Question: Below you find data for each division, data for GE, market data, and asset betas for the industries most comparable to each of GE's divisions.

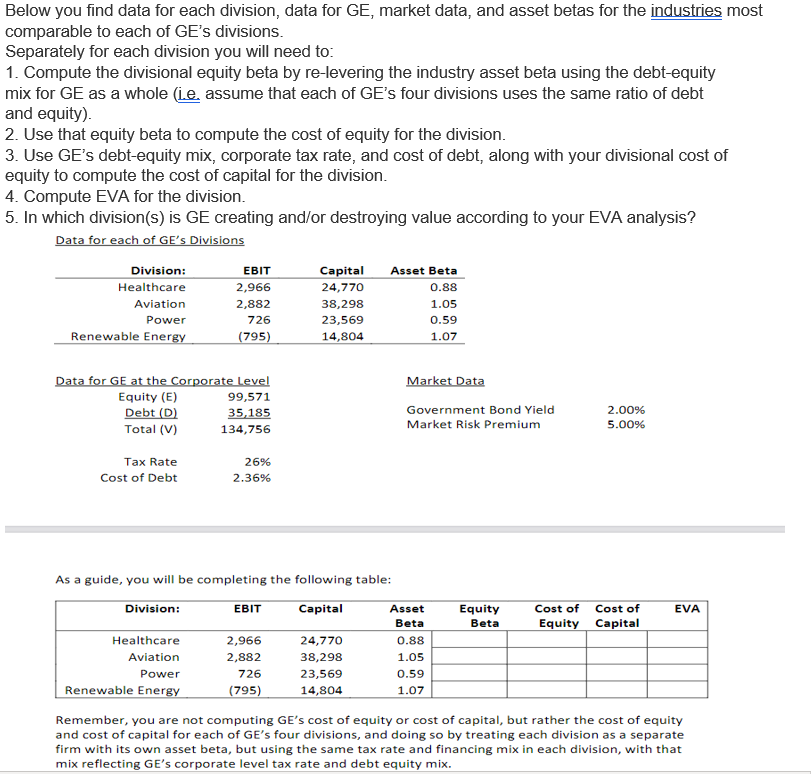

Below you find data for each division, data for GE, market data, and asset betas for the industries most comparable to each of GE's divisions. Separately for each division you will need to: 1. Compute the divisional equity beta by re-levering the industry asset beta using the debt-equity mix for GE as a whole (ie assume that each of GE's four divisions uses the same ratio of debt and equity). 2. Use that equity beta to compute the cost of equity for the division. 3. Use GE's debt-equity mix, corporate tax rate, and cost of debt, along with your divisional cost of equity to compute the cost of capital for the division. 4. Compute EVA for the division. 5. In which division(s) is GE creating and/or destroying value according to your EVA analysis? Data for each of GE's Divisions Division: EBIT Capital Asset Beta Healthcare 2,966 24,770 0.88 Aviation 2,882 38,298 Power Renewable Energy (795) 726 23,569 14,804 1.05 0.59 1.07 Data for GE at the Corporate Level Equity (E) 99,571 Debt (D) 35,185 Total (V) 134,756 Market Data Government Bond Yield Market Risk Premium 2.00% 5.00% Tax Rate Cost of Debt 26% 2.36% EVA Equity Beta Cost of Cost of Equity Capital As a guide, you will be completing the following table: Division: EBIT Capital Asset Beta Healthcare 2,966 24,770 0.88 Aviation 2,882 38,298 1.05 Power 726 23,569 0.59 Renewable Energy (795) 14,804 1.07 Remember, you are not computing GE's cost of equity or cost of capital, but rather the cost of equity and cost of capital for each of GE's four divisions, and doing so by treating each division as a separate firm with its own asset beta, but using the same tax rate and financing mix in each division, with that mix reflecting GE's corporate level tax rate and debt equity mix. Below you find data for each division, data for GE, market data, and asset betas for the industries most comparable to each of GE's divisions. Separately for each division you will need to: 1. Compute the divisional equity beta by re-levering the industry asset beta using the debt-equity mix for GE as a whole (ie assume that each of GE's four divisions uses the same ratio of debt and equity). 2. Use that equity beta to compute the cost of equity for the division. 3. Use GE's debt-equity mix, corporate tax rate, and cost of debt, along with your divisional cost of equity to compute the cost of capital for the division. 4. Compute EVA for the division. 5. In which division(s) is GE creating and/or destroying value according to your EVA analysis? Data for each of GE's Divisions Division: EBIT Capital Asset Beta Healthcare 2,966 24,770 0.88 Aviation 2,882 38,298 Power Renewable Energy (795) 726 23,569 14,804 1.05 0.59 1.07 Data for GE at the Corporate Level Equity (E) 99,571 Debt (D) 35,185 Total (V) 134,756 Market Data Government Bond Yield Market Risk Premium 2.00% 5.00% Tax Rate Cost of Debt 26% 2.36% EVA Equity Beta Cost of Cost of Equity Capital As a guide, you will be completing the following table: Division: EBIT Capital Asset Beta Healthcare 2,966 24,770 0.88 Aviation 2,882 38,298 1.05 Power 726 23,569 0.59 Renewable Energy (795) 14,804 1.07 Remember, you are not computing GE's cost of equity or cost of capital, but rather the cost of equity and cost of capital for each of GE's four divisions, and doing so by treating each division as a separate firm with its own asset beta, but using the same tax rate and financing mix in each division, with that mix reflecting GE's corporate level tax rate and debt equity mix

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts