Question: Below one is the question that you need to solve. SOLVE Only c no. (a and b i already solved) Below one is a example

Below one is the question that you need to solve. SOLVE Only c no. (a and b i already solved)

Below one is a example question/answer and format that how you need to solve this math

example question

Above i have shown a sample/example for you, i will help you i hope, if your answer is correct and you followed the example format i will not miss to give you like for sure. thanks in advance.

Above i have shown a sample/example for you, i will help you i hope, if your answer is correct and you followed the example format i will not miss to give you like for sure. thanks in advance.

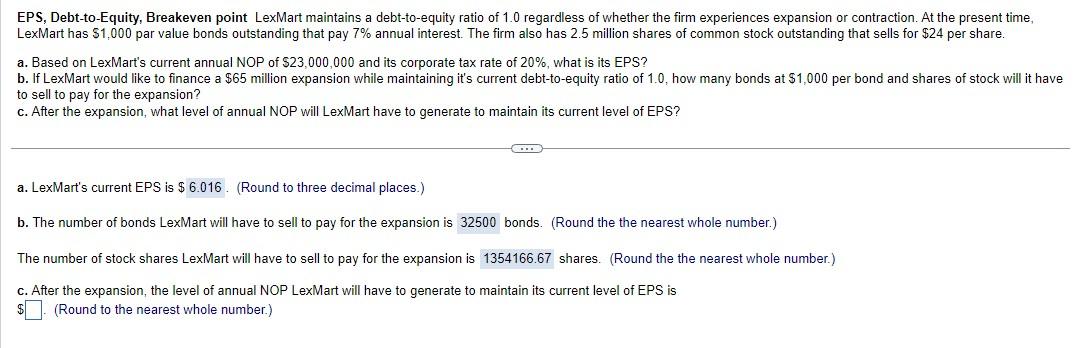

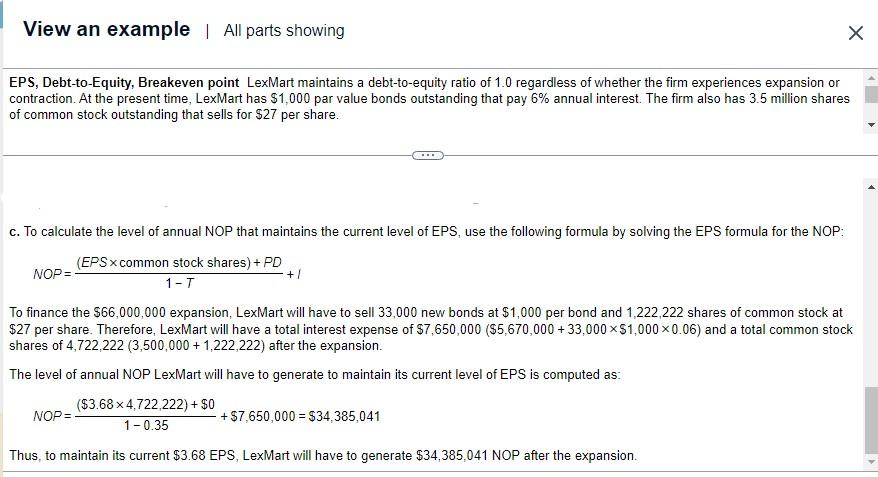

EPS, Debt-to-Equity, Breakeven point LexMart maintains a debt-to-equity ratio of 1.0 regardless of whether the firm experiences expansion or contraction. At the present time, LexMart has $1,000 par value bonds outstanding that pay 7% annual interest. The firm also has 2.5 million shares of common stock outstanding that sells for $24 per share. a. Based on LexMart's current annual NOP of $23,000,000 and its corporate tax rate of 20%, what is its EPS? b. If LexMart would like to finance a $65 million expansion while maintaining it's current debt-to-equity ratio of 1.0, how many bonds at $1,000 per bond and shares of stock will it have to sell to pay for the expansion? c. After the expansion, what level of annual NOP will LexMart have to generate to maintain its current level of EPS? a. LexMart's current EPS is $ (Round to three decimal places.) b. The number of bonds LexMart will have to sell to pay for the expansion is bonds. (Round the the nearest whole number.) The number of stock shares LexMart will have to sell to pay for the expansion is shares. (Round the the nearest whole number.) c. After the expansion, the level of annual NOP LexMart will have to generate to maintain its current level of EPS is $ (Round to the nearest whole number.) EPS, Debt-to-Equity, Breakeven point LexMart maintains a debt-to-equity ratio of 1.0 regardless of whether the firm experiences expansion or contraction. At the present time, LexMart has $1,000 par value bonds outstanding that pay 6% annual interest. The firm also has 3.5 million shares of common stock outstanding that sells for $27 per share. c. To calculate the level of annual NOP that maintains the current level of EPS, use the following formula by solving the EPS formula for the NOP: NOP=1T(EPScommonstockshares)+PD+1 To finance the $66,000,000 expansion, LexMart will have to sell 33,000 new bonds at $1,000 per bond and 1,222,222 shares of common stock at $27 per share. Therefore, LexMart will have a total interest expense of $7,650,000($5,670,000+33,000$1,0000.06) and a total common stock shares of 4,722,222(3,500,000+1,222,222) after the expansion. The level of annual NOP LexMart will have to generate to maintain its current level of EPS is computed as: NOP=10.35($3.684,722,222)+$0+$7,650,000=$34,385,041

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts