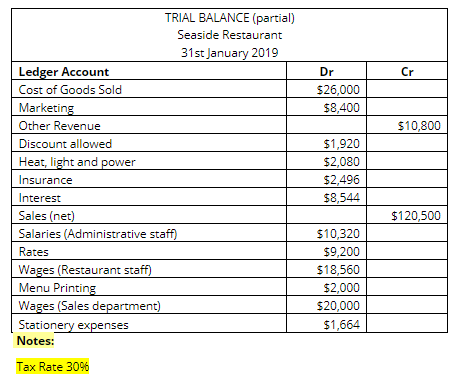

Question: Below you are provided with a partial trial balance from Seaside Restaurants. Your task is to use the information from the trial balance to complete

Below you are provided with a partial trial balance from Seaside Restaurants. Your task is to use the information from the trial balance to complete the income statement.

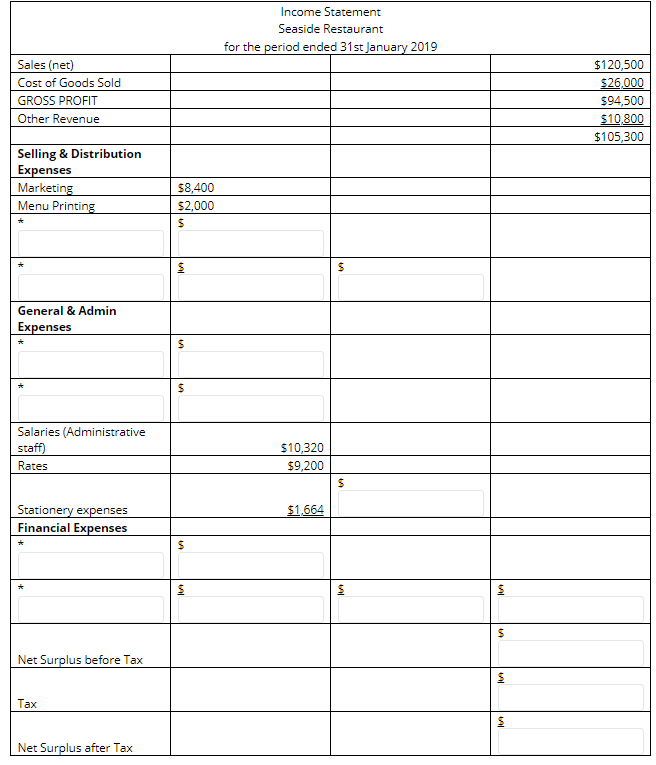

Cr Dr $26,000 $8,400 $10,800 TRIAL BALANCE (partial) Seaside Restaurant 31st January 2019 Ledger Account Cost of Goods Sold Marketing Other Revenue Discount allowed Heat, light and power Insurance Interest Sales (net) Salaries (Administrative staff) Rates Wages (Restaurant staff) Menu Printing Wages (Sales department) Stationery expenses Notes: Tax Rate 30% $1,920 $2,080 $2,496 $8,544 $120,500 $10,320 $9,200 $18,560 $2,000 $20,000 $1,664 Income Statement Seaside Restaurant for the period ended 31st January 2019 Sales (net) Cost of Goods Sold GROSS PROFIT Other Revenue $120,500 $26.000 $94,500 $10.800 $105,300 Selling & Distribution Expenses Marketing Menu Printing $8,400 $2,000 S * $ General & Admin Expenses $ S Salaries (Administrative staff) Rates $10,320 $9,200 $ $1,664 Stationery expenses Financial Expenses $ 5 $ $ Net Surplus before Tax 19 Tax $ Net Surplus after Tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts