Question: For Both Write-up, and Presentation: Deadline: Before Submit your write-up and Power Points Slides through . Case Write-ups are worth 15 points and presentations a

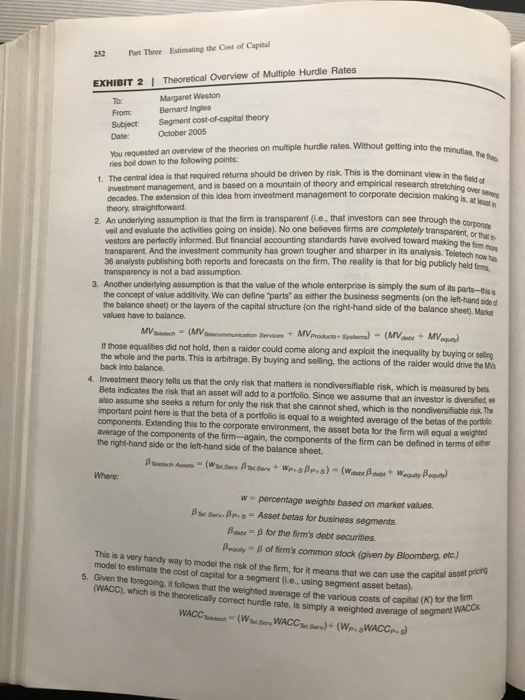

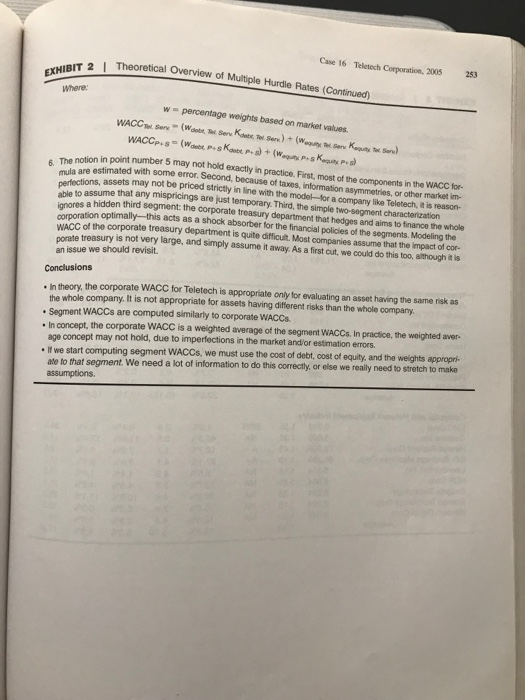

For Both Write-up, and Presentation: Deadline: Before Submit your write-up and Power Points Slides through . Case Write-ups are worth 15 points and presentations a Please read through the case material from page 243 to 25 In you analysis, answer the following questions. Explore the b a. Background Information about Teletech. Why was the sto b. What is the Hurdle rate? How is Teletech applying it? c. What are the arguments for risk-adjusted hurdle rates? d. What are the oppositions to risk-adjusted hurdle rates? e. What should Teletech's response be? Why? Formatting instructions: . Singe spaced. Times rew roman, 12 font e Restrict your write-up between two to three pages. ! A Term.. Hurdle Rates Case 16 Teleech Corporation, 200 7 The hurdle rate used in the assessments of economic focus of considerable debate in recent moeths. This rate was based on an estimate of Teletech's weighted average cost of capital (WACC). Management was completely satisfied with the intellectual relevance of a hurdle rate as an expression of the oppor- tunity cost of money. The notion that the WACC represented this opportunity cost had been hotly debated within the company, and while its measurement had never been considered wholly scientific, it was generally accepted. profit and NPV had been the Teletech was "split-rated between A- and BBB+. An investment banker recently suggested that, at those ratings, new debt funds might cost Teletech 5,88% (about 3.53 after a 40% tax rate). With a beta of 1.15, the cost of equity might be about 1095 At market-value weights of 22% for debt and 78% for equity, the resulting w ACC would be 9.30%. Exhibit 1 summarizes the calculation. The hurdle rate of 9.30% was applied to all investment and performance-measurement analyses at the firm Arguments for Risk-Adjusted Hurdle Rates How the rate should be used within the company in evaluating projects was another point one faced, differences of opinion arose at the segment level over the appropriateness of measuring all projects against the corporate hurdle rate of 9.30%. The chief ad cate for multiple rates was Rick Phillips, executive vice president of telecommanica- tions services, who presented his views as follows: two basinesses and the risks each Each phase of our business is different. They mast compete differently and must draw on capital differently. Given the historically stable nature of this industry, many telecommeni- cations companies can raise large quantities of capital from the debt markets. In operation comparable to telecommunications services, 50% of the necessary capital is rased in the debt markets at interest rates reflecting solid A quality, on averape. This is beter than Teletech's corporate bond rating of A-/BBB+ I also have to believe that the cost of equity for telecommunications services is lower than it is for products and systems. Although the products and systems segment's sales growth and profitability have been strong, its risks are high Independent equipmest manu facturers are financed with higher-yielding BB-rated deke and a greater proportion of equity In my book, the burdle rate for products and systems should reflect those higher costs of funds. Without the risk-adjusted system of hundle rates, telecommunications services will gradually starve for capital, while perodacts and systems will be force-fed-tha's cause our returns are less than the corporate hurdle rate, and theirs are greater. Telecomma- nications services lowers the risk of the wholke corporation, and should not be penalized Here's a rough graph of what I think is going on (Figure D) Telecommunications services, which can earn 9 10% on capital, is atually profitable on a risk-adjusted basis, even though it is not profitable compared to the corporate hurdle rate. The triangle shape on the drawing shows about where telecommvunications services is located. My hunch is that the reverse is true for products and systems [P&SJ, which pom ises to earn 11.0% on capital. PAS is located on the graph near the Inle anle. In dedng Cane 16 Teletech Corporation, 2005 249 Opposition to Risk-Adjusted Hurdle Rates While several others within Teletech supported Phil within the products and systems segment. Helen Buono, executive vice president of products and systems, expressed her opinion as follows: lips's views, opposition was strong All money is green. Investors can't know as much about our operations as we do. To them the firm is a black box; they hire us to take care of what is inside the box, and judge us by the dividends coming out of the box. We can't say that one part of the box has a diffiercot hurdle rate than another part of the box if our investors don't think that way. Like I say, all money is green: all investments at Teletech should be judged against one hurdle rane. Multiple hurdle rates are illogical. Suppose that the burdle rate for telecommunica- tions services was much lower than the corporate-wide hurdle rate. If we undertook imvest ments that met the segment hurdle rate, we weren't meeting the corporate hurdle rate. we would be destroying shareholder value because a put our money where the returns are best. A single hurdle rate may deprive an under profitable division of imvestments in order to channel more funds into a more profitable division, but isn't that the aim of the process? Our chal- lenge today is simple: we must earn the highest absolute rates of returm that we can get In reality, we don't finance each division separately. The corporation raises capital based on its overall prospects and record. The diversification of the company probably helps keep our capital costs down and enables us to borrow more in total than the sum of the capabilities of the divisions separatly. As a result, developing separate hurdle rates is both unrealistic and misleading. All our stockholders want is for us to invest our funds wisely in order to increase the value of their stock. This happens when we pick the most promising projects, irrespective of the source. Margaret Weston's Concerns As Weston listened to these arguments, presented over the course of several months, she became increasingly concerned about several related considerations. First, Teletech's corporate strategy had directed the company toward integrating the two segments. One effect of using multiple hurdle rates would be to make justifying high-technology research and application proposals be increased. On the one hand, she thought, perhaps multiple burdle rates were the right idea, but the notion that they should be based on capital costs rather than strategic con- siderations might be wrong. On the other hand, perhaps multiple rates based on capital costs should be used, but, in allocating funds, some qualitative adjustment should be made for unquantifiable strategic considerations. In Weston's mind, the theory was cer- tainly not clear on how to achieve strategic objectives when allocating capital. more difficult, as the required rate of retun woulkd Second, using a single measure of the cost of money (the hurdle rate or discount factor) made the NPV results consistent, at least in economic terms. If Teletech adopted multiple rates for discounting cash flows, Weston was afraid that the NPV and eco- nomic-profit calculations would lose their meaning and comparability across business segments. To her, a performance criterion had to be consistent and understandable, or it would not be useful. 29 Pat Three Estimating the Cost of Capita In addition, Weston was concerned about the problem of tures to divisions. In the telecommunications services se ing station might be financed by mortgage bonds. In products and o ew it was impossible for the division to borrow directly; indeed, any feasible because the corporation guaranteed the detcn highly risky-at best, perhaps, warranting only a minimal deb considered the debt-capacity decision difficult enough for the corporation a let alone for each division. Judgments could only be very crude. attributing capial ste systems, howe financing wason Such projects were ci struct In further discussions with others in the organization about the hurdle rates, Weston discovered two predominant themes. One ar investment decisions should never be mixed with financing decisions. A fim first decide what its investments should be and then determine how to most efficiently. Adding leverage to a present-value calculation would results. The use of multiple hurdle rates was simply a way of mixing f argument held t investment analysis. This argument also held that a single rate made the risk a clear-cut. Management could simply adjust its standard (NPV or economic the risks increased. The contrasting line of reasoning noted that the WACC tended to represent age market reaction to a mixture of risks. Lower-than-average-risk projects so probably be accepted even when they did not meet the weighted-average criterin Higher-than-normal-risk projects should provide a return premium. While the mulipe hurdle-rate system was a crude way to achieve this end, at least it was a step in right direction. Moreover, some argued that Teletech's objective should be to maxin return on equity funds, and because equity funds were and would remain a compur tively scarce resource, a multiple-rate system would tend to maximize returns to stock- holders better than a single-rate system would. Da To help resolve these issues, Weston asked her assistant, Bernard Ingles, to s marize the scholarly thought regarding multiple hurdle rates. His memorandum is gha in Exhibit 2. She also requested that Ingles obtain samples of firms comparable vi the telecommunications services segment and the products and systems unit that be used in deriving segment WACCs. A summary of the data is given in Exhibir Information on capital-market conditions in October 2005 is given in Eshibit Conclusion Weston could not realistically hope that all the issues before her would be in time to influence Victor Yossarian's attack on management. But the tate the need for an objective assessment of the performance o segments-the choice of hurdle rates would be very important in the did want to institute a pragmatic system of appropriate hurdle rates (or on ever, that would facilitate judgments in the changing circumstances faced o What were the appropriate hurdle rates for the two segments? Was systems segment underperforming, as suggested by Yossarian? How should eletech's t very erformanc products an respond to the raider? 252 Part Three Estimating the Cost of Capital EXHIBIT 2 I Theoretical Overview of Multiple Hurdle Rates Margaret Weston Bernard ingles Subject: Segment cost-of-capital theory Date:October 2005 From the overview of the theories on multple hurdle rates. Without getting into the minutiae ries boil down to the following points 1. The central idea is that required returns should be driven by risk. This is the dominant viow in he investment management, and is based on a mountain of theory and empirical research decades. The extension of this idea from investment management to corporate decision theory, straightforward stretching over seven making is, at loust in 2. An underlying assumption is that the firm is transparent (ie., that investors can see through the veil and evaluate the activities going on inside). No one believes firms are completely transparent, or vestors are perfectly informed. But financial accounting standards have evolved toward making the firm mone now has transparent. And the investment community has grown tougher and sharper in its analysis. Teletech 36 analysts publishing both reports and forecasts on the firm. The reality is that for big publicly held transparency is not a bad assumption. 3. Another underlying assumption is that the value of the whole enterprise is simply the sum of its parts-tis the concept of value additivity. We can define "parts" as either the business segments (on the left-hand the balance sheet) or the layers of the capital structure (on the right-hand side of the balance sheet),. Market side d values have to balance f those equalities did not hold, then a raider could come along and exploit the inequality by buying or sellig the raider would drive the MV 4. Investment theory tells us that the only risk that matters is nondiversifiable risk, which is measured by bea the whole and the parts. This is arbitrage. By buying and selling, the actions of back into balance. Beta indicates the risk that an asset will add to a portfolio. Since we assume that an investor is diversifed, w also assume she seeks a return for only the risk that she cannot shed, which is the nondiversifiable risk The mportant point here is that the beta of a portfolio is equal to a weighted average of the betas of the portbio components. Extending this to the corporate environment, the asset beta for the frm will equal a weighted average of the components of the firm-again, the components of the firm can be defined in terms of ether the right-hand side or the left-hand side of the balance sheet Where: wpercentage weights based on market values Ser Bps-Asset betas for business segments. o B for the firm's debt securities BequtB of firm's common stock (given by Bloomberg, etc,) This is a very handy way to model the risk of the firm, for it means that we can use model to estimate the cost of capital for a segment (.e., using segment asset betas 5. Given the foregoing, it follows that the weighted average of the various costs of capital ( (WACC), which is the theoretically correct hurdle rate, is simply a weighted average the capital asset pn (k) for the irm of segment WACCS Case 16 Teletech Corporation, 2005 253 BIT 2 I Theoretical Overview of Multiple Hurdle Rates (Continued) Where w- percentage weights based on market values. e notion in point number 5 may not hold exactly in practice. First, most of the components in the WACC for- astimated with some error. Second, because of taxes, information asymmetries, or other market im- mula are e assets may not be priced strictly in line with the model-for a company like Teletech, it is reason- Peihe to assume that any mispricings are just temporary Third, the simple two-segment characterization a hidden third segment: the corporate treasury department that hedges a and aims to finance the whole ion optimally-this acts as a shock absorber for the financial policles of the segments. Modeling the corporation WACC of the corporate treasury department is quite difficult. Most companies assume that the impact of cor- porate treasury is not very large, and simply assume it away As a first cut, we could do this too, although i is an issue we should revisit. in theory, the corporate WACC for Teletech is appropriate only for evaluating an asset ha ing the same nsk as the whole company. It is not appropriate for assets having different risks than the whole company .Segment WACCs are computed similarly to corporate WACCs. In concept, the corporate WACC is a weighted average of the segment WACCs. In practice, the weighted aver- age concept may not hold, due to imperfections in the market and'or estimation errors If we start computing segment WACCs, we must use the cost of debt, oost of equity, and the weights appropri- We need a lot of information to do this correctly, or else we really need to stretch to make assumptions For Both Write-up, and Presentation: Deadline: Before Submit your write-up and Power Points Slides through . Case Write-ups are worth 15 points and presentations a Please read through the case material from page 243 to 25 In you analysis, answer the following questions. Explore the b a. Background Information about Teletech. Why was the sto b. What is the Hurdle rate? How is Teletech applying it? c. What are the arguments for risk-adjusted hurdle rates? d. What are the oppositions to risk-adjusted hurdle rates? e. What should Teletech's response be? Why? Formatting instructions: . Singe spaced. Times rew roman, 12 font e Restrict your write-up between two to three pages. ! A Term.. Hurdle Rates Case 16 Teleech Corporation, 200 7 The hurdle rate used in the assessments of economic focus of considerable debate in recent moeths. This rate was based on an estimate of Teletech's weighted average cost of capital (WACC). Management was completely satisfied with the intellectual relevance of a hurdle rate as an expression of the oppor- tunity cost of money. The notion that the WACC represented this opportunity cost had been hotly debated within the company, and while its measurement had never been considered wholly scientific, it was generally accepted. profit and NPV had been the Teletech was "split-rated between A- and BBB+. An investment banker recently suggested that, at those ratings, new debt funds might cost Teletech 5,88% (about 3.53 after a 40% tax rate). With a beta of 1.15, the cost of equity might be about 1095 At market-value weights of 22% for debt and 78% for equity, the resulting w ACC would be 9.30%. Exhibit 1 summarizes the calculation. The hurdle rate of 9.30% was applied to all investment and performance-measurement analyses at the firm Arguments for Risk-Adjusted Hurdle Rates How the rate should be used within the company in evaluating projects was another point one faced, differences of opinion arose at the segment level over the appropriateness of measuring all projects against the corporate hurdle rate of 9.30%. The chief ad cate for multiple rates was Rick Phillips, executive vice president of telecommanica- tions services, who presented his views as follows: two basinesses and the risks each Each phase of our business is different. They mast compete differently and must draw on capital differently. Given the historically stable nature of this industry, many telecommeni- cations companies can raise large quantities of capital from the debt markets. In operation comparable to telecommunications services, 50% of the necessary capital is rased in the debt markets at interest rates reflecting solid A quality, on averape. This is beter than Teletech's corporate bond rating of A-/BBB+ I also have to believe that the cost of equity for telecommunications services is lower than it is for products and systems. Although the products and systems segment's sales growth and profitability have been strong, its risks are high Independent equipmest manu facturers are financed with higher-yielding BB-rated deke and a greater proportion of equity In my book, the burdle rate for products and systems should reflect those higher costs of funds. Without the risk-adjusted system of hundle rates, telecommunications services will gradually starve for capital, while perodacts and systems will be force-fed-tha's cause our returns are less than the corporate hurdle rate, and theirs are greater. Telecomma- nications services lowers the risk of the wholke corporation, and should not be penalized Here's a rough graph of what I think is going on (Figure D) Telecommunications services, which can earn 9 10% on capital, is atually profitable on a risk-adjusted basis, even though it is not profitable compared to the corporate hurdle rate. The triangle shape on the drawing shows about where telecommvunications services is located. My hunch is that the reverse is true for products and systems [P&SJ, which pom ises to earn 11.0% on capital. PAS is located on the graph near the Inle anle. In dedng Cane 16 Teletech Corporation, 2005 249 Opposition to Risk-Adjusted Hurdle Rates While several others within Teletech supported Phil within the products and systems segment. Helen Buono, executive vice president of products and systems, expressed her opinion as follows: lips's views, opposition was strong All money is green. Investors can't know as much about our operations as we do. To them the firm is a black box; they hire us to take care of what is inside the box, and judge us by the dividends coming out of the box. We can't say that one part of the box has a diffiercot hurdle rate than another part of the box if our investors don't think that way. Like I say, all money is green: all investments at Teletech should be judged against one hurdle rane. Multiple hurdle rates are illogical. Suppose that the burdle rate for telecommunica- tions services was much lower than the corporate-wide hurdle rate. If we undertook imvest ments that met the segment hurdle rate, we weren't meeting the corporate hurdle rate. we would be destroying shareholder value because a put our money where the returns are best. A single hurdle rate may deprive an under profitable division of imvestments in order to channel more funds into a more profitable division, but isn't that the aim of the process? Our chal- lenge today is simple: we must earn the highest absolute rates of returm that we can get In reality, we don't finance each division separately. The corporation raises capital based on its overall prospects and record. The diversification of the company probably helps keep our capital costs down and enables us to borrow more in total than the sum of the capabilities of the divisions separatly. As a result, developing separate hurdle rates is both unrealistic and misleading. All our stockholders want is for us to invest our funds wisely in order to increase the value of their stock. This happens when we pick the most promising projects, irrespective of the source. Margaret Weston's Concerns As Weston listened to these arguments, presented over the course of several months, she became increasingly concerned about several related considerations. First, Teletech's corporate strategy had directed the company toward integrating the two segments. One effect of using multiple hurdle rates would be to make justifying high-technology research and application proposals be increased. On the one hand, she thought, perhaps multiple burdle rates were the right idea, but the notion that they should be based on capital costs rather than strategic con- siderations might be wrong. On the other hand, perhaps multiple rates based on capital costs should be used, but, in allocating funds, some qualitative adjustment should be made for unquantifiable strategic considerations. In Weston's mind, the theory was cer- tainly not clear on how to achieve strategic objectives when allocating capital. more difficult, as the required rate of retun woulkd Second, using a single measure of the cost of money (the hurdle rate or discount factor) made the NPV results consistent, at least in economic terms. If Teletech adopted multiple rates for discounting cash flows, Weston was afraid that the NPV and eco- nomic-profit calculations would lose their meaning and comparability across business segments. To her, a performance criterion had to be consistent and understandable, or it would not be useful. 29 Pat Three Estimating the Cost of Capita In addition, Weston was concerned about the problem of tures to divisions. In the telecommunications services se ing station might be financed by mortgage bonds. In products and o ew it was impossible for the division to borrow directly; indeed, any feasible because the corporation guaranteed the detcn highly risky-at best, perhaps, warranting only a minimal deb considered the debt-capacity decision difficult enough for the corporation a let alone for each division. Judgments could only be very crude. attributing capial ste systems, howe financing wason Such projects were ci struct In further discussions with others in the organization about the hurdle rates, Weston discovered two predominant themes. One ar investment decisions should never be mixed with financing decisions. A fim first decide what its investments should be and then determine how to most efficiently. Adding leverage to a present-value calculation would results. The use of multiple hurdle rates was simply a way of mixing f argument held t investment analysis. This argument also held that a single rate made the risk a clear-cut. Management could simply adjust its standard (NPV or economic the risks increased. The contrasting line of reasoning noted that the WACC tended to represent age market reaction to a mixture of risks. Lower-than-average-risk projects so probably be accepted even when they did not meet the weighted-average criterin Higher-than-normal-risk projects should provide a return premium. While the mulipe hurdle-rate system was a crude way to achieve this end, at least it was a step in right direction. Moreover, some argued that Teletech's objective should be to maxin return on equity funds, and because equity funds were and would remain a compur tively scarce resource, a multiple-rate system would tend to maximize returns to stock- holders better than a single-rate system would. Da To help resolve these issues, Weston asked her assistant, Bernard Ingles, to s marize the scholarly thought regarding multiple hurdle rates. His memorandum is gha in Exhibit 2. She also requested that Ingles obtain samples of firms comparable vi the telecommunications services segment and the products and systems unit that be used in deriving segment WACCs. A summary of the data is given in Exhibir Information on capital-market conditions in October 2005 is given in Eshibit Conclusion Weston could not realistically hope that all the issues before her would be in time to influence Victor Yossarian's attack on management. But the tate the need for an objective assessment of the performance o segments-the choice of hurdle rates would be very important in the did want to institute a pragmatic system of appropriate hurdle rates (or on ever, that would facilitate judgments in the changing circumstances faced o What were the appropriate hurdle rates for the two segments? Was systems segment underperforming, as suggested by Yossarian? How should eletech's t very erformanc products an respond to the raider? 252 Part Three Estimating the Cost of Capital EXHIBIT 2 I Theoretical Overview of Multiple Hurdle Rates Margaret Weston Bernard ingles Subject: Segment cost-of-capital theory Date:October 2005 From the overview of the theories on multple hurdle rates. Without getting into the minutiae ries boil down to the following points 1. The central idea is that required returns should be driven by risk. This is the dominant viow in he investment management, and is based on a mountain of theory and empirical research decades. The extension of this idea from investment management to corporate decision theory, straightforward stretching over seven making is, at loust in 2. An underlying assumption is that the firm is transparent (ie., that investors can see through the veil and evaluate the activities going on inside). No one believes firms are completely transparent, or vestors are perfectly informed. But financial accounting standards have evolved toward making the firm mone now has transparent. And the investment community has grown tougher and sharper in its analysis. Teletech 36 analysts publishing both reports and forecasts on the firm. The reality is that for big publicly held transparency is not a bad assumption. 3. Another underlying assumption is that the value of the whole enterprise is simply the sum of its parts-tis the concept of value additivity. We can define "parts" as either the business segments (on the left-hand the balance sheet) or the layers of the capital structure (on the right-hand side of the balance sheet),. Market side d values have to balance f those equalities did not hold, then a raider could come along and exploit the inequality by buying or sellig the raider would drive the MV 4. Investment theory tells us that the only risk that matters is nondiversifiable risk, which is measured by bea the whole and the parts. This is arbitrage. By buying and selling, the actions of back into balance. Beta indicates the risk that an asset will add to a portfolio. Since we assume that an investor is diversifed, w also assume she seeks a return for only the risk that she cannot shed, which is the nondiversifiable risk The mportant point here is that the beta of a portfolio is equal to a weighted average of the betas of the portbio components. Extending this to the corporate environment, the asset beta for the frm will equal a weighted average of the components of the firm-again, the components of the firm can be defined in terms of ether the right-hand side or the left-hand side of the balance sheet Where: wpercentage weights based on market values Ser Bps-Asset betas for business segments. o B for the firm's debt securities BequtB of firm's common stock (given by Bloomberg, etc,) This is a very handy way to model the risk of the firm, for it means that we can use model to estimate the cost of capital for a segment (.e., using segment asset betas 5. Given the foregoing, it follows that the weighted average of the various costs of capital ( (WACC), which is the theoretically correct hurdle rate, is simply a weighted average the capital asset pn (k) for the irm of segment WACCS Case 16 Teletech Corporation, 2005 253 BIT 2 I Theoretical Overview of Multiple Hurdle Rates (Continued) Where w- percentage weights based on market values. e notion in point number 5 may not hold exactly in practice. First, most of the components in the WACC for- astimated with some error. Second, because of taxes, information asymmetries, or other market im- mula are e assets may not be priced strictly in line with the model-for a company like Teletech, it is reason- Peihe to assume that any mispricings are just temporary Third, the simple two-segment characterization a hidden third segment: the corporate treasury department that hedges a and aims to finance the whole ion optimally-this acts as a shock absorber for the financial policles of the segments. Modeling the corporation WACC of the corporate treasury department is quite difficult. Most companies assume that the impact of cor- porate treasury is not very large, and simply assume it away As a first cut, we could do this too, although i is an issue we should revisit. in theory, the corporate WACC for Teletech is appropriate only for evaluating an asset ha ing the same nsk as the whole company. It is not appropriate for assets having different risks than the whole company .Segment WACCs are computed similarly to corporate WACCs. In concept, the corporate WACC is a weighted average of the segment WACCs. In practice, the weighted aver- age concept may not hold, due to imperfections in the market and'or estimation errors If we start computing segment WACCs, we must use the cost of debt, oost of equity, and the weights appropri- We need a lot of information to do this correctly, or else we really need to stretch to make assumptions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts