Question: Please create a spreadsheet like shown below for this problem. Thank you for understanding. (or if there is a way to upload an excel file

Please create a spreadsheet like shown below for this problem. Thank you for understanding.

(or if there is a way to upload an excel file up on to Chegg, please let me know and I can send you the excel file which will be a lot more easier for you to finish this problem)

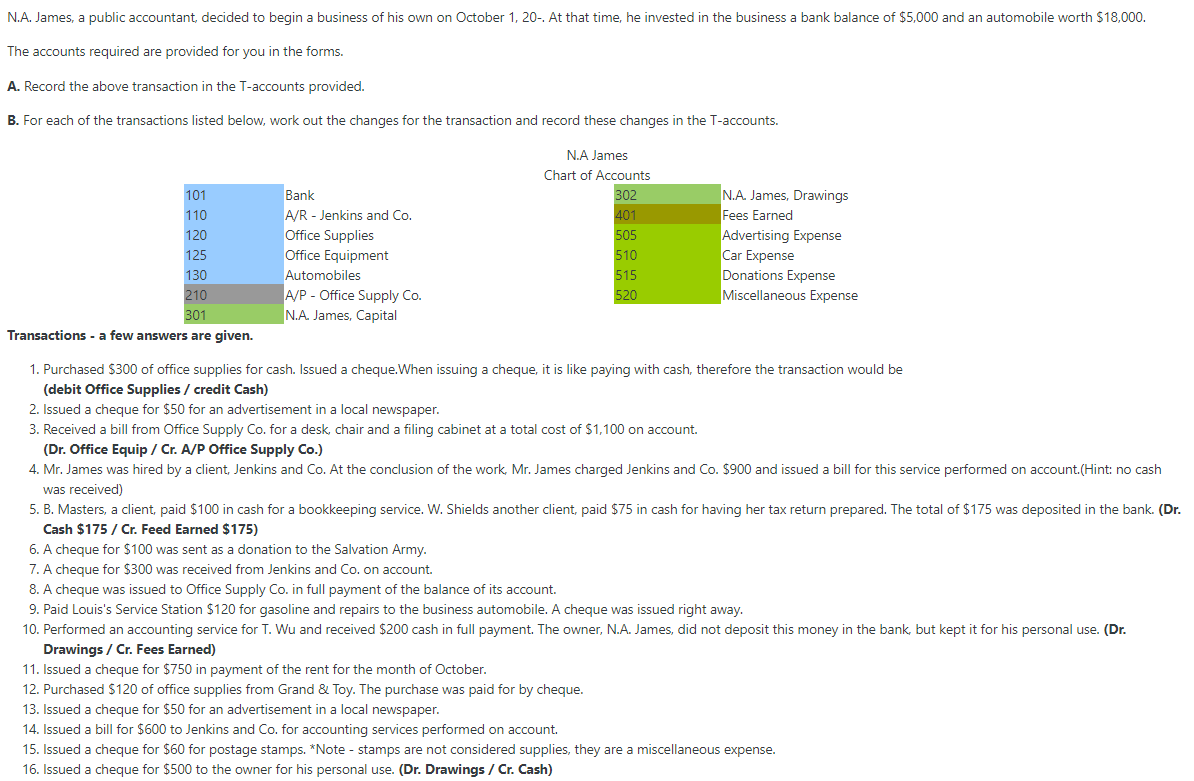

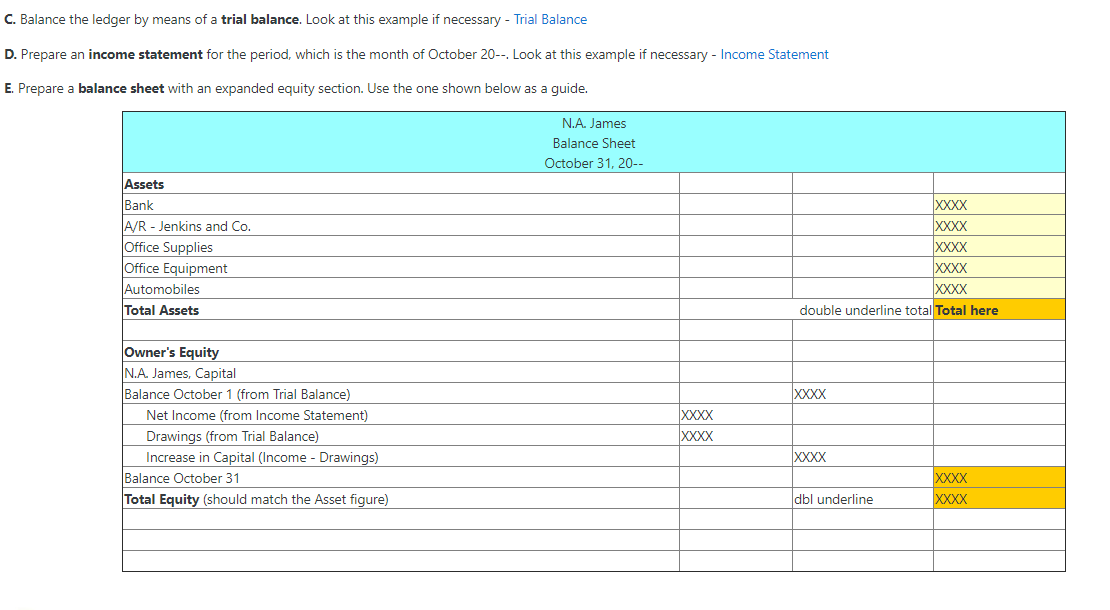

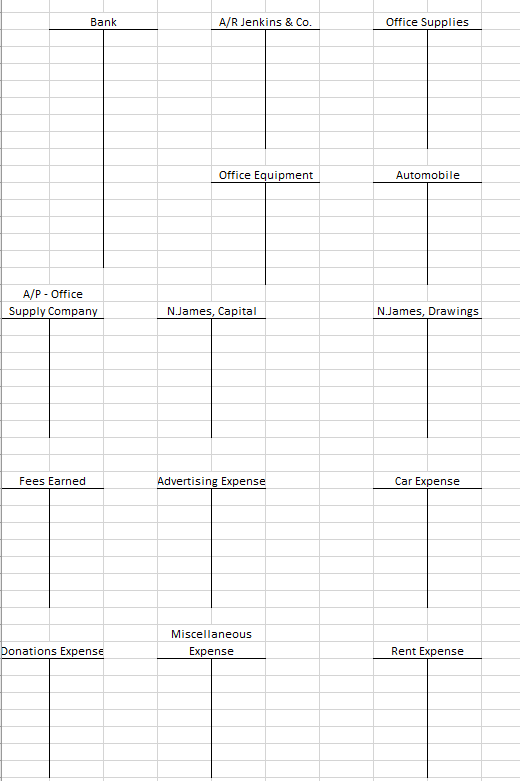

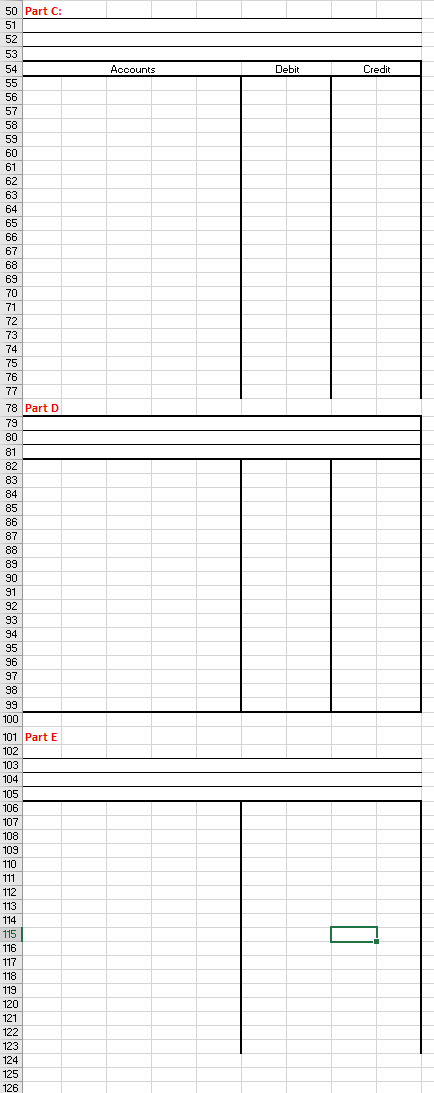

N.A.James, a public accountant, decided to begin a business of his own on October 1, 20-. At that time, he invested in the business a bank balance of $5,000 and an automobile worth $18,000. The accounts required are provided for you in the forms. A. Record the above transaction in the T-accounts provided. B. For each of the transactions listed below, work out the changes for the transaction and record these changes in the T-accounts. 101 110 120 125 130 210 301 Transactions - a few answers are given. Bank A/R - Jenkins and Co. Office Supplies Office Equipment Automobiles A/P - Office Supply Co. N.A.James, Capital N.A James Chart of Accounts 302 401 505 510 515 520 N.A.James, Drawings Fees Earned Advertising Expense Car Expense Donations Expense Miscellaneous Expense 1. Purchased $300 of office supplies for cash. Issued a cheque.When issuing a cheque, it is like paying with cash, therefore the transaction would be (debit Office Supplies / credit Cash) 2. Issued a cheque for $50 for an advertisement in a local newspaper. 3. Received a bill from Office Supply Co. for a desk, chair and a filing cabinet at a total cost of $1,100 on account. (Dr. Office Equip / Cr. A/P Office Supply Co.) 4. Mr. James was hired by a client, Jenkins and Co. At the conclusion of the work. Mr. James charged Jenkins and Co. $900 and issued a bill for this service performed on account.(Hint: no cash was received) 5. B. Masters, a client, paid $100 in cash for a bookkeeping service. W. Shields another client, paid $75 in cash for having her tax return prepared. The total of $175 was deposited in the bank. (Dr. Cash $175 / Cr. Feed Earned $175) 6. A cheque for $100 was sent as a donation to the Salvation Army. 7. A cheque for $300 was received from Jenkins and Co. on account. 8. A cheque was issued to Office Supply Co. in full payment of the balance of its account. 9. Paid Louis's Service Station $120 for gasoline and repairs to the business automobile. A cheque was issued right away. 10. Performed an accounting service for T. Wu and received $200 cash in full payment. The owner, N.A. James, did not deposit this money in the bank, but kept it for his personal use. (Dr. Drawings / Cr. Fees Earned) 11. Issued a cheque for $750 in payment of the rent for the month of October. 12. Purchased $120 of office supplies from Grand & Toy. The purchase was paid for by cheque. 13. Issued a cheque for $50 for an advertisement in a local newspaper. 14. Issued a bill for $600 to Jenkins and Co. for accounting services performed on account. 15. Issued a cheque for $60 for postage stamps. *Note - stamps are not considered supplies, they are a miscellaneous expense. 16. Issued a cheque for $500 to the owner for his personal use. (Dr. Drawings / Cr. Cash) C. Balance the ledger by means of a trial balance. Look at this example if necessary - Trial Balance D. Prepare an income statement for the period, which is the month of October 20-- Look at this example if necessary - Income Statement E. Prepare a balance sheet with an expanded equity section. Use the one shown below as a guide. N.A. James Balance Sheet October 31, 20-- Assets Bank A/R - Jenkins and Co. Office Supplies Office Equipment Automobiles Total Assets XXXX XXXX XXXX xxxx double underline total Total here Owner's Equity N.A. James, Capital Balance October 1 (from Trial Balance) Net Income (from Income Statement) Drawings (from Trial Balance) Increase in Capital (Income - Drawings) Balance October 31 Total Equity (should match the Asset figure) XXXX xxxx XXXX XXXX XXXX dbl underline Bank A/R Jenkins & Co. Office Supplies Office Equipment Automobile A/P - Office Supply Company N.James, Capital N.James, Drawings Fees Earned Advertising Expense Car Expense Donations Expense Miscellaneous Expense Rent Expense Parti

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts