of each. (5 Marks) c) Assume that the company is negotiating to do business with a new supplier who has offered credit terms of 3/15, net 30. The financial manager is planning to delay payment for an additional 10 days i.e. to only settle the account after 40 days. The current bank overdraft rate for the firm is 25% per annum. Calculate the effective cost of finance provided by this supplier and comment on the financial manager's plans. [3 Marks] d) An aspect of working capital policy which requires managerial attention is the manner in which the items are financed. Discuss aggressive policy in this regard. [5 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts